Flexible monetary policy - an effective "medicine" for recovery

| Flexible monetary policy helps recover credit growth amid pandemic | |

| Central bank to keep proactive, flexible monetary policy |

|

| Lower interest rates for over 1.94 million customers affected by the pandemic. Source: SSI |

Going in the right direction

| SBV Deputy Governor Pham Thanh Ha: Ensuring liquidity for the economy The room for monetary policy in the future depends on the challenges of the banking industry. In particular, inflation is a global problem, so the State Bank will closely monitor the situation to develop timely response policies. Moreover, the interest rate reduction will only be reduced to the extent that it is still enough to attract depositors, so the State Bank will regulate interest rates that are balanced with inflation in correlation with the interests of depositors. Under favourable conditions, the State Bank can reduce interest rates at an appropriate level. In addition, the management of monetary policy, including the exchange rate, is not only concerned with domestic scope, but also with the relationship with major trading partners, including the United States. |

According to statistics from the State Bank of Vietnam (SBV), since the beginning of the year, the world has witnessed 93 interest rate increases by central banks, of which September 2021 alone witnessed 50 interest rate increases, and only about 11 interest rate cuts. All of them stem from concerns about inflation, which has prompted central banks in many countries to begin narrowing currency easing measures.

In Vietnam, financial experts have warned about the risk of "importing inflation" when Vietnam is a highly open economy.

The good news is that the "risk" is real, but in fact, controlling inflation and supporting the economy in Vietnam's monetary policy is still going in the right direction.

Some experts have said that inflation was becoming a global concern, but Vietnam's core inflation rate in 2021 was still acceptable, below the 4% target set by the National Assembly and the Government.

Therefore, monetary policy still has room to show all the positive effects on the economy.

According to calculations by the BIDV Training and Research Institute, the banking industry supported the economy with about VND 30,600 billion in 2020 and was estimated at VND54 trillion in 2021, equivalent to more than 1% of GDP (adjusted).

In addition, finance and banking expert Dr. Can Van Luc said that the SBV managed the money supply proactively and flexibly, ensuring liquidity and safety of the system, sticking to the growth target and controlling inflation.

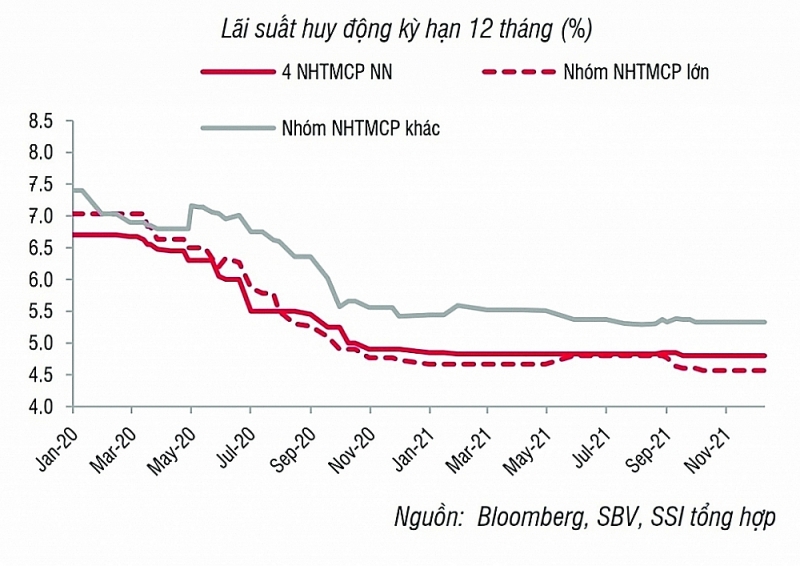

Indeed, the report of the State Bank said that, after three times reducing operating interest rates with a decrease of 1.5-2% per year in 2020 and being one of the central banks with the heaviest reduction of interest rates in the region, in 2021, the SBV kept the operating interest rates unchanged, creating favourable conditions for credit institutions to access capital from the SBV at a low cost.

As a result, the lending interest rate level after reducing 1% per year in 2020 decreased by 0.7% per year in the first nine months of 2021. Moreover, by the end of November, credit reached VND10.18 quadrillion, up 10.7% compared to the end of 2020. This shows that credit had actively supported the economy after a long time implementing social distancing in many localities in the third quarter.

In particular, banks have also exempted, reduced and lowered interest rates for over 1.94 million customers affected by the pandemic with outstanding loans of more than VND3.81 quadrillion.

Along with that, the exchange rate management continued to ensure flexibility, in line with market movements and smooth foreign currency demand. The VND/USD exchange rate continued to be stable, while many regional currencies depreciated significantly against the USD (Thai baht down 11.2%, Malaysian ringgit down 2.8%, Singapore dollar down 1.95%). As a result, the import and export activities of enterprises have improved.

Facing pressure

Despite the positive results, economic expert Dr. Le Xuan Nghia said that there was no country in the world that "pulls" commercial banks into action to support economic recovery during the pandemic through support packages, because this would greatly affect the asset balance sheet, endangering the sustainability of the banking system.

This expert even recalled the financial crisis in 2009 with the lesson of the interest rate bailout package, which caused a huge amount of bad debt, it could only be resolved many years later.

Furthermore, the SBV adjusted and amended Circular 01/2020/TT-NHNN when issuing Circular 03/2021/TT-NHNN dated April 2, 2021 and Circular 14/2021/TT-NHNN dated September 7, 2021 on the rescheduling of debt repayments, exemptions and reduction of interest and fees, maintaining the same debt group to support customers affected by the pandemic, with the extension of the scope and application period for the next 6 months, until the end of June 2022.

These are considered timely policies to support enterprises and people. But at the same time, there are warnings about bad debt increasing. According to some forecasts, about VND3 quadrillion of credit, of over VND10 quadrillion, equivalent to more than 30%, are in a high-risk situation.

Entering 2022, the SBV said that the management of monetary policy still faced many challenges, while maintaining support for the economic recovery process being fragile, uncertain, and moderate and proactively dealing with rising inflationary pressure. Therefore, the "medicine" from monetary policy needs to be combined with many other policy solutions and tools.

A report by a group of experts from the National Economics University recommended that the State Bank should study to reduce the required reserve ratio, because just a 0.5% reduction in this ratio would free up capital of up to VND50,000 billion. The SBV should also remove the regulation on credit limits with commercial banks, to avoid creating an ask-for-give mechanism between the SBV and banks.

In addition, experts said the SBV needed to extend the implementation deadline for the ratio of short-term capital for medium- and long-term loans from now until the end of 2023 in order to reduce pressure on raising deposit rates. Commercial banks should be very careful about credit quality management, aggressively set up provisions for credit risks under the real nature of restructured debts.

Related News

Quang Ninh Customs: making efforts to help businesses improve compliance

16:47 | 31/12/2024 Customs

Agree to continue reducing VAT by 2%

11:02 | 29/11/2024 Finance

Bac Ninh Customs encourages customs brokerage services

15:32 | 05/11/2024 Customs

Fiscal policy needs to return to normal state in new period

09:54 | 04/11/2024 Finance

Latest News

Việt Nam tightens fruit inspections after warning from China

08:01 | 15/01/2025 Import-Export

Brand building key to elevate Vietnamese fruit and vegetable sector: experts

08:00 | 15/01/2025 Import-Export

Freight transport via China-Việt Nam cross-border trains posts rapid growth

08:01 | 13/01/2025 Import-Export

Vietnamese retail industry expects bright future ahead

06:22 | 11/01/2025 Import-Export

More News

Complying with regulations of each market for smooth fruit and vegetable exports

13:06 | 09/01/2025 Import-Export

Fruit and vegetable industry aims for $10 billion in exports by 2030

15:12 | 07/01/2025 Import-Export

GDP grows by over 7 per cent, exceeds target for 2024

15:11 | 07/01/2025 Import-Export

Vietnamese pepper: decline in volume, surge in value

15:10 | 07/01/2025 Import-Export

Việt Nam maintains position as RoK’s third largest trading partner

15:09 | 07/01/2025 Import-Export

Greater efforts to be made for stronger cooperation with European-American market

15:08 | 06/01/2025 Import-Export

Leather, footwear industry aims to gain export growth of 10% in 2025

15:06 | 06/01/2025 Import-Export

Grasping the green transformation trend - A survival opportunity for Vietnamese Enterprises

14:53 | 06/01/2025 Import-Export

Việt Nam to complete database of five domestic manufacturing industries in 2026

20:57 | 05/01/2025 Import-Export

Your care

Việt Nam tightens fruit inspections after warning from China

08:01 | 15/01/2025 Import-Export

Brand building key to elevate Vietnamese fruit and vegetable sector: experts

08:00 | 15/01/2025 Import-Export

Freight transport via China-Việt Nam cross-border trains posts rapid growth

08:01 | 13/01/2025 Import-Export

Vietnamese retail industry expects bright future ahead

06:22 | 11/01/2025 Import-Export

Complying with regulations of each market for smooth fruit and vegetable exports

13:06 | 09/01/2025 Import-Export