E-commerce tax management increasingly tightened

| E-commerce tax management: Review from individuals to organizations providing services | |

| E-commerce tax management needs close control | |

| Addressing challenges in e-commerce tax management |

|

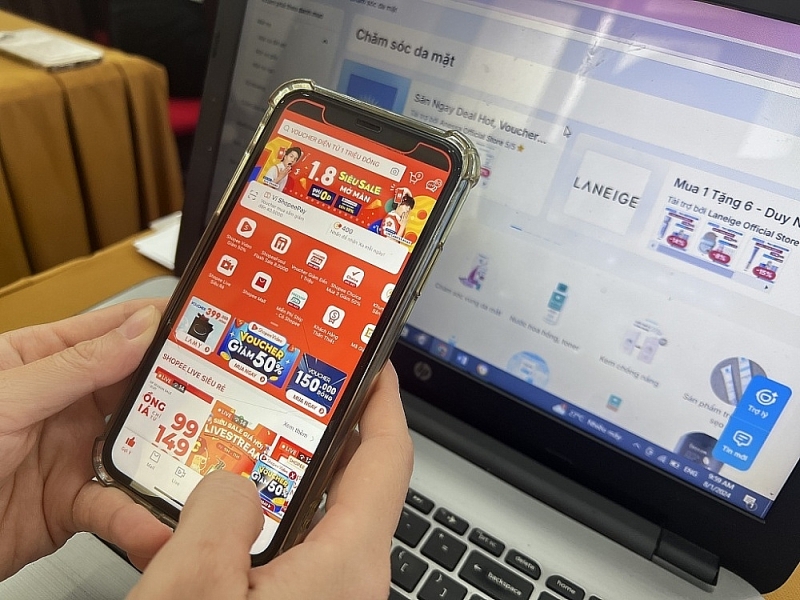

| The boom in e-commerce business leads to difficulties in management of goods, sales and tax. Photo: H.Anh |

Strengthen e-commerce tax management

| In the first six months of 2024, foreign suppliers paid more than VND4,039 billion of taxes. From the time of implementing the e- portal until now, the state budget revenue from foreign suppliers is VND15,613 billion. |

Along with the development of the digital economy, e-commerce activities have grown strongly, especially with livestream sales sessions achieving record revenue of hundreds of billions of dong. However, this boom also leads to difficulties in the management of goods, sales and taxes, leading to risks due to the very large volume of issued invoices every day.

According to Ms. Nguyen Thi Cuc, President of the Vietnam Tax Consulting Association (VTCA), this is a great opportunity for brands to increase their sales and promote the general economy of the entire society. In the context of explosive development of e-commerce activities, tax management practices for e-commerce business have also achieved important results. According to Ms. Cuc, the Ministry of Finance and the General Department of Taxation have drastically directed the local tax departments to strengthen tax management, inspection and examination according to risk management methods. The amount of tax arrears and fines from organizations and individuals doing e-commerce business reached hundreds of billions of dong, especially at the Hanoi Tax Department and Ho Chi Minh City Tax Department. In addition to these two major tax departments, other local tax agencies also strengthen collection and penalties for e-commerce business activities.

According to the General Department of Taxation, from the beginning of 2024, the Tax agency has focused on building inspection and examination plans for taxpayers engaging in the field of e-commerce, digital platform business, and livestream sales. In the first six months of the year, the Tax agency handled 4,560 violations (including 1,274 businesses and 3,286 individuals) with the amount of tax arrears and fined of VND297 billion. According to data from the General Department of Taxation, from January to July, the Ho Chi Minh City Tax Department alone reviewed 7,134 businesses, households and individuals engaging in e-commerce business, thereby urging tax declarations and payments of VND1,298 billion; collecting and sanctioning 1,318 cases with a total amount of more than VND72 billion.

Ms. Nguyen Thi Cuc said that according to tax laws, households and individuals doing e-commerce businesses must comply with tax payment obligations, self-declaration, self-calculation, self-payment and self-responsibility for the declared data. Specifically, brands must declare VAT and corporate income tax on actual revenue from orders. For livestreamers, they pay tax in two ways: if an individual register to pay tax as a business household, they pay 7% tax on the commission received from the brands (5% of added value, 2% of personal income); If an individual does not register a business and is considered an employee for the brand, he or she must pay personal income tax according to the progressive tax schedule ranging from 5% to 35%; the brand temporarily deducts 10% tax on the commission before payment to the livestreamer, remitting it to the state budget and the livestreamer is responsible for declaring their own annual tax finalization with the Tax authority. "If having difficulty paying taxes, business households and individuals can contact professional accounting service providers or tax agents for support," Ms. Cuc recommended.

Preventing tax fraud, evasion and avoidance

Mr. Nguyen Ngoc Dung, Chairman of the Vietnam E-commerce Association, said that currently, with new technology platforms and strict management of authorities, e-commerce business tax management is increasingly tightened. Tax authorities fully implement the information exchange regime with tax authorities of countries and territories; thereby signing an agreement to avoid double taxation. This is to capture information about the sales and income generated by e-commerce businesses in Vietnam, determine tax obligations, and prevent tax fraud, evasion and avoidance in Vietnam. Mr. Nguyen Ngoc Dung emphasized that to avoid fines and criminal prosecution due to late declaration and payment of taxes, households and individuals doing e-commerce businesses need to proactively comply with tax payment obligations, in order to create equality in tax obligations, a fair and competitive business environment

The Ministry of Finance also said that, in addition to inspection and examination of e-commerce tax, the Tax sector has continued to effectively manage the e-portal for foreign suppliers to support foreign suppliers to register, declare, and pay taxes in Vietnam from March 21, 2022. To date, there have been 101 foreign suppliers implementing tax registration, declaration and payment.

Sharing from the perspective of tax consulting businesses, Mr. Tran Minh Dai, Director of Tin Phat Accounting and Tax Consulting Company, said that to apply and support taxpayers to do business on the e-commerce platform better, accounting businesses need to continuously update their knowledge and apply new technologies. Mr. Tran Minh Dai recommended that businesses need to comply with the law, apply modern, advanced technology and automation to meet the development of transactions on e-commerce platforms.

Related News

Paving the way for Vietnamese agricultural products in China

11:08 | 26/12/2024 Import-Export

Rise in e-commerce violations sparks concern

09:31 | 20/12/2024 Anti-Smuggling

Strengthen the management and use of electronic invoices for e-commerce

11:24 | 16/12/2024 Finance

Concerns over counterfeit goods in e-commerce and express delivery

10:00 | 17/12/2024 Anti-Smuggling

Latest News

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Finance ministry announces five credit rating enterprises

14:54 | 25/12/2024 Finance

The capital market will see positive change

09:44 | 25/12/2024 Finance

Corporate bond issuance value rises by 60 per cent

13:51 | 24/12/2024 Finance

More News

Slower mobilization than credit may put pressure on interest rates

09:02 | 24/12/2024 Finance

Fed’s foreseen rate cuts affect foreign exchange rate

14:12 | 23/12/2024 Finance

Untying the knot for green finance

11:08 | 23/12/2024 Finance

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

Six SOEs to be transferred back to industry ministry

15:38 | 18/12/2024 Finance

Your care

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Finance ministry announces five credit rating enterprises

14:54 | 25/12/2024 Finance

The capital market will see positive change

09:44 | 25/12/2024 Finance

Corporate bond issuance value rises by 60 per cent

13:51 | 24/12/2024 Finance

Slower mobilization than credit may put pressure on interest rates

09:02 | 24/12/2024 Finance