Experts: Trimmed interest rates might affect NIMs

|

On July 7, the SBV decided to cut the annual maximum refinancing interest rate, rediscount interest rate and overnight interest rate applied to electronic inter-bank payments. It also cut the rate of loans in order to offset capital shortage in clearing of payments between the SBV and domestic banks by 0.25 percentage points. The new rates came into effect on July 10.

The annual short-term interest rate ceiling for credit institutions loans in VND has also been cut by 0.5 percentage points for some sectors.

Accordingly, businesses operating in agricultural, export and auxiliary industries; small and medium-sized enterprises; and high-tech firms can borrow loans at a maximum short-term rate of 6.5 percent per year, instead of 7 percent.

Following the decision, several commercial banks announced rate cuts.

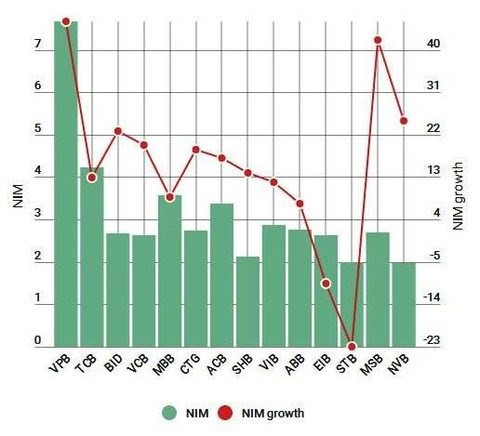

The adjustments are expected to support businesses and boost economic growth, but they also may negatively impact banks’ NIM.

NIM is the ratio of net interest income to invested assets, with the net interest income being the difference between interest income and interest expense.

To maintain a sound NIM, commercial banks would have to reduce their deposit interest rates, which would probably send capital flows to other investment channels, said Can Van Luc, director of BIDV Training School at the Bank for Investment and Development of Vietnam (BIDV).

Commercial banks would also have to comply with the SBV’s Circular 06/2016/TT-NHNN, which specifies a roadmap for the maximum ratio of short-term funds used for medium and long term loans.

Under the circular, the 50 percent ratio will be kept until December 31 this year. It will drop to 40 percent from the beginning of 2018.

To prepare for the deadline, it is unlikely that commercial banks will further push down their deposit interest rates. Otherwise, they would face difficulties in term of liquidity and their net interest income would be harmed, financial expert Nguyen Tri Hieu said.

According to KIS Vietnam Securities Company analysts, the Vietnamese banking system NIM has continuously declined from 3.07 percent in 2013 to 2.69 in 2016. This level is also much lower than those of regional neighbours such as Thailand (3.07 percent), Indonesia (5.82 percent) and the Philippines (3.58 percent).

With such a low NIM, the banking system would find it hard to suffer a savings rate reduction, Luc said.

Statistics from the General Statistics Office of Vietnam show that capital mobilisation of credit institutions increased by 5.89 percent in the first six month of the year, compared with 8.23 percent of the same period last year. Meanwhile, credit from January to June grew by 7.54 percent, the highest rate in the past six year.

Related News

Stipulate implementation of centralized bilateral payments of the State Treasury at banks

09:29 | 29/10/2024 Finance

The biggest challenges businesses are facing

15:28 | 20/10/2024 Headlines

How does the Fed's interest rate cut affect Vietnam?

11:56 | 05/10/2024 Headlines

Bank profits improve but there are no expectations

09:48 | 20/07/2024 Import-Export

Latest News

EU partners no longer 'lenient', Vietnam must adapt through ESG policies

09:02 | 05/11/2024 Import-Export

Changes in Canada's trade defense laws

09:00 | 05/11/2024 Import-Export

Import and export are expected to reach 800 billion USD

13:32 | 04/11/2024 Import-Export

Fresh coconuts quenching new overseas markets

13:29 | 04/11/2024 Import-Export

More News

Rice exports likely to set new record in 2024

13:25 | 04/11/2024 Import-Export

Vietnamese goods conquer halal market through trust and quality

09:57 | 04/11/2024 Import-Export

Exporters urged to have strategies to take advantage of UKVFTA for expansion

17:33 | 03/11/2024 Import-Export

Fresh coconuts quenching new overseas markets

17:29 | 03/11/2024 Import-Export

Vietnam and UAE trade sees billion-dollar growth

07:15 | 03/11/2024 Import-Export

Sharing responsibility for ensuring security and safety of the supply chain

07:13 | 03/11/2024 Import-Export

Many factors affecting tuna exports in the last months of the year

19:38 | 02/11/2024 Import-Export

Vietnam still dominates Philippine rice import

19:36 | 02/11/2024 Import-Export

Vietnam cements ties with partners to engage in global semiconductor, AI industries

19:35 | 02/11/2024 Import-Export

Your care

EU partners no longer 'lenient', Vietnam must adapt through ESG policies

09:02 | 05/11/2024 Import-Export

Changes in Canada's trade defense laws

09:00 | 05/11/2024 Import-Export

Import and export are expected to reach 800 billion USD

13:32 | 04/11/2024 Import-Export

Fresh coconuts quenching new overseas markets

13:29 | 04/11/2024 Import-Export

Rice exports likely to set new record in 2024

13:25 | 04/11/2024 Import-Export