From now until the end of the year, interest rates will face many upward pressures

| Banks continue savings interest rates “race” | |

| Interest rate support package has little effect on stock market | |

| The hard liquidity, increasing credit, interest rates are under upward pressure |

|

| The increase in interest rates will not be too high this year. Photo: Internet |

Increasing cost of new loans

Recently, the US Federal Reserve (Fed) decided to increase interest rates by 0.75 percentage points, to 1.5-1.75%, to restrain inflation. This is the highest interest rate of the Fed since the outbreak of the Covid-19 pandemic in March 2020.

According to economic expert Dr. Can Van Luc and a team of authors from the BIDV Training and Research Institute, this will cause Vietnam's trade activities to slow down when the global economic recovery slows down. Moreover, the Fed's interest rate increase will make the USD appreciate against most other currencies, including VND, putting more pressure on the USD/VND exchange rate.

On the other hand, according to experts from the BIDV Training and Research Institute, the Fed's interest rate increase will make the domestic interest rate level tend to increase, causing the cost of new loans and the debt repayment obligation in USD to increase.

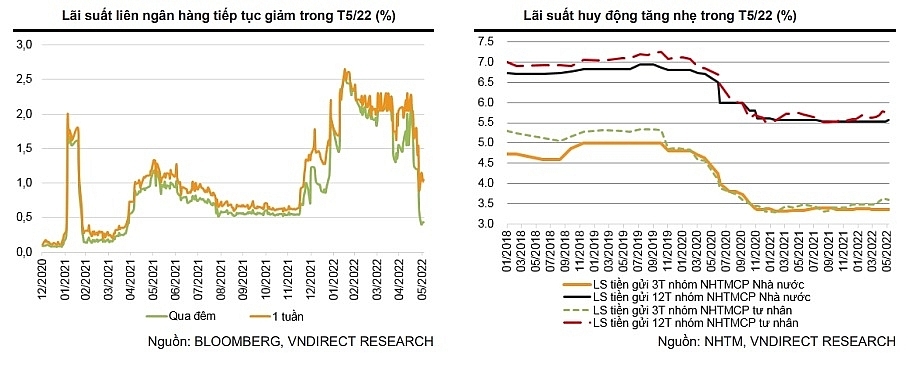

It is forecast that savings interest rates will continue to increase in the context that the liquidity of the credit institutions system is shrinking, and inflation pressure will increase when the CPI has increased by 2.86% in May compared with the same period last year and an average increase of 2.25% compared to the end of 2021.

Besides, credit demand increased sharply (by the end of June 9, increased by about 8.16%, much higher than 4.95% of the first five months of 2021), leading to an increase in capital demand.

|

| Deposit interest rates will continue to increase from now until the end of 2022 |

According to a survey on the market today, for more than a month now, many banks from small, mid-range to "big" ones have increased deposit interest rate by 0.3-0.5% per year in some terms, making the deposit interest rate of 7% per year more popular.

According to a macro assessment report of VnDirect Securities Company, deposit interest rates (in VND) are under increasing pressure in the last months of the year due to the increase in USD interest rates and high inflationary pressure in Vietnam in the next quarters.

However, the increase will not be large with the forecast that interest rates will increase by about 30-50 basis points from now until the end of the year. VnDirect forecasts that the 12-month term deposit interest rate of commercial banks may increase to 6.0-6.2% per year by the end of 2022 (currently at the average rate of 5.7% per year). still lower than the pre-pandemic level of 7.0% per year.

In addition, according to experts, although deposit interest rates tend to increase, lending rates have remained stable to support the recovery as directed by the Government and the State Bank of Vietnam, especially when the credit package supporting 2% interest rate with a subsidy of VND40,000 billion was implemented.

Reasonable management in the face of inflation pressure

From the above issues, experts of VnDirect said that the State Bank would make efforts to maintain the "appropriate" monetary policy, not rush to tighten the policy immediately to support the recovery of the economy and stabilize the market. The SBV still prioritized the goal of maintaining low lending rates to support enterprises and the recovery of the economy. As for the operating interest rate, if there was any increase this year, it would likely happen in the fourth quarter of 2022 and the increase (if any) would be limited at around 0.25-0.5%.

Similarly, analysts from HSBC also believed that Vietnam's inflation in 2022 was not a problem. In its recently released report, HSBC had reduced its inflation forecast for Vietnam this year from 3.7% to 3.5%. HSBC also forecast that the SBV would raise the operating interest rate by 50 basis points in the third quarter of 2022 before raising the interest rate three times, 25 basis points each time in 2023.

With the above problems, Dr. Can Van Luc recommended that, in order to minimize the negative impacts caused by the central banks of countries, especially the Fed, which tended to tighten monetary policy, management agencies should continue to strengthen the coordination of monetary policy, fiscal policy and price management to stabilize the macro-economy; It was necessary to develop a roadmap and coordinate to enforce the price regulation of goods managed by the State.

In a recent press conference, Mr. Dao Minh Tu, Deputy Governor of the State Bank, also said that in the last six months of the year, the biggest pressure on monetary policy was inflation. Therefore, the State Bank would calculate plans and solutions to manage monetary policy, and coordinate with fiscal policy and other policies with the goal of controlling inflation according to the desired target.

Related News

Complying with regulations of each market for smooth fruit and vegetable exports

13:06 | 09/01/2025 Import-Export

Coconut export enter acceleration cycle

11:02 | 30/12/2024 Import-Export

Increasing consumption demand, steel enterprises have many opportunities

07:43 | 31/12/2024 Import-Export

Latest News

Việt Nam tightens fruit inspections after warning from China

08:01 | 15/01/2025 Import-Export

Brand building key to elevate Vietnamese fruit and vegetable sector: experts

08:00 | 15/01/2025 Import-Export

Freight transport via China-Việt Nam cross-border trains posts rapid growth

08:01 | 13/01/2025 Import-Export

Vietnamese retail industry expects bright future ahead

06:22 | 11/01/2025 Import-Export

More News

Fruit and vegetable industry aims for $10 billion in exports by 2030

15:12 | 07/01/2025 Import-Export

GDP grows by over 7 per cent, exceeds target for 2024

15:11 | 07/01/2025 Import-Export

Vietnamese pepper: decline in volume, surge in value

15:10 | 07/01/2025 Import-Export

Việt Nam maintains position as RoK’s third largest trading partner

15:09 | 07/01/2025 Import-Export

Greater efforts to be made for stronger cooperation with European-American market

15:08 | 06/01/2025 Import-Export

Leather, footwear industry aims to gain export growth of 10% in 2025

15:06 | 06/01/2025 Import-Export

Grasping the green transformation trend - A survival opportunity for Vietnamese Enterprises

14:53 | 06/01/2025 Import-Export

Việt Nam to complete database of five domestic manufacturing industries in 2026

20:57 | 05/01/2025 Import-Export

Logistics firms optimistic about growth prospects in 2025: Survey

20:54 | 05/01/2025 Import-Export

Your care

Việt Nam tightens fruit inspections after warning from China

08:01 | 15/01/2025 Import-Export

Brand building key to elevate Vietnamese fruit and vegetable sector: experts

08:00 | 15/01/2025 Import-Export

Freight transport via China-Việt Nam cross-border trains posts rapid growth

08:01 | 13/01/2025 Import-Export

Vietnamese retail industry expects bright future ahead

06:22 | 11/01/2025 Import-Export

Complying with regulations of each market for smooth fruit and vegetable exports

13:06 | 09/01/2025 Import-Export