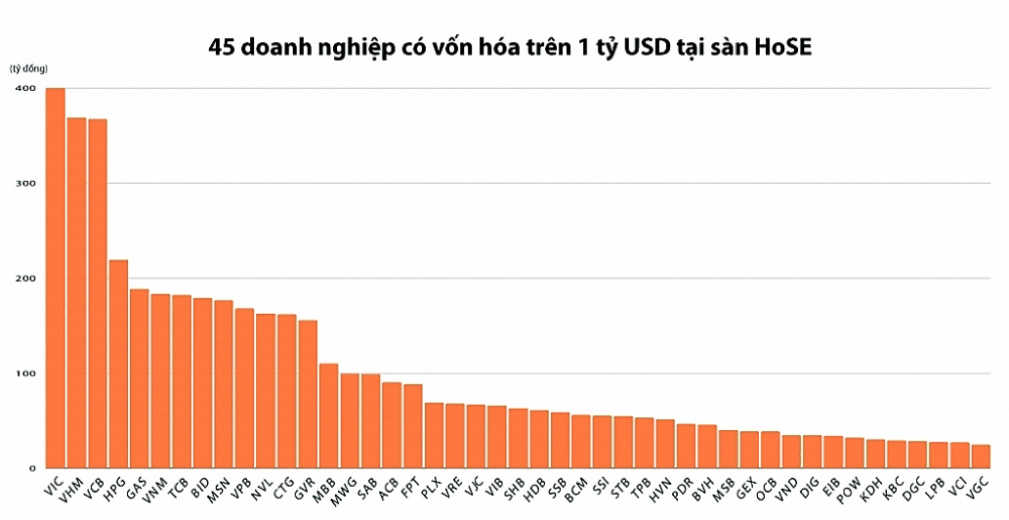

Impressive billion USD businesses

|

| Sketch by Phương Anh |

The financial group “co-starter”

The outstanding mark of the stock market in 2021 is the return of the "king stock" group after many years of ups and downs. According to the statistics of Maybank Kim Eng Securities Company, in the first nine months of 2021, the total profit before tax of 17 listed banks has increased impressively by nearly 43% over the same period in 2020.

Circular 01/2020/TT -NHNN and 03/2021/TT-NHNN of the State Bank, together with the low-interest rate environment, have helped banks significantly reduce the cost of capital at a faster rate than the rate of decline in lending rates, thereby helping NIM (net profit margin) expand at most banks.

The high growth in profit has helped banking stocks become a "hot" industry in the market, attracting strong cash flow. The market's expectations were even higher than the profit growth rate of banks, pushing up stock prices. As a result, all 17 banking stocks on HoSE are included in the billion-dollar club of this exchange. Vietcombank alone has a market capitalization of more than US$14 billion.

Forecasting the prospects of banking stocks, experts of Maybank Kim Eng Securities Company believe that Vietnam's banking industry is still in a highly profitable cycle and is supported by reasonable capital regulations.

Concerns about bad debt risk will cool down from the end of the first quarter of 2022 along with the recovery of the economy, which will boost market sentiment on bank stocks. The plans to sell equity and raise capital will also be the driving force for bank shares to be re-evaluated in the near future. Accordingly, Maybank Kim Eng expects banks to maintain a stable profit growth rate and return on capital (ROE) to continue at a high level of 18-25% in 2022.

Similar to the banking group, the excitement of the stock market also helped many securities stocks continuously conquer new heights. More than 1.3 million new securities accounts were opened in the first eleven months of 2021 are bringing with it an explosion in market liquidity. Thereby helping securities companies "take money" from the brokerage segment.

Besides, margin lending activities also brought in strong growth in revenue. Total margin loans of the whole market increased to an all-time record. The phenomenon of tight margin in many securities companies is happening continuously.

The positivity of profits supported the market price of stocks. Accordingly, three representatives of this industry are in the billion-dollar club including SSI, VNDirect and Ban Viet. In order to have more resources for business activities in the context of the booming market, many securities companies are racing to raise capital. Therefore, the forecast of a breakthrough of securities companies has not stopped, especially in the context that this is still considered an attractive investment channel and continues to attract cash flow.

Manufacturing, real estate rising

Besides the boom of the securities channel, the low-interest rate environment also promotes strong cash flow into the real estate investment channel. According to a report by VCBS Securities, despite being heavily affected by the Covid-19 pandemic, people's real estate demand is still high.

This is reflected in the high absorption rate at projects that are open for sale and the price level continues to record an upward trend even during the period of social distancing. From the fourth quarter of 2021, real estate transaction activity is assessed to recover strongly when the demand for housing and investment is pent-up during the lockdown period, while travel restrictions are gradually lifted. In addition, the prolonged shortage of supply, especially in big cities, will promote the trend of increasing real estate prices in 2022.

There are eight real estate enterprises included in the list of billion USD of HoSE. In which, the share price of DIG of Construction Investment and Development Corporation is now more than four times higher than that of the beginning of the year; stocks KDH, PDR also doubled in price, bringing the company into the billion-dollar group.

In the manufacturing sector, DGC shares of Duc Giang Chemical Group have never been so hot when at one point approached the threshold of VND180,000, a very strong increase compared to the price of only VND44,500 in the opening session in 2021.

According to Mirea Asset Securities, the Chinese government's policy is changing when they gradually reduce the production of heavy industrial products such as steel, chemicals, coal-fired power to reduce the impact on the environment. This has caused a shortage of raw materials worldwide, pushing up raw material prices. In addition, the world's chip demand increased sharply, but the supply was not enough, causing a shortage of chips around the world. In particular, the scarcity of phosphorus, an input material for production, is also one of the main reasons why the price of this material has continuously increased in recent years. That has helped DGC benefit greatly in 2021.

Similarly, "steel king" Hoa Phat (HPG) also witnessed strong growth in the stock market, bringing the capitalization of this enterprise to surpass US$10 billion at one point. Currently, the stock price has adjusted from the peak, it is still 53% higher than the beginning of the year. This increase came from the sudden improvement in business results when the world steel price continuously increased. In 2022, HPG is forecast to be the main beneficiary of the accelerated disbursement of public investment.

It can be seen that behind each billion-dollar enterprise is a separate story about production and business activities. Accordingly, besides the unexpected opportunities brought by the market, it is also a solid foundation from the potential and position in the industry to be able to turn opportunities into profits as well as positive prospects in the future of these enterprises.

Related News

Untying the knot for green finance

11:08 | 23/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Transparency evates the standing of listed companies

09:47 | 21/11/2024 Finance

State budget revenue for 2024 nears target

10:06 | 08/11/2024 Finance

Latest News

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

More News

Six SOEs to be transferred back to industry ministry

15:38 | 18/12/2024 Finance

PM urges stronger measures to manage interest rates

16:53 | 17/12/2024 Finance

Six SOEs to be transferred back to industry ministry

16:48 | 17/12/2024 Finance

Vietnamese products: Conquering foreign customers in supermarket systems

16:45 | 17/12/2024 Finance

Answering many questions from businesses at dialogue conference on tax and customs policies

10:01 | 17/12/2024 Finance

Enterprises face difficulties in tax refunds due to partners closing

10:01 | 17/12/2024 Finance

Strengthen the management and use of electronic invoices for e-commerce

11:24 | 16/12/2024 Finance

Ministry of Finance proposes comprehensive amendments to the Personal Income Tax Law

11:23 | 16/12/2024 Finance

Expansionary fiscal policy halts decline, boosts aggregate demand

19:27 | 14/12/2024 Finance

Your care

Untying the knot for green finance

11:08 | 23/12/2024 Finance

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance