KVFTA has Korean firms targeting fresh sectors

|

Hong Sun, vice chairman of the Korea Chamber of Business in Vietnam, said that since taking effect in late 2015, the reduced tariffs of the Korea-Vietnam Free Trade Agreement (KVFTA) have been among major propellants in the skyrocketing rise of Korean investment and exports into Vietnam.

“Thanks to KVFTA, Korea’s investments and exports to Vietnam have and will continue rising because many Korean firms are seeking to invest and expand their business so as to meet conglomerates’ demands in Vietnam, like Samsung, and LG,” Sun said.

The General Statistics Office last week reported that in this year’s first six months, Korea was Vietnam’s second-largest import market (after China), with a turnover of $22.5 billion, up 51.2 percent year-on-year. Vietnam suffered from a trade deficit of $15.9 billion from Korea.

Meanwhile, in last year’s corresponding period, Korea was also Vietnam’s second-largest import market (after China), with the turnover of $14.9 billion, up 8 percent year-on-year. Vietnam suffered from a trade deficit of $9.8 billion from Korea.

According to statistics from the Ministry of Planning and Investment, Korea is Vietnam’s largest foreign investor. As of June 2016, the number of Korean investment projects in Vietnam was 5,364, registered at $48.5 billion. By May 20, 2017, the number had increased to nearly 6,100 projects, clocking in at $54.54 billion.

Over the 15-year period following the implementation of KVFTA, Vietnam will completely remove import duties on 89.9 per cent of all products from Korea.

For example, Vietnam will remove it's 30 and 20 per cent tariffs imposed on Korean air conditioners and rice cookers, respectively, over the next 10 years. The average tariffs for foodstuffs and consumer goods will gradually be reduced from the existing 16-17 per cent to 0 per cent over the next five years.

In this year’s first six months, Vietnam has removed tariffs on 16 lines of products shipped from Korea. Items subject to the next round of tariff cuts include two-litre and larger engines for vehicles, auto parts, steel, and petrochemical products.

Over the past few years, Korean investments in Vietnam have been largely focused on the property, industrial, and textile and garment sectors.

But Sun also stressed an increase in Korean investment in Vietnam’s foodstuff and consumer goods sector, thanks to KVFTA.

“Not only Korean firms but also foreign ones in general are seeing Vietnam’s foodstuff and consumer foods sector as a new investment attractor,” Sun said.

“This has strongly spurred the development of the foodstuff and consumer foods sector. Then Korean firms will benefit from this via their growing investment.”

In a specific case, Chang Bok Sang, president and CEO of CJ Group Vietnam under the listed Korean conglomerate CJ Group, told VIR that CJ will continue expanding its operations in Vietnam, a country which is “very important” to the group.

“We are trying to create a new culture by [combining] what we have done best in Korea and what we see best for the Vietnamese people. CJ’s vision in Vietnam is making the food industry a basic business to create a new culture, [one] which would serve best for Vietnamese people’s lives,” Sang said.

“We are finding the best ways to connect with Vietnamese consumers and the market in long-term investment. Mergers and acquisitions are a way to reach it.”

Having been in Vietnam for over 20 years, CJ is acquiring a 65 per cent stake in Vietnam-based Minh Dat Food for VND294.8 billion ($13.4 million). Prior to Minh Dat, CJ acquired a 47.3 per cent stake in Cau Tre, another Ho Chi Minh City-based food producer.

Last month, Lotte Duty Free established a joint venture in Vietnam with a local partner. The first duty-free store has been opened on a pilot basis – a 1,000 square metres at Danang International Airport. The official opening is expected for August.

It is expected that Lotte Duty Free will continue opening more stores in major cities throughout Vietnam.

In another case, Ourhome, one of the top food catering service firms in Korea, last month expanded its business operations in Vietnam, where it provides meals for workers at LG Innotek’s production facility. Ourhome, owned by LG Group, serves an average of 500 meals per day, and expects to expand the number to 1,000 by the end of 2017.

Other top food catering companies, such as Samsung Welstory, Hyundai Green Food, CJ Freshway, and Shinsegae Food, and retailers like Emart are also expanding into Vietnam.

Lee Hyuk, Korean Ambassador to Vietnam, told VIR that there are already many companies in Korea well-equipped with capital, state-of-the art technology, and strong management abilities that are paying special attention to Vietnam in their search for new markets.

“Therefore, with KVFTA in full swing, I am certain that Korean companies’ investments will grow both in quantity and quality in the years ahead,” Hyuk said.

According to him, KVFTA is also having a positive effect on investment. Compared to the Korea-ASEAN FTA or the Korea-Vietnam Bilateral Investment Treaty, KVFTA provides a higher level of investment liberalisation and investor protection.

“This creates a favourable business environment for Korean companies, thereby making Vietnam an even more attractive investment destination,” Hyuk said.

Related News

Import and export in the first quarter: clearer and clearer bounce- back trend

15:54 | 10/04/2024 Import-Export

A lot of room for growth in the potential for Vietnam - Rok financial cooperation

10:05 | 12/03/2024 Finance

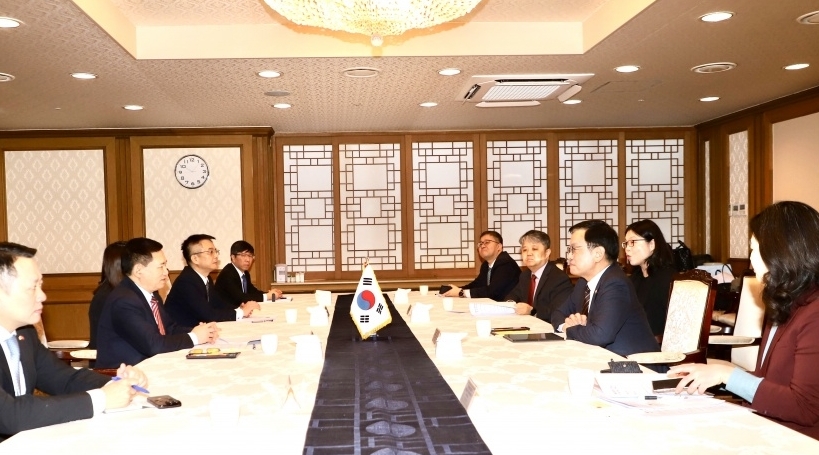

The Minister of Finance chaired the Vietnam - Korea Financial Investment Promotion Conference

10:19 | 09/03/2024 Finance

What is the solution to bring shrimp exports to over US$ 4 billion?

14:29 | 08/03/2024 Import-Export

Latest News

Import and export are expected to reach 800 billion USD

13:32 | 04/11/2024 Import-Export

Fresh coconuts quenching new overseas markets

13:29 | 04/11/2024 Import-Export

Rice exports likely to set new record in 2024

13:25 | 04/11/2024 Import-Export

Vietnamese goods conquer halal market through trust and quality

09:57 | 04/11/2024 Import-Export

More News

Exporters urged to have strategies to take advantage of UKVFTA for expansion

17:33 | 03/11/2024 Import-Export

Fresh coconuts quenching new overseas markets

17:29 | 03/11/2024 Import-Export

Vietnam and UAE trade sees billion-dollar growth

07:15 | 03/11/2024 Import-Export

Sharing responsibility for ensuring security and safety of the supply chain

07:13 | 03/11/2024 Import-Export

Many factors affecting tuna exports in the last months of the year

19:38 | 02/11/2024 Import-Export

Vietnam still dominates Philippine rice import

19:36 | 02/11/2024 Import-Export

Vietnam cements ties with partners to engage in global semiconductor, AI industries

19:35 | 02/11/2024 Import-Export

Aquatic exports expected to rise in year-end despite challenges

19:33 | 02/11/2024 Import-Export

Trade Defense: The Key to Success for Vietnamese Businesses

10:39 | 02/11/2024 Import-Export

Your care

Import and export are expected to reach 800 billion USD

13:32 | 04/11/2024 Import-Export

Fresh coconuts quenching new overseas markets

13:29 | 04/11/2024 Import-Export

Rice exports likely to set new record in 2024

13:25 | 04/11/2024 Import-Export

Vietnamese goods conquer halal market through trust and quality

09:57 | 04/11/2024 Import-Export

Exporters urged to have strategies to take advantage of UKVFTA for expansion

17:33 | 03/11/2024 Import-Export