E-Government Architecture: Towards digital finance of the Finance sector

|

| Mr. Nguyen Dai Tri. |

Sir, what role does the Finance sector play in realizing the goal of building a modern digital finance, contributing to promoting E-Government in Vietnam?

On December 28, 2018, Minister Dinh Tien Dung signed Decision No. 2445 / QD-BTC promulgating the E-Government Architecture of the Finance sector. This is a very important decision in building the e-Government according to Government’s Resolution No. 36a / NQ-CP dated October 14, 2015, on e-Government, and the Prime Minister’s Decision No. 1819 / QD-TTg dated October 26, 2015, approving the National Program on information technology application in the operation of state agencies for the 2016-2020 period of the Government in general, and of the Finance sector in particular.

The E-Government Architecture of the Finance sector shapes the basic foundations for building e-Government towards digital finance of the Financial sector. E-Government Architecture is to improve the effectiveness and efficiency of the Finance sector and the service quality to the people and businesses. It is based on big and open data towards digital finance with the aim of considering the people and the business as a center. It is to create a foundation for the Finance sector to access and take an active and facilitating role and take the lead in transforming into modern digital finance in Vietnam.

It can be said that the E-Government Architecture is the first information technology planning architecture for the Finance sector.

What is the roadmap for the E-Government Architecture of the Finance sector, Sir?

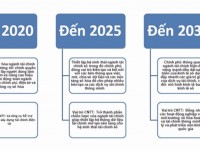

The E-Government Architecture of the Finance sector has set a roadmap of 3 phases. In particular, the phase from now to 2020 will continue to complete the construction of e-Government in the Finance sector towards the serving Government considering the user as center, and to improve the operating efficiency of the whole sector through e-Government and digital tools.

The 2021 – 2025 phase will continue to improve information systems for the development of paperless offices; build a digital finance platform based on data and open data; set up a digital finance ecosystem in which the Government plays the role of facilitating and connecting with parties through opening, sharing data and digital platforms to enable multiple parties to create smart financial services.

The 2026 - 2030 phase will establish a completely digital financial system and smart finance. The Finance sector plays a leading role in the development of digital economy based on accelerating the added value of financial services and transforming economy models including digital economy.

Could you tell us the outstanding features in the E-Government Architecture model of the Finance sector?

First of all, the methodology of building the E-Government Architecture of the Finance sector must be mentioned. That is the combination between TOGAF method (The Open Group Architecture Framework) and the FEAF method (federal enterprise architecture framework) to build the architecture. The above method is evaluated as an advanced method and widely used in building E-Government Architecture in the world. Currently, the Ministry of Information and Communications is also presiding over a draft of Vietnam E-Government Architecture Framework, version 2.0 based on referring to the FEAF architecture framework. Thus, e-Government Architecture of the Finance sector has used FEAF method, and when Ministry of Information and Communications issues E-Government Architecture Framework 2.0, the E-Government Architecture of the Finance sector basically does not need to be adjusted anymore.

The E-Government Architecture of the Finance sector has generalized all the financial operations in the interconnection model of operations and information of the Finance sector according to 7 main operational groups: State financial operating management; Financial market management; State management on customs; State management on tax; Inspection; Other operational groups and inner sectorial activities and Information reported outside. Operational architecture of the Finance sector shows the strict data linkage and business interconnection in each line and group and among lines and groups. The interconnection model of operation and information is a key foundation for planning, building and developing the information technology system of the whole Finance sector towards professional goals, ensuring the appropriateness and efficiency of the information technology application and investment.

In particular, the E-Government Architecture of the Finance sector expresses the view of attaching importance to applying advanced technologies of the industrial revolution 4.0 on the basis of analyzing the development strategy of the Finance sector and the Government’s orientations towards development of digital Government, digital economy and society, operational interconnection model, information and IT status of the Finance sector.

The E-Government Architecture of the Finance sector shapes the basic foundations for the construction of E-Government towards digital Finance of the Finance sector and ensures flexibility in design. This architecture allows the Ministry of Finance to reuse Government’s platforms, and General Departments can plan to reuse available platforms of the sector to further develop their systems.

In addition, the E-Government Architecture of the Finance sector has also been studied and applied the Gartner Digital Government Maturity Model 2.0 (Gartner) to determine the transformation roadmap of the Finance sector to 2030.

The Ministry of Finance is a multi-sectorial ministry, with many difficult and complicated fields, so what are the difficulties in the process of developing and promulgating the E-Government Architecture for the Finance sector? How did the Ministry of Finance overcome these difficulties?

The development and promulgation of E-Government Architecture of the Finance sector is really a big challenge for us. Ministry of Finance is a multi-sectorial ministry which manages many complicated areas such as budget, tax, customs and so on, thus one of the most difficulties in the process of building E-Government architecture of the Finance sector is analysis and unification with units to complete the operational model, identify data interconnection model between operational lines and groups among units in the Finance sector. In order to unify the models and contents in the E-Government Architecture of the Finance sector, in addition to weekly meetings of technical teams to review the drafting process, we organized many seminars for direct comments and written comments to the leaders of the units and officials in the sector.

The E-Government Architecture of the Finance sector shows the orientations on the application of new technologies of the 4th industrial revolution in the spirit of Resolution No. 02-NQ / BCSĐ dated 9 March 2018 of the Ministry of Finance’s Party Committee on deploying technology application of the 4th industrial revolution in the Finance – Budget field. Researching and understanding new technologies as well as the ability to apply these technologies in the field of finance-budget and expressing them in the E-Government Architecture of the Finance sector is a very new and difficult task requiring the intellect of leaders, officials and units in the process of building and completing the Architecture.

Another difficulty is the lack of guiding documents of competent units on digital Government and digital finance as well as models of digital conversion. Therefore, the research of the above contents is done through foreign technical resources. This is also a big challenge for us to learn, analyze and apply in the E-Government Architecture of the Finance sector.

Through our survey, the E-Government Architecture of the Ministry of Finance is the first E-Government Architecture in ministries and ministerial-level agencies that have adopted and applied the Gartner version 2.0 to determine the transformation roadmap from E-Government into E-Government of the Finance sector. The above results show the high level of research focus of the Department of Financial Informatics and Statistics when advising and proposing the Ministry's leaders to introduce a digital transformation roadmap on the basis of scientific research and appropriate application of current information and technology of the Finance sector.

To overcome these difficulties and challenges, in the process of building the E-Government Architecture, we have received the attention and close guidance of the Ministry's leaders and the determination and solidarity of the leaders and officials of the Financial Informatics and Statistics Department, as well as the support and coordination of units in the sector.

What will the Ministry of Finance do to implement the E-Government Architecture meeting the goals set out, sir?

In order to implement the E-Government Architecture, at Decision No. 2445 / QD-BTC, the Ministry’s leaders have assigned tasks to each specific unit, including a number of key points to successfully deploy E-Government Architecture of the Finance sector. That is, building a Financial Strategy to 2030 and the strategies for each fields of taxation, customs, treasury, public debt, public assets, securities, national reserves, prices, insurance, accounting – audit, etc, in accordance with the roadmap for administrative procedure reform, the E-Government construction roadmap of the Government and the Finance sector. Mobilizing resources of the whole sector, including human resources and capital sources to implement IT tasks and projects. Adjusting and updating the plan of the information technology application for five years and every year in line with the E-Government Architecture of the Finance sector. Ensuring the maintenance and updating of the E-Government Architecture of the Finance sector in accordance with the IT development orientations of the Government in general and the Finance sector in general.

| Which roadmap for the e-Government of the Finance sector? VCN- With the attention to the application of advanced technologies of industrial revolution 4.0, the e-Government Architecture ... |

Currently, the Ministry of Finance is drafting a document to guide units in the deployment of the E-Government Architecture, which is expected to be issued in the first quarter of 2019.

Related News

Finance sector exceeds revenue target in 4 years thanks to comprehensive reform of collection method

09:30 | 07/11/2024 Finance

Finance sector urgently amends 7 Laws to remove bottlenecks and promote economic growth

09:09 | 29/08/2024 Finance

Managing fiscal policy has achieved many positive and comprehensive results

14:12 | 19/07/2024 Finance

The local Finance sector is flexible and strict in managing budget revenues and expenditures

10:05 | 17/07/2024 Finance

Latest News

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

More News

Six SOEs to be transferred back to industry ministry

15:38 | 18/12/2024 Finance

PM urges stronger measures to manage interest rates

16:53 | 17/12/2024 Finance

Six SOEs to be transferred back to industry ministry

16:48 | 17/12/2024 Finance

Vietnamese products: Conquering foreign customers in supermarket systems

16:45 | 17/12/2024 Finance

Answering many questions from businesses at dialogue conference on tax and customs policies

10:01 | 17/12/2024 Finance

Enterprises face difficulties in tax refunds due to partners closing

10:01 | 17/12/2024 Finance

Strengthen the management and use of electronic invoices for e-commerce

11:24 | 16/12/2024 Finance

Ministry of Finance proposes comprehensive amendments to the Personal Income Tax Law

11:23 | 16/12/2024 Finance

Expansionary fiscal policy halts decline, boosts aggregate demand

19:27 | 14/12/2024 Finance

Your care

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

Six SOEs to be transferred back to industry ministry

15:38 | 18/12/2024 Finance