Expecting support from foreign capital

| 10 ministries, branches and localities have foreign capital disbursement rate of 0% | |

| Many industry stocks draw foreign capital in October | |

| Continuing to selectively attract foreign capital |

|

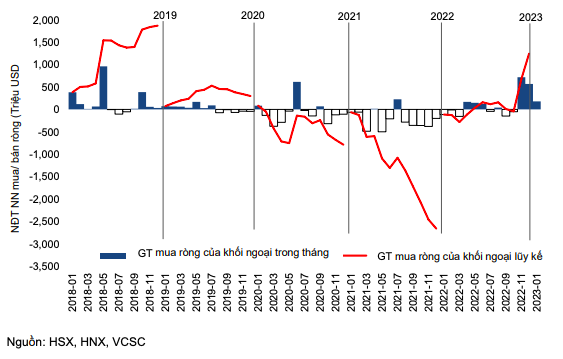

| Net buying value of foreign sector by months |

In 2022, the market witnessed a drop to a more attractive valuation, attracting foreign investment, especially in the fourth quarter of 2022. Despite the less positive performance of the Vietnamese stock market, the cash flow from ETFs still increased in 2022. According to data from SSI Research, for 2022, foreign investors have net bought US$1.24 billion (mainly in the fourth quarter), the highest level since 2017. In addition, 14 ETFs provided an additional investment of US$1.1 billion for 2022.

In January 2023, foreign investors' capital inflow trend remained positive. According to Viet Capital Securities Company (VCSC), foreign investors net bought US$178.6 million on all three floors.

HPG, FUEVFVND, SSI and VIC recorded the highest net buying values in the month with US$58.4 million, US$27.2 million, US$21.1 million and US$18.6 million, respectively. On the other hand, foreign investors net sold EIB (US$143.1 million), DGC (US$10.4 million) and DPM (US$6.6 million).

Meanwhile, in neighbouring markets, in January, foreign investors net bought US$545 million and US$122 million, respectively, on SET of Thailand and PCOMP of the Philippines and net sold US$204 million on JCI of Indonesia.

According to SSI Research's experts, besides the positive cash flow from ETFs in January 2023, the disbursement of cash flow from funds into the stock market often has a delay, so the strong net buying of foreign investors in January is not a surprise factor. Regarding industry groups, the finance-banking and steel industries are attracting the most attention. It is because they have attractive valuations and meet liquidity conditions.

With a long-term investment outlook, the momentum from foreign investors is currently alleviating concerns about short-term risks. However, the decline in Q4 business results and macro data in January 2022 shows that the economy is facing many difficulties.

In the report on the 2023 strategy, Mirae Asset Securities Company's experts said that the Government of Vietnam's efforts in cleaning up the financial market, especially the corporate bond and real estate segments, will help improve the transparency of Vietnam's financial market. Moreover, policymakers are still very flexible in supporting the economy, such as proposing to amend and supplement Decree 65 on corporate bonds. However, corporate bonds are still putting great pressure on the financial system when a large number of bonds will mature in 2023 in the context of interest rates tending to increase and the market needing time to adapt to a new legal framework with many important changes.

However, in the short term, SSI Research's experts give a neutral point of view on capital flow after continuous disbursement. Besides, there are still challenges from the domestic macro situation, and the possibility of the cash flow into the Chinese market is not excluded, reducing capital inflows into neighbouring countries.

| Foreign capital poured into industrial real estate The Vietnamese industrial real estate market continued to record positive signals, attracting a large amount of foreign ... |

Related News

Agree to continue reducing VAT by 2%

11:02 | 29/11/2024 Finance

Green transformation: It's time to force businesses to "get involved"

09:23 | 25/11/2024 Headlines

Bac Ninh Customs encourages customs brokerage services

15:32 | 05/11/2024 Customs

Fiscal policy needs to return to normal state in new period

09:54 | 04/11/2024 Finance

Latest News

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Finance ministry announces five credit rating enterprises

14:54 | 25/12/2024 Finance

The capital market will see positive change

09:44 | 25/12/2024 Finance

Corporate bond issuance value rises by 60 per cent

13:51 | 24/12/2024 Finance

More News

Slower mobilization than credit may put pressure on interest rates

09:02 | 24/12/2024 Finance

Fed’s foreseen rate cuts affect foreign exchange rate

14:12 | 23/12/2024 Finance

Untying the knot for green finance

11:08 | 23/12/2024 Finance

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

Six SOEs to be transferred back to industry ministry

15:38 | 18/12/2024 Finance

Your care

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Finance ministry announces five credit rating enterprises

14:54 | 25/12/2024 Finance

The capital market will see positive change

09:44 | 25/12/2024 Finance

Corporate bond issuance value rises by 60 per cent

13:51 | 24/12/2024 Finance

Slower mobilization than credit may put pressure on interest rates

09:02 | 24/12/2024 Finance