Export growth supports the economy and stock market

| Catfish enterprises overcome challenges and accelerate export growth | |

| Wood processing industry to see slow export growth in 2024 | |

| Binh Duong export growth hopes to bounce back |

|

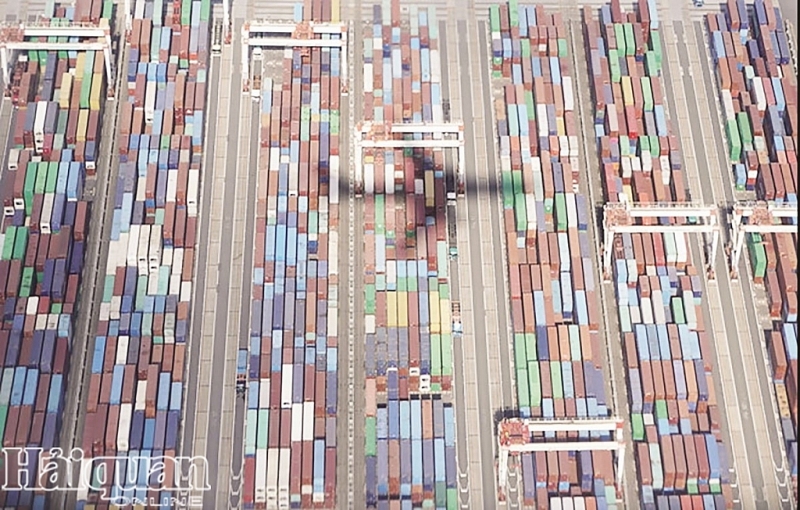

| Vietnam's exports grew strongly in January 2024. |

Exports are on the rebound

According to Mr. Michael Kokalari, Director of VinaCapital Macroeconomic Analysis and Market Research Department, the strong growth of Vietnam's exports in January 2024 is due to an increase of nearly 60% over the same period in the export segment of computers and electronic products.

Global smartphone revenue also returned to growth at the end of 2023 for the first time in two years, although the recovery was not as pronounced as in the computer segment because new products lacked attractive enough functions to push users to upgrade. Vietnam's smartphone exports increased by 16% over the same period in January 2024, thanks to the launch of the new Samsung S24 phone model during the month.

Another reason why Vietnam's exports increased sharply in January 2024 is because this month has 25% more working days than January 2023 (due to Lunar New Year taking place on January 21-27 of 2023).

Manufacturing increased by 19.3% year-on-year in January 2024, so export growth far exceeded production growth. That means that manufacturers' inventories fell last month (Vietnam's January 2024 PMI index also confirmed a decline in finished goods inventories). The combination of falling inventories and increasing new orders means that factory production in Vietnam will need to ramp up to meet rising demand for “Made in Vietnam” products.

Manufacturing accounts for nearly 25% of Vietnam's GDP, so boosting manufacturing activities will boost GDP growth. In addition, nearly 10% of Vietnam's workforce is working for FDI companies with relatively high salaries.

According to the General Statistics Office, FDI companies have cut workers in early 2023, which is also a reason why Vietnam's GDP only increased by 3.3% in the first quarter of 2023, but labor in the manufacturing industry has been recovering from last year's cuts. Factory worker wages also recovered 5-7% after hitting bottom last year.

So the economy will get a boost from increasing manufacturing activity and higher consumption this year, supported by rising manufacturing jobs. Consumer confidence and domestic demand will recover.

"While we do not expect consumer spending to grow strongly in the first quarter, we still expect consumer spending and domestic consumer demand to be stronger in the later stages of this year," the VinaCapital expert emphasized.

Economic recovery boosts profits of listed companies

VinaCapital experts also expect that, along with export growth, domestic investors will pour more money into the Vietnamese stock market in the first quarter and this year.

The reasons to motivate domestic investors to pour money into the stock market are that bank deposit interest rates in Vietnam are near the lowest level; The above broad economic recovery will boost corporate profits - especially the banking industry and consumer companies. Along with that, market valuation is at a very attractive level, 25% lower than the valuation of emerging markets in the same region.

Vietnam's export recovery started in the fourth quarter of 2023 and gained momentum in January 2024, supported by rising demand for high-tech electronic products. VinaCapital expects manufacturing activities to continue to grow throughout 2024.

Plus, manufacturing employment has rebounded after last year's cuts, so consumption will likely get a boost as factories employ more workers in the coming months.

“A broad-based economic recovery from exports, production and consumption will boost the profits of listed companies. We expect the profits of listed companies to recover from a decrease of 33% in 2023 to an increase of 50% in 2024, and the profits of listed banks will increase from 6% to 18%," Mr. Michael Kokalari said.

Related News

Exchange rate risks need attention in near future

16:31 | 15/02/2025 Import-Export

Securities 2025 expects a breakthrough in scale and quality

14:37 | 10/02/2025 Finance

Five solutions for developing stock market in 2025

10:01 | 07/02/2025 Finance

Outlook for lending rates in 2025?

15:20 | 31/12/2024 Finance

Latest News

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

More News

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance

Fiscal, monetary policies support demand stimulation, price stabilisation

14:49 | 14/02/2025 Finance

Vietnam secures VND 157 billion from state enterprise divestment in 2024

09:16 | 14/02/2025 Finance

Vietnam gears up for potential inflation impact in 2025

14:26 | 11/02/2025 Finance

VN’s credit conditions in 2025 expected to be stable

14:24 | 11/02/2025 Finance

State revenue in first month of the year equal to 14% of the estimate

10:12 | 11/02/2025 Finance

Cash reserves in stock accounts at six-quarter low amid margin rise

08:23 | 10/02/2025 Finance

Minister of Finance Nguyen Van Thang works with GDVC at the first working day after the Tet holiday

14:43 | 04/02/2025 Finance

The stock market after Tết 2025 presents both challenges and opportunities

07:55 | 04/02/2025 Finance

Your care

The system has not recorded your reading habits.

Please Login/Register so that the system can provide articles according to your reading needs.

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance