HCM City Tax Department diversifies methods to support taxpayers

| HCM City: Customs and Tax coordinate to combat revenue loss | |

| HCM City Tax Department collects billions of dong in tax arrears | |

| Many enterprises violate on tax policy |

|

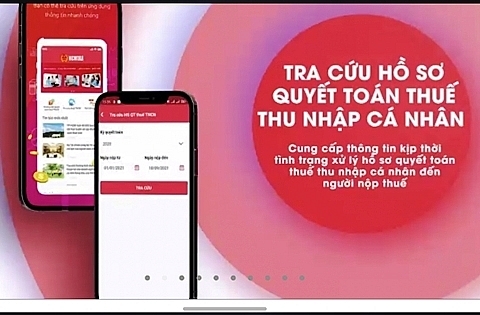

| HCMTax application. |

HCMTax application is an application for exchanging information between taxpayers and the taxman, facilitating and ensuring the confidentiality of taxpayers’ information and helping taxpayers to fully and quickly access information from tax authorities.

The application also integrates some utilities to support taxpayers, including searching the receipt of taxpayers’ documents, personal income tax finalisation records, setting working schedules, supporting in declaring tax payable and recovering Etax password. Many other additional functions will be built in the near future.

Taxpayers can access HCM City Tax department’s website https://www.hcmtax.gov.vn or download the HCMTax application on mobile devices. Taxpayers will get detailed instruction on the application or Faceboom page, Zalo, or YouTube of the department.

According to Director of HCM City Tax Department, Le Duy Minh, the complex development of the Covid-19 pandemic and application of strict social distancing measures have seriously affected the businesses’ operation and residents’ lives. HCM City Tax Department has provided online support solutions, including the HCMTax application.

This shows the efforts of HCM City Tax Department in supporting taxpayers amid the pandemic, and is the digital transformation step in administrative reform and modernisation towards a digital government, changing the working method between tax authorities and taxpayers, saving time and costs, publicity and transparency of information between taxman and taxpayers.

Related News

From January 1, 2025: 13 product codes increase export tax to 20%

14:23 | 29/12/2024 Regulations

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

Achievements in revenue collection are a premise for breakthroughs in 2025

09:57 | 18/12/2024 Customs

Answering many questions from businesses at dialogue conference on tax and customs policies

10:01 | 17/12/2024 Finance

Latest News

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

More News

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance

Fiscal, monetary policies support demand stimulation, price stabilisation

14:49 | 14/02/2025 Finance

Vietnam secures VND 157 billion from state enterprise divestment in 2024

09:16 | 14/02/2025 Finance

Vietnam gears up for potential inflation impact in 2025

14:26 | 11/02/2025 Finance

VN’s credit conditions in 2025 expected to be stable

14:24 | 11/02/2025 Finance

State revenue in first month of the year equal to 14% of the estimate

10:12 | 11/02/2025 Finance

Securities 2025 expects a breakthrough in scale and quality

14:37 | 10/02/2025 Finance

Cash reserves in stock accounts at six-quarter low amid margin rise

08:23 | 10/02/2025 Finance

Five solutions for developing stock market in 2025

10:01 | 07/02/2025 Finance

Your care

The system has not recorded your reading habits.

Please Login/Register so that the system can provide articles according to your reading needs.

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance