Expanding preferential treatment for subjects directly affected by Covid-19

| Wood firms seek new market channels amid COVID-19 | |

| Vietnam, RoK share experience in combating COVID-19 | |

| Excess inventories and COVID-19 lead to significant price drops for tuna |

|

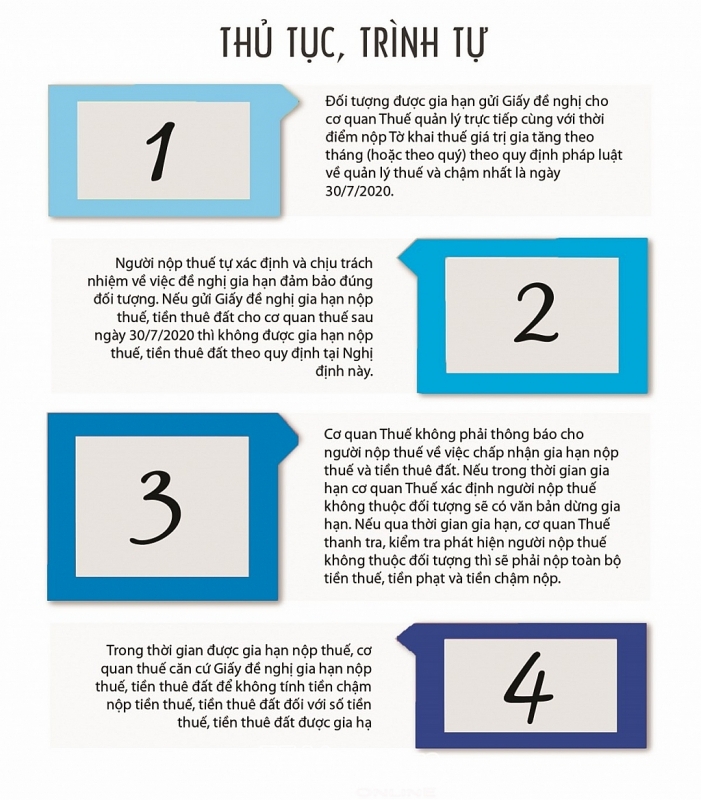

| Steps and procedures for drafting a decree to extend tax and land rents to support businesses, organisations, individuals and business households directly affected by Covid-19. Photo: H.V. |

Extension of corporate income tax

Following the Prime Minister's directive, the Ministry of Finance has urgently prepared a draft decree to extend tax and land rent payment deadlines to support businesses, organisations, individuals and business households directly affected by Covid-19. Based on the comments, the Ministry of Finance completed and officially submitted to the Government on March 26.

In terms of beneficiaries, compared to the previous draft, basically, the three groups of beneficiaries of this support package remained the same, but after a field study, the Ministry of Finance proposed adding several industries which are not manufacturing or services but are also directly affected by the Covid-19 epidemic, includingeducation - training, health care, art creation, entertainment, sports and recreation.

In terms ofpreferential policies, the Ministry of Finance continues to propose extension of the tax payment time limit for arising Value Added Tax (VAT) amounts payable in the tax periods of March, April, May and June, 2020 (for cases of monthly VAT declaration) and the tax period of the first and second quarter of 2020 (for quarterly VAT declaration) of the above-said enterprises and organisations. The extension is fivemonths from the end of the deadline for paying VAT in accordance with the regulations of law on tax administration. This offer will not apply to VAT forthe import stage.

New in the official draft is the Corporate Income Tax (CIT) incentive, extending the tax payment deadline for the remaining CIT payable according to the balance sheet of 2019 but not yet paid into the State budget. The State budget and the provisional corporate income tax (CIT) of the first quarter, second quarter of 2020 of enterprises and organizations mentioned above. The extension is also fivemonths from the end of the deadline for paying CIT in accordance with the law on tax administration.

For business households and individuals, besides asking for an extension of the deadline for paying VAT as in the previous draft, the Ministry of Finance proposes extending Personal Income Tax (PIT) for tax amount to be paid in 2020 by households and individuals doing business in the above-mentioned economic sectors. Business households and individuals shall pay the deferred tax amount in this clause before December 15, 2020.

Along with that, the Ministry of Finance also proposes to extend the land rental payment term for the amount of land rent to be paid in the first period of 2020 of enterprises, organizations and individuals directly leased land by the State under the decision of competent State agencies in the form of annual land rent payment, which on the decisions and land lease contracts for production and business purposes in the above-mentioned economic sectors.

Particularly for small and micro enterprises, the entire land rent payable for the first period of 2020 of the enterprise will be extended. The grace period is fivemonths from 31 May, 2020.

In case an enterprise, organisation, household or individual engages in production and business activities of various economic sectors, including economic sectors subject to the extension, such enterprises or organizations may participate in the extension the whole time of the VAT amount, the payable EIT amount; business households and individuals are allowed to extend all payable VAT and PIT.

Support package is more than80 trillion VND

According to the Ministry of Finance, the five-month VAT payment deadline for VAT payable from March to June 2020 will reduce approximately VND 61,600 billion of those State revenues. Similarly, the extension of the tax payment deadline for CIT payable after the 2019 tax finalisationis estimated by tax authorities to be extended about VND 11,100 billion. For business households and individuals, the group's 2019 tax amount to be extended is about VND 3,000 billion. In addition, estimated land rent extension is about 4,500 billion VND and businesses, households and business individuals must submit to the State budget before October 31, 2020.

Pham DinhThi - Director of Tax Policy Department, Ministry of Finance said because of expanding the subjects and adding extensions to the payable CIT in 2019, the total number of extensions will be more thanVND 80 trillion instead of 30 trillion VND as the first draft. The extension will reduce the State budget revenue in the extended months but this amount will be remitted by the end of 2020 so overall, does not affect the budget revenue for the whole 2020.

Thi also said the Ministry of Finance is asking the Government to immediately apply the policy when the Decree is signed. Therefore, businesses, organisations, individuals and business households must pay attention to determine exactly whether they are included in the extended subjects or not to send requests to tax offices. On the basis of the application, the tax office will make an extension for the subjects. In addition, according to the representative of the Ministry of Finance, this draft proposal proposes to extend the finalized corporate income tax of 2019. According to the Law on Tax Administration, this tax must be declared and settled after 90 days from the date of submission since the end of the year. Therefore, businesses must grasp this spirit, waiting for the official decision of the Government; businesses will be extended fivemonths. For enterprises which are subject to the extension of the enterprise income tax which have been finalised and paid already, it will be deducted from other taxes to the State budget.

Related News

Vietnam makes comprehensive strides in public financial management reform

09:16 | 01/12/2024 Finance

Major reforms in the management of state capital in enterprises

09:18 | 01/12/2024 Finance

Revising the title of a draft of 1 Law amending seven finance-related laws

14:33 | 21/11/2024 Finance

Truly comprehensive finance: supporting micro and small enterprises

09:36 | 07/11/2024 Import-Export

Latest News

From January 1, 2025: 13 product codes increase export tax to 20%

14:23 | 29/12/2024 Regulations

Export tax rates of 13 commodity codes to increase to 20% from January 1, 2025

13:46 | 28/12/2024 Regulations

Proposal to reduce 30% of land rent in 2024

14:58 | 25/12/2024 Regulations

Resolve problems related to tax procedures and policies for businesses

13:54 | 22/12/2024 Regulations

More News

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations

Actively listening to the voice of the business community

09:39 | 12/12/2024 Customs

Step up negotiations on customs commitments within the FTA framework

09:44 | 08/12/2024 Regulations

Proposal to amend regulations on goods circulation

13:45 | 06/12/2024 Regulations

Review of VAT exemptions for imported machinery and equipment

10:31 | 05/12/2024 Regulations

Customs tightens oversight on e-commerce imports

13:39 | 04/12/2024 Regulations

Bringing practical experience into customs management policy

13:48 | 03/12/2024 Regulations

Businesses anticipate new policies on customs procedures and supervision

15:41 | 29/11/2024 Regulations

Do exported foods need iodine supplementation?

11:06 | 29/11/2024 Regulations

Your care

From January 1, 2025: 13 product codes increase export tax to 20%

14:23 | 29/12/2024 Regulations

Export tax rates of 13 commodity codes to increase to 20% from January 1, 2025

13:46 | 28/12/2024 Regulations

Proposal to reduce 30% of land rent in 2024

14:58 | 25/12/2024 Regulations

Resolve problems related to tax procedures and policies for businesses

13:54 | 22/12/2024 Regulations

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations