Experience against tax losses of some countries

| HCM City Tax Department: severely prevent tax loss from real estate | |

| Tax inspection and examination at enterprises should not be prolonged | |

| Many effective solutions to anti tax losses |

|

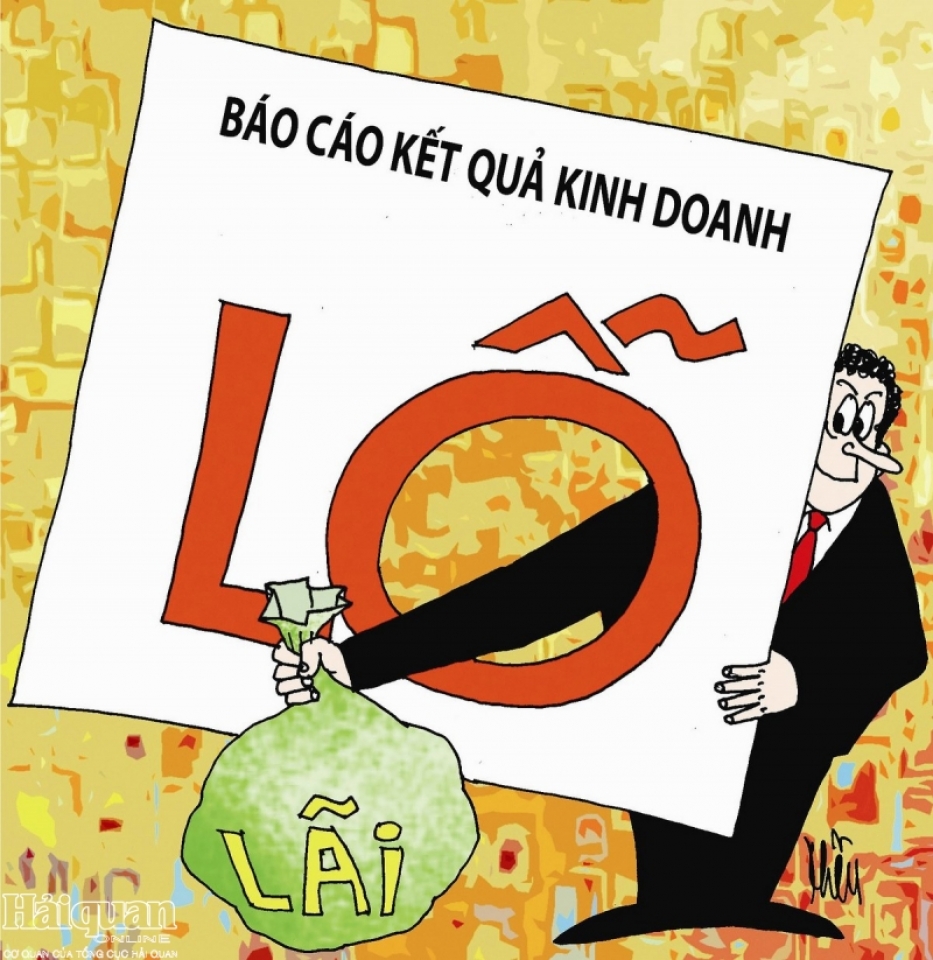

| Completing the tax policy system is one of the effective solutions that countries make to prevent loss of revenue. Photo: Internet |

| Tax avoidance and tax evasion cause big losses for the budget According to the study of the Institute of Financial Policy Strategy,most countries have conducted a review and identification of some of the main forms of tax losses: Avoiding taxes; tax evasion and tax settlement. For collecting agencies, it is difficult to identify tax evasion or tax fraud compared to tax avoidance activities or tax settlements. According to Pham Thi Thu Hong, Institute of Financial Policy Strategy, tax avoidance and tax evasion are two main forms that cause huge revenue losses in all countries. The Organization for Economic Co-operation and Development (OECD) has pointed out that the loss of tax revenues due to acts of evadingtax collection and remittance base is about $100-240 billion annually, equivalent to 4-10% of annual corporate income tax revenue. Developing countries are most affected because they are largely dependent on revenues from corporate income tax. Due to inadequate and inexperienced legal and tax policies they have not enough resources to manage and minimize tax losses. Therefore, the Financial Strategy and Policy Institute said that national governments need to identify and classify potential activities that cause tax losses and take measures to combat these losses appropriately with the conditions of each country. In Indonesia, tax losses are reflected in issues such as low tax compliance and low contribution of corporate income tax. A review of Indonesia's Corporate Income Tax Reports shows that businesses always make losses (regarding transfer pricing) and there are many tax arrangements that lead to tax avoidance / evasion. In China, there are many causes of tax evasion or tax avoidance one of them being through commercial activities between China and Hong Kong: Declaring lack or wrong value of goods; lack of tax declaration; misclassification between high tax rates and low tax rates. Promote the application of information technology in tax administration According to Mrs. Pham Thi Thu Hong, anti-revenue solutions in the countries focus mainly on: Completing the tax policy system (which focuses on corporate income tax and value-added tax); improve tax collection management system; boosting the application of information technology to manage tax collection and human resource development and raising the qualifications of tax collection managers. According to a representative of the Financial Policy Strategy Institute, recent trends show that some OECD countries implement measures to expand the corporate income tax base in order to prevent tax losses, specifically tax avoidance at international level. For example, Austria expanded its tax base for real estate transactions. Japan, in addition to reducing the corporate income tax rate from 25.5% to 23.2% in 2018, also implemented measures to expand tax bases including simplification of tax system for depreciation and reduction of the maximum threshold of deductible losses when calculating taxable income of the enterprise. A number of countries have recently introduced strict tax administration regulations such as strengthening international cooperation in exchanging tax information to prevent tax evasion. Focusing on investigating and coping with tax avoidance activities for businesses with overseas accounts; prevent and resolve tax disputes and improve audit work.

To combat tax losses, most countries promote the application of information technology in the management of tax collection. According to the Financial Policy Strategy Institute, the main purpose of applying information technology to tax administration is not only to reduce tax collection costs but also to improve the quality and standards of modern tax administration. For example, in Thailand, Malaysia, Kenya and Uganda tax services employ technology on mobile phones. Indonesia introduced a program called "Knowing taxpayers" in which tax officials were tasked with monitoring some specific cases (about 1,500 cases) they were familiar with. The taxpayer data is recorded into the computer's data system, thereby managing registered businesses. When the database is complete, managing the tax collection system will be more effective. Other countries that use electronic invoices instead of paper bills have a significant impact on the costs incurred by businesses (allowing for automatic compliance). Leading in this area are Latin American countries,China and some European countries are using electronic invoices to minimize Value Added Tax / fraudulent acts. The Netherlands applies 100% of information technology to tax administration and uses social media applications. |

Related News

Achievements in revenue collection are a premise for breakthroughs in 2025

09:57 | 18/12/2024 Customs

Enterprises face difficulties in tax refunds due to partners closing

10:01 | 17/12/2024 Finance

Customs sector collects over VND384 trillion in revenue

17:13 | 12/12/2024 Customs

Revenue faces short-term difficulties but will be more sustainable when implementing FTA

19:27 | 14/12/2024 Customs

Latest News

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Finance ministry announces five credit rating enterprises

14:54 | 25/12/2024 Finance

The capital market will see positive change

09:44 | 25/12/2024 Finance

Corporate bond issuance value rises by 60 per cent

13:51 | 24/12/2024 Finance

More News

Slower mobilization than credit may put pressure on interest rates

09:02 | 24/12/2024 Finance

Fed’s foreseen rate cuts affect foreign exchange rate

14:12 | 23/12/2024 Finance

Untying the knot for green finance

11:08 | 23/12/2024 Finance

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

Six SOEs to be transferred back to industry ministry

15:38 | 18/12/2024 Finance

Your care

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Finance ministry announces five credit rating enterprises

14:54 | 25/12/2024 Finance

The capital market will see positive change

09:44 | 25/12/2024 Finance

Corporate bond issuance value rises by 60 per cent

13:51 | 24/12/2024 Finance

Slower mobilization than credit may put pressure on interest rates

09:02 | 24/12/2024 Finance