Corporate bond market still holds risks for investors: SSI

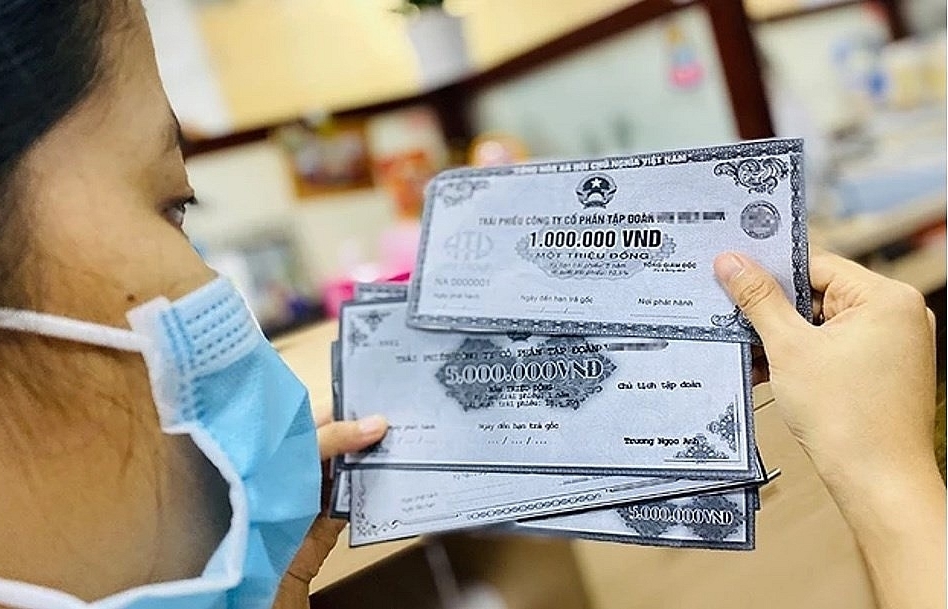

Cash notes counted at a bank office. Data from the Hanoi Stock Exchange and securities firms showed total bond issuance cooled down in September but risks still persist for buyers.(Photo vietnammoi.vn)

Data from the Hanoi Stock Exchange (HNX) showed the total value of corporate bonds sold in September was VND16.25 trillion (nearly US$700 million).

September’s value noseped 80% from August's record of VND83.8 trillion and was still modest compared to the March-July period.

The decline came after Decree 81/2020/NĐ-CP took effect on September 1 to restrict risky purchases of corporate bonds to make the bond market stronger and more sustainable.

A recent report by SSI Securities Incorporation (SSI) showed local companies in the third quarter issued VND164.4 trillion worth of corporate bonds, up 29% from the prior quarter and 95% year-on-year.

In the first nine months of the year, the total value of corporate bonds pumped into the market was estimated at VND341 trillion, up 79% year-on-year and the value of the bond market in comparison with total GDP gained 3 percentage points to 14.4% at the end of September.

SSI also pointed out the total value of non-collateral bonds reached VND43 trillion in the nine months, including VND20.5 trillion worth of bonds issued by real estate companies.

About VND29.1 trillion worth of corporate bonds were guaranteed by the issuers or third-party companies. Of the figure, real estate companies’ bonds accounted for 78.7%.

More than 95% of all bonds with no collateral or low creditability were sold in the nine months, proving market demand is at a high though investors have been warned of such assets, SSI said.

Those bonds may be too risky for investors as they may go home empty-handed if issuers declare bankruptcy or liquidation, SSI said.

Some economists said most corporate bonds having been issued are not guaranteed and of low creditability.

Many companies are making unreal assets, which are not referred to their real financial and business performances, they said.

Those bonds are not due within a year so the situation is still under control, they said.

But from the second year, if those companies are unable to pay interest, the bonds could turn worthless and the consequences may be too harsh for investors and the economy, they said.

Nguyen Thi Thanh Tu, a senior analyst at SSI Securities’ research unit, said local companies may return to bank loans in the last quarter of the year after the bond market is tightened by Decree 81.

Total lending increased by only 6.09% in January-September from the beginning of the year, lower than the target of 8-10% set by the State Bank of Vietnam (SBV) for 2020.

That means there is room for VND150-320 trillion worth of capital to be pumped into the economy in the fourth quarter, Tu said.

“Most local companies have complied with Decree 81, making the bond market cool down in September. They would seek borrowings from banks so that risks could be hedged and investors are protected from potential losses,” she said.

“It is unlikely the corporate bond market would boom in the last three months of the year. Companies will have to encounter stricter rules on information disclosure and issuance standards,” Tu said.

But on the secondary corporate bond market, buying and selling would still be dynamic, she said, adding interest rates offered by bond issuers and third-party companies would still be higher than banks’ saving rates – which are now at 3-5.8% for terms of up to 13 months.

According to the Asian Development Bank (ADB), the Vietnamese corporate bond market has made great achievements in recent years but is still highly risky for investors because no independent organisation takes charge of rating local companies. The lack of such an organisation puts investors at risk when purchasing bonds.

Related News

Transparency evates the standing of listed companies

09:47 | 21/11/2024 Finance

Industrial real estate - "Magnet" attracting foreign capital

09:01 | 07/09/2024 Import-Export

Many positive signals in the corporate bond market

10:20 | 25/08/2024 Finance

Transparent and stable legislation is needed to develop renewable energy

13:45 | 01/08/2024 Import-Export

Latest News

Bank stocks drive market gains as VN-Index closes final Friday of 2024 on a positive note

17:59 | 28/12/2024 Finance

Banks still "struggling" to find tools for handling bad debt

13:47 | 28/12/2024 Finance

Forecast upbeat for banking industry in 2025

14:30 | 27/12/2024 Finance

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

More News

Finance ministry announces five credit rating enterprises

14:54 | 25/12/2024 Finance

The capital market will see positive change

09:44 | 25/12/2024 Finance

Corporate bond issuance value rises by 60 per cent

13:51 | 24/12/2024 Finance

Slower mobilization than credit may put pressure on interest rates

09:02 | 24/12/2024 Finance

Fed’s foreseen rate cuts affect foreign exchange rate

14:12 | 23/12/2024 Finance

Untying the knot for green finance

11:08 | 23/12/2024 Finance

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

Your care

Bank stocks drive market gains as VN-Index closes final Friday of 2024 on a positive note

17:59 | 28/12/2024 Finance

Banks still "struggling" to find tools for handling bad debt

13:47 | 28/12/2024 Finance

Forecast upbeat for banking industry in 2025

14:30 | 27/12/2024 Finance

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Finance ministry announces five credit rating enterprises

14:54 | 25/12/2024 Finance