Manufacturers should work out strategies to deal with trade war: experts

|

Experts and industry insiders in discussion at the workshop, entitled “Trade war: The Future for Manufacturing Companies?” in HCMC on November 23

However, manufacturers should devise their own strategies to counter long-term risks, rather than only care about doing business in a small number of sectors which benefit from the trade conflict, said experts.

The Saigon Times Group and NS Bluescope Vietnam, one of the leading suppliers of steel products and solutions, held a workshop, entitled “Trade war: The Future for Manufacturing Companies?” at the Adora Dynasty Convention Center in District 1, HCMC on November 23.

Over 300 representatives from manufacturing firms attended the workshop, whose aim was to provide them with insights into escalating trade frictions between the world’s two largest economies, as well as to discuss measures to prepare responses to cope with the economic impact of the conflict.

Associate professor Tran Dinh Thien, former director of the Vietnam Institute of Economics and currently a member of the Prime Minister’s economic consulting team, presented an overview of the U.S.-China trade war, along with its impact on the Vietnamese economy, in general, and local firms, in particular.

He said the war is shifting flows of cheap Chinese goods to Vietnam. If they are sources of materials, they will be beneficial to the local economy. However, if they are finished products, he questioned if Vietnamese counterparts could compete with them.

That Chinese firms are having difficulty exporting their products to the United States opens up great opportunities for the products of other countries, including Vietnam. “Does Vietnamese goods have high enough quality to enter the American market or not?” he asked.

After more than 30 years of economic renovation, according to the senior economist, the private business sector, which is regarded as a key driver of the market economy, still contributes less than 10% of gross domestic product (GDP). Meanwhile, the household sector accounts for up to 30% of the GDP, and the State business sector makes up roughly 30%.

He stressed that an economy that remains dependent upon the household sector could not be called “a powerful economy,” and it is time to restructure the economy. Rather than small and medium-sized enterprises, it is big private corporations that will lead the corporate sector.

According to Thien, local firms could benefit from certain sectors in the short run. However, they should come up with strategies to cope with long-term risks, as the impact on the national economy could be significant in a more negative manner, in the long run.

He explained that the trade war has an effect on investments, which decreases investor confidence. This is why flows of capital depart emerging markets, including Vietnam. As a result, global supply chains are disrupted, while the investment and trade environment becomes more uncertain.

Nguyen Thi Thu Trang, director of the WTO and Integration Center under the Vietnam Chamber of Commerce and Industry, said Vietnamese firms could have opportunities to penetrate market segments in the U.S. and China, especially those that involve products subject to tariffs, or products using material inputs subject to such tariffs.

However, she stressed that the two largest economies, in fact, would not leave these market segments vacant – but have merely reduced their competitive capacity, in terms of prices. That is not to mention that many other economies are also keen on taking advantage of these opportunities.

She suggested that the Government take measures to improve the business environment, and learn about and approach potential investors, while firms should seek cooperative opportunities and create joint ventures, if possible, as well as be cautious about “fraudulent cooperative” invitations, such as Chinese goods bearing made-in-Vietnam labels to avoid taxes.

Vietnam also faces risks of fake investment shifts and commercial fraud, as well as competitive risks in investments and exports, she said. For example, Chinese firms might make investments in small stages of production in Vietnam, so that their products could then be of Vietnamese origins.

Vo Minh Nhut, general director of NS Bluescope Vietnam, told the participants of the event that his company is striving to create its own values by introducing breakthrough technologies and lines of new products that focus on the green technology trend, to create a difference in the market.

He noted that the company is trying to persify its export products, and look for new and potential markets, such as Africa, the Caribbean and South America, in a bid to avoid being affected by tax regulations.

The plastics industry is witnessing a shift in manufacturing investment to Vietnam from China, in order to reduce labor costs, according to Ho Duc Lam, chairman of the Vietnam Plastics Association and chairman of the board of directors at Rang Dong Plastic Company.

He said a small proportion of local plastics employees are enjoying higher salaries because Chinese firms seek to recruit skilled workers. Meanwhile, local customers are able to purchase plastic products at cheaper prices.

However, according to Lam, local plastics firms suffer negative impacts when they have to compete face-to-face with Chinese firms, because these foreign firms increase their investments for the sake of obtaining Vietnamese labels.

Therefore, he proposed the Government consider levying import taxes if signs of dumping emerge, and do not grant investment licenses and business registration certificates for manufacturing projects which could fail to ensure their use of over two-thirds of production chains based in Vietnam.

Furthermore, the Government should promote new-generation free trade agreements with Europe and other countries to minimize risks, because the Vietnamese economy is still heavily dependent on the U.S. and China. Such trade pacts will bring about positive impacts on the economy, in terms of environmental, labor and intellectual property issues.

Related News

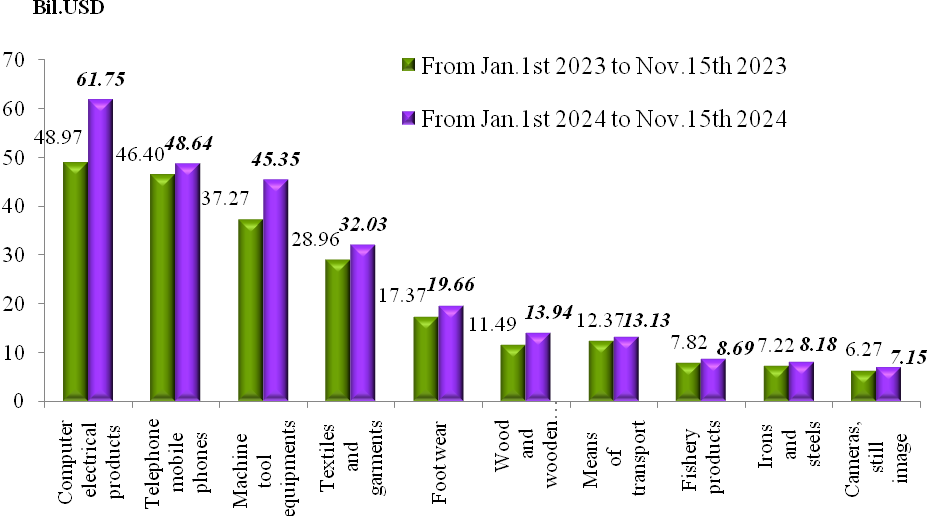

Preliminary assessment of Vietnam international merchandise trade performance in the second half of November, 2024

15:18 | 19/12/2024 Customs Statistics

Total import-export turnover reaches US$715.55 billion in 11 months

10:23 | 13/12/2024 Import-Export

Customs sector collects over VND384 trillion in revenue

17:13 | 12/12/2024 Customs

Preliminary assessment of Vietnam international merchandise trade performance in the first half of November, 2024

09:40 | 12/12/2024 Customs Statistics

Latest News

Nghệ An Province anticipates record FDI amidst economic upswing

15:49 | 26/12/2024 Import-Export

Green farming development needs supportive policies to attract investors

15:46 | 26/12/2024 Import-Export

Vietnamese enterprises adapt to green logistics trend

15:43 | 26/12/2024 Import-Export

Paving the way for Vietnamese agricultural products in China

11:08 | 26/12/2024 Import-Export

More News

VN seafood export surpass 2024 goal of $10 billion

14:59 | 25/12/2024 Import-Export

Exporters urged to actively prepare for trade defence investigation risks when exporting to the UK

14:57 | 25/12/2024 Import-Export

Electronic imports exceed $100 billion

14:55 | 25/12/2024 Import-Export

Forestry exports set a record of $17.3 billion

14:49 | 25/12/2024 Import-Export

Hanoi: Maximum support for affiliating production and sustainable consumption of agricultural products

09:43 | 25/12/2024 Import-Export

Việt Nam boosts supporting industries with development programmes

13:56 | 24/12/2024 Import-Export

VN's wood industry sees chances and challenges from US new trade policies

13:54 | 24/12/2024 Import-Export

Vietnam's fruit, vegetable exports reach new milestone, topping 7 billion USD

13:49 | 24/12/2024 Import-Export

Aquatic exports hit 10 billion USD

13:45 | 24/12/2024 Import-Export

Your care

Nghệ An Province anticipates record FDI amidst economic upswing

15:49 | 26/12/2024 Import-Export

Green farming development needs supportive policies to attract investors

15:46 | 26/12/2024 Import-Export

Vietnamese enterprises adapt to green logistics trend

15:43 | 26/12/2024 Import-Export

Paving the way for Vietnamese agricultural products in China

11:08 | 26/12/2024 Import-Export

VN seafood export surpass 2024 goal of $10 billion

14:59 | 25/12/2024 Import-Export