Ministry proposes new electricity tariffs

(Source: Nguoi Lao Dong (Labourer) Newspaper)

The Ministry of Industry and Trade (MoIT) has released a draft of the Prime Minister's decision on the structure of retail electricity tariffs for public feedback. The draft proposes a new pricing scheme based on a percentage of the average retail price of electricity for different groups of users.

The proposed scheme includes specific retail prices for various groups such as production, business, administrative, non-business, daily use, electric vehicle charging stations and tourist accommodation.

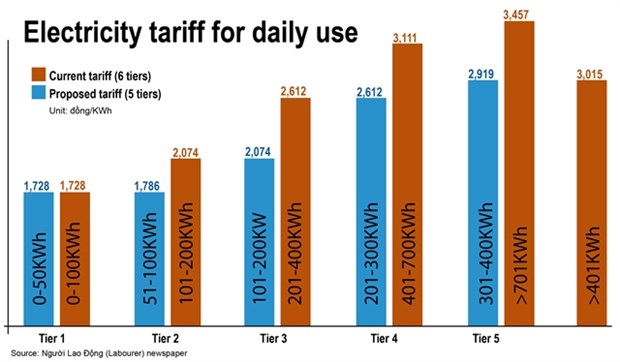

Regarding the retail electricity tariffs for daily use, the plan proposed by the MoIT, which suggests reducing the pricing tiers from six to five, is not much different from the proposal in September 2022. This change narrows the gap between the first steps and expands the pricing range for higher consumption levels.

Under the new plan, the first two steps are combined into tier 1, where the price for the first 100kWh is set at 90% of the average retail price. Tier 2, which remains the same as before (101 to 20 kWh), has a price equal to 108% of the average retail price. Tier 3 widens the consumption gap from 201 to 400kWh compared to before, priced at 136% of the average retail price. Tier 4 covers consumption from 401-700kWh, priced at 162% of the average retail price, while tier 5 includes consumption of 701kWh or more, with a price equal to 180% of the average retail price.

These prices do not include value-added tax (VAT) and are based on the average retail price of electricity, which was adjusted in May 2023 to 1,920.37 VND (8 US cent) per KWh.

With the new five-tier option, the lowest average retail price of electricity is 1,728 VND/KWh, and the highest is 3,457 VND/KWh (excluding VAT). The pricing scheme aims to maintain stable electricity prices for low-income households and those with low electricity usage while providing incentives for efficient electricity consumption.

The proposed changes will result in reduced electricity bills for 89% of households using 700kWh or less. However, households consuming 701 kWh per month or more (2% of households) will experience an increase in their electricity bills.

For production, business, administrative customers, electric vehicle charging stations, and tourist accommodation establishments, the prices are categorised based on voltage levels, ranging from 1 to 35kV, with the lowest price set at 54% and the highest price at 167% of the average retail price of electricity.

This draft also includes electricity prices for electric vehicle charging stations for the first time, ranging from 68% to 205% of the average retail price based on voltage level.

The MoIT has stated that the proposed retail prices aim to maintain consistency while affecting different customer groups to varying degrees. Some groups will benefit from reduced electricity bills, while others will face increases.

The draft decision also specifies that households classified as poor based on income criteria, as determined by the Prime Minister, will receive electricity subsidies. The monthly subsidy amount is equivalent to the cost of electricity usage of 30kWh, calculated based on the current retail price of electricity for household usage in tier 1.

Related News

Opportunities for Vietnamese businesses from the shift in US production chains

14:15 | 26/10/2023 Import-Export

Tariff table for the implementation of the AKFTA Agreement in the new phase: Ensuring the stability of the special preferential tariff table.

17:10 | 15/05/2023 Regulations

Synchronous solutions in energy conversion

09:16 | 09/07/2022 Import-Export

US waives tariffs on solar panels from Việt Nam

16:32 | 07/06/2022 Import-Export

Latest News

Consulting on customs control for e-commerce imports and exports

14:50 | 14/02/2025 Regulations

Flexible tax policy to propel Việt Nam’s economic growth in 2025

14:14 | 06/02/2025 Regulations

Brandnew e-commerce law to address policy gaps

18:44 | 29/01/2025 Regulations

From January 1, 2025: 13 product codes increase export tax to 20%

14:23 | 29/12/2024 Regulations

More News

Export tax rates of 13 commodity codes to increase to 20% from January 1, 2025

13:46 | 28/12/2024 Regulations

Proposal to reduce 30% of land rent in 2024

14:58 | 25/12/2024 Regulations

Resolve problems related to tax procedures and policies for businesses

13:54 | 22/12/2024 Regulations

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations

Actively listening to the voice of the business community

09:39 | 12/12/2024 Customs

Step up negotiations on customs commitments within the FTA framework

09:44 | 08/12/2024 Regulations

Proposal to amend regulations on goods circulation

13:45 | 06/12/2024 Regulations

Review of VAT exemptions for imported machinery and equipment

10:31 | 05/12/2024 Regulations

Customs tightens oversight on e-commerce imports

13:39 | 04/12/2024 Regulations

Your care

The system has not recorded your reading habits.

Please Login/Register so that the system can provide articles according to your reading needs.

Consulting on customs control for e-commerce imports and exports

14:50 | 14/02/2025 Regulations

Flexible tax policy to propel Việt Nam’s economic growth in 2025

14:14 | 06/02/2025 Regulations

Brandnew e-commerce law to address policy gaps

18:44 | 29/01/2025 Regulations

From January 1, 2025: 13 product codes increase export tax to 20%

14:23 | 29/12/2024 Regulations

Export tax rates of 13 commodity codes to increase to 20% from January 1, 2025

13:46 | 28/12/2024 Regulations