Finance Ministries of Vietnam and Laos promote comprehensive cooperation

| Deputy Director General Hoang Viet Cuong welcomes Deputy Director General of Laos Customs | |

| Vietnam, Laos sign new trade agreement |

|

| The meeting. |

At the meeting, Minister Ho Duc Phoc said that the traditional friendly relationship between the two countries’ increasingly develops.

Evaluating the results of implementing the cooperation agreement in 2023, Minister Ho Duc Phoc said that the two sides have implemented 26 of 35 contents set out in the agreement, the remaining contents will be implemented in 2024 and the two sides will sign new cooperation agreement to implement in the next phase.

|

| Minister of Finance Ho Duc Phoc speaks at the meeting. |

At the meeting, the Minister shared some experiences in operating and managing the financial sector such as institutional improvement and public debt management. The Minister said the importance of institutional improvement and affirmed that this is also one of the breakthroughs in Vietnam's economic development.

The Minister affirmed that the Ministry of Finance of Vietnam is ready to share experiences and support the Ministry of Finance of Laos for sustainable development of both sides. The Ministry of Finance of Vietnam will continue to send specialized units to closely coordinate with units of Lao Ministry of Finance to share experiences and implement specialized contents.

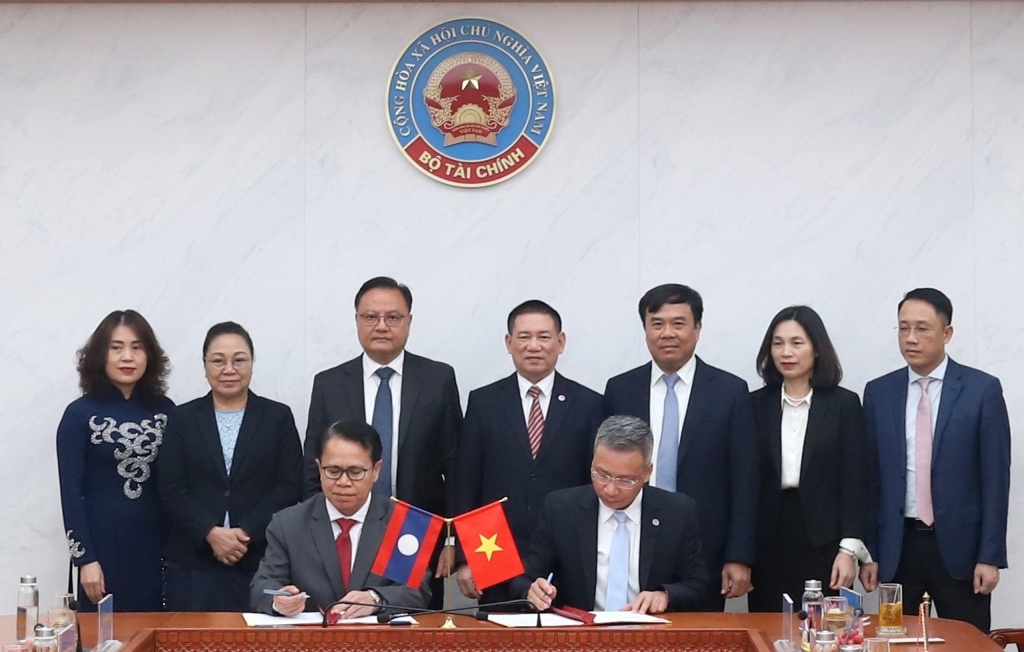

The two countries' Ministries of Finance sign the Minutes of the 18th meeting of the Steering Committee of the Cooperation Program between the two Ministries of Finance of Vietnam and Laos.

Minister Ho Duc Phoc expressed his belief that the comprehensive cooperative partnership between the two countries' Ministries of Finance will increasingly develop, contributing to enhancing the traditional friendly cooperation and comprehensive cooperation between the two Parties, two States, and the people of the two countries.

At the meeting, Lao Minister of Finance Santiphab Phomvihane affirmed that cooperative activities have helped the Ministry gain more professional experience to overcome difficulties in financial and budget management and training for officers in the fields of Tax, Customs, and State Treasury...

|

| The two Ministries signed the Minutes of the 18th meeting of the Steering Committee of the Cooperation Program between the two Ministries of Finance of Vietnam and Laos. |

The Lao Minister discussed on key contents that the two sides will promote cooperation in 2024, such as supporting the development orientation of the Lao Finance industry in the medium and long term; assisting institutional reform and improvement of the legal framework; supporting the implementation of research, dissemination and appraisal of draft laws and guiding documents of the Lao Finance industry.

Minister Santiphab Phomvihane hoped that the cooperation program between the two sides will increasingly develop well, thereby helping the Lao Ministry of Finance improve financial management capacity, and officers of the two sides to strengthen understanding and support each other.

At the meeting, representatives of the two Ministries signed the Minutes of the 18th meeting of the Steering Committee of the Cooperation Program between the two Ministries of Finance of Vietnam and Laos.

Related News

Vietnam secures VND 157 billion from state enterprise divestment in 2024

09:16 | 14/02/2025 Finance

Vietnam kicked off the year with a strong start in trade, exceeding US$63 billion in the first month

16:30 | 15/02/2025 Import-Export

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

Vietnam gears up for potential inflation impact in 2025

14:26 | 11/02/2025 Finance

Latest News

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance

More News

Fiscal, monetary policies support demand stimulation, price stabilisation

14:49 | 14/02/2025 Finance

VN’s credit conditions in 2025 expected to be stable

14:24 | 11/02/2025 Finance

State revenue in first month of the year equal to 14% of the estimate

10:12 | 11/02/2025 Finance

Securities 2025 expects a breakthrough in scale and quality

14:37 | 10/02/2025 Finance

Cash reserves in stock accounts at six-quarter low amid margin rise

08:23 | 10/02/2025 Finance

Five solutions for developing stock market in 2025

10:01 | 07/02/2025 Finance

Minister of Finance Nguyen Van Thang works with GDVC at the first working day after the Tet holiday

14:43 | 04/02/2025 Finance

The stock market after Tết 2025 presents both challenges and opportunities

07:55 | 04/02/2025 Finance

Opportunities and challenges in Việt Nam's crypto boom

14:27 | 03/02/2025 Finance

Your care

The system has not recorded your reading habits.

Please Login/Register so that the system can provide articles according to your reading needs.

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance