E-commerce tax collection: Great potential - Huge challenges

|

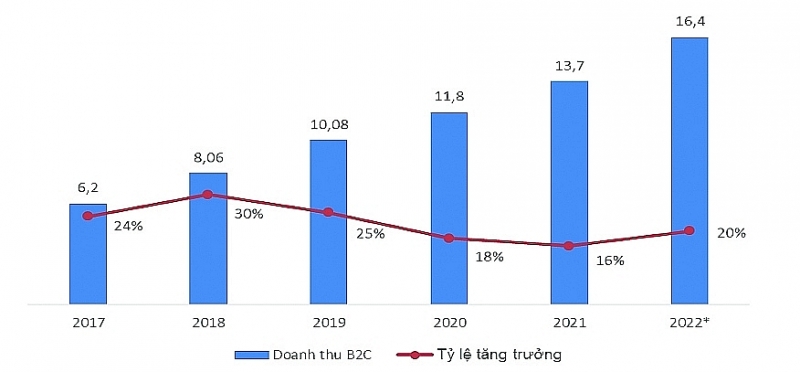

| B2C e-commerce revenues in Vietnam from 2017 to 2022. Source: Vietnam E-commerce and Digital Economy Agency |

Great potential

According to data published by the Vietnam E-commerce and Digital Economy Agency (Ministry of Industry and Trade), the average growth rate of retail e-commerce revenue in these two years reached 17%/year, reaching total revenue of US$13.7 billion and accounting for 7% of sales of consumer goods and services nationwide in 2021. The pandemic period has contributed to creating online shopping habits for consumers, especially in big cities.

Correspondingly, the tax revenue from this activity also increased sharply year by year. According to the General Department of Taxation, the proportion of retail e-commerce revenue (B2C e-commerce – business to consumers) compared to the total retail sales of goods and services nationwide increased from 3% in 2016 to the rate of 5.5% in 2020.

Revenues from e-commerce activities through organizations operating in Vietnam declared and paid on behalf of contractor tax from 2018 to July 14, 2022, reached VND5,458 billion, the average collection rate reached 130%, and the average revenue is about VND1,200 billion/year. In particular, many foreign suppliers are allowed to declare and pay taxes, which generate a large amount of revenue, such as: Facebook (VND 2,076 billion); Google (VND2,040 billion); and Microsoft (VND699 billion).

To manage businesses on digital platforms, the National Assembly and Government have issued legal documents to manage electronic transaction activities for organizations and individuals doing business on digital platforms. However, the characteristics of the digital economy and the rapid development of e-commerce in Vietnam it has posed many challenges for the management of e-commerce activities as well as tax management.

But it also poses many challenges

Many experts pointed out that enterprises and individuals doing business in cyberspace often find ways to avoid taxes. They split into many different accounts for business operation, leading to inaccurate tax declarations and very difficult to control. In addition, many social networking sites originated overseas and did not have a legal entity to manage in Vietnam, causing many difficulties in obtaining information and tax collection.

Another reason is that businesses in the field of e-commerce may be easier to evade taxes than in traditional business forms because digital technology can keep the information confidential in business. Many organizations and individuals use the website for advertising products and goods, selling directly to consumers, and do not issue sales invoices or declare revenue for calculation of value added tax or personal income tax and corporate income tax.

In the past two years, many individuals have been detected and paid taxes due to generating income from social networks Facebook, Google, etc. In Hanoi, thanks to a thorough review and call for action, it was found that 1,194 individuals operating in e-commerce receive income from foreign organizations. Since then, revenue in 2020 was VND134 billion and VND129.3 billion in 2021. Up to now, Hanoi Tax Department has built a database of 32,084 business establishments engaging in online sales activities and 2,307 house rental/accommodation establishments to put into tax administration from 2021.

Furthermore, HCM City Tax Department also pointed out a typical example of tax collection management for individuals doing business in Ho Chi Minh City. For instance, in 2018, Mr T.P was taxed over VND4 billion (paid) due to generating income from Google (over VND41 billion). This is because he provided advertising services for Google on game application software. In the two years 2021-2022, in this area, there were also two individuals whose tax arrears were over VND8 billion/individual (paid) due to earning income from making video clips and entertainment films on social network applications (Youtube, Tiktok).

Faced with this situation, besides active communication, strengthening inspection, building a database for risk management, and applying artificial intelligence (AI) to data processing. Currently, the General Department of Taxation is studying several suggestions to help strengthen the tax administration for e-commerce activities, typically the proposal to collect value-added tax at the source for e-commerce transactions. Specifically, the tax authority will directly deduct value-added tax on successful payment cash flows into two parts: the value-added tax amount that will be transferred to the account of the tax agency opened at the treasury, and the rest will be transferred to the seller.

However, to implement this solution, it is necessary to strengthen the legal basis, such as amending the Law on Value Added Tax, the Law on Personal Income Tax, the Law on Tax Administration and guiding documents. Therefore, while the tax laws have not been revised, to be able to deduct value-added tax, declare tax, and pay tax at the source, a system of collecting and storing tax will be developed, analyze and process big data, apply AI to collect information of organizations and individuals that conduct part or the whole process of buying and selling goods and services on the e-commerce website and payment transactions for cross-border digital services as soon as transactions arise for effective tax management.

Related News

E-commerce tax collection estimated at VND 116 Trillion

07:54 | 31/12/2024 Finance

Violations via e-commerce in HCM City surges

13:45 | 28/12/2024 Anti-Smuggling

Sustainable Green Development: New Driving Force for the Retail Industry

07:44 | 31/12/2024 Import-Export

Paving the way for Vietnamese agricultural products in China

11:08 | 26/12/2024 Import-Export

Latest News

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

More News

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance

Fiscal, monetary policies support demand stimulation, price stabilisation

14:49 | 14/02/2025 Finance

Vietnam secures VND 157 billion from state enterprise divestment in 2024

09:16 | 14/02/2025 Finance

Vietnam gears up for potential inflation impact in 2025

14:26 | 11/02/2025 Finance

VN’s credit conditions in 2025 expected to be stable

14:24 | 11/02/2025 Finance

State revenue in first month of the year equal to 14% of the estimate

10:12 | 11/02/2025 Finance

Securities 2025 expects a breakthrough in scale and quality

14:37 | 10/02/2025 Finance

Cash reserves in stock accounts at six-quarter low amid margin rise

08:23 | 10/02/2025 Finance

Five solutions for developing stock market in 2025

10:01 | 07/02/2025 Finance

Your care

The system has not recorded your reading habits.

Please Login/Register so that the system can provide articles according to your reading needs.

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance