Concerns about bank credit quality as bad debt increases

| Bank credit growth recovers partly in March | |

| Ensuring the healthy development of the corporate bond market | |

| Banks have adjusted credit growth targets |

|

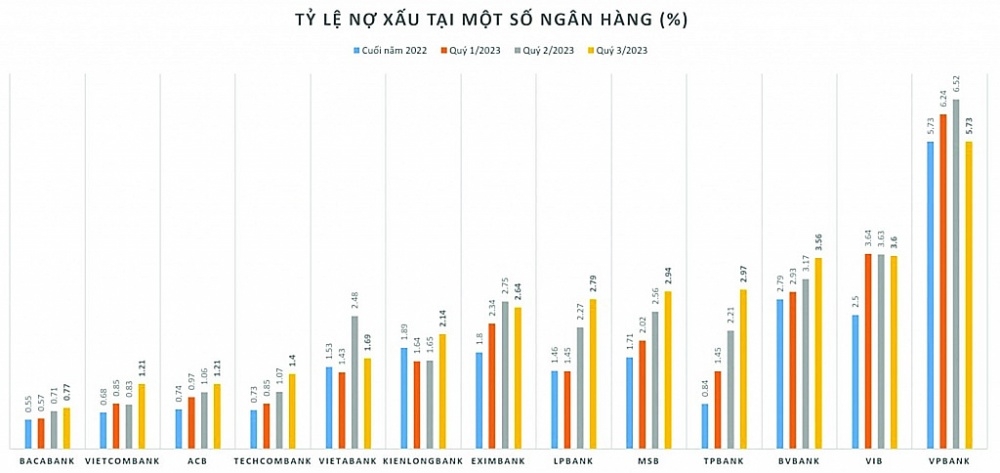

| Compare bad debt ratio from the end of 2022 with 3 quarters of 2023 at some banks. Chart: H.D |

There is only 1 bank left with a bad debt ratio of less than 1%

According to the newly released consolidated financial report, Vietcombank reported pre-tax profit for the first 9 months of 2023 of more than 29,550 billion VND, an increase of 18% over the same period last year. However, this bank's credit quality went backwards when the total bad debt as of September 30, 2023 was VND 14,394 billion, an increase of 84% compared to the beginning of the year. In particular, sub-standard debt (debt group 3) and doubtful debt (debt group 4) both increased more than 6 times compared to the end of 2022. Therefore, the ratio of bad debt to loan balance increased from 0.68 % at the beginning of the year increased to 1.21%.

At Techcombank, this bank's 9-month pre-tax profit reached more than 17,115 billion VND, down 19% over the same period last year due to a sharp increase in provision costs. Regarding loan quality, if at the end of 2022, this bank only recorded a bad debt ratio on total outstanding loans of 0.73%, then after 9 months of 2023, this ratio has increased to 1.4%. Among them, substandard debt and doubtful debt increased the most, while group 5 debt increased by 79% to more than 1,791 billion VND, accounting for nearly 27.7% of total bad debt.

Similar to ACB, pre-tax profit increased by 11% to more than VND 15,024 billion in the first 9 months of 2023 despite a sharp increase in provisioning, but the ratio of bad debt to total outstanding debt also increased from 0.74% at the end of 2022, increased to 1.21% with the volume of bad debts of groups 3, 4, and 5 all increasing quite sharply. At TPBank, pre-tax profit decreased by 26% over the same period, to only nearly 1,576 billion VND, but the ratio of bad debts to outstanding loans increased sharply from 0.84% at the beginning of the year to 2.97% after 9 months of 2023.

Among the banks that have announced their financial statements for the third quarter of 2023 to date, only BacABank has recorded a bad debt ratio below 1%, although it has also increased. Accordingly, the ratio of bad debt to BacABank's total outstanding debt increased from 0.55% at the end of 2022 to 0.77% at the end of the third quarter of 2023. In particular, debt group 3 increased by 245%, debt group 4 increased by 289%.

Bad debt is still hidden, there are many difficulties in debt handling

Although the bad debt ratio of the four banks mentioned above has increased, it is still at a low level in the industry. Currently, many banks have recorded a high increase in bad debt ratio, exceeding 3% of total outstanding loans, some banks even recorded a double-digit bad debt ratio.

According to VPBank's individual financial report, the ratio of bad debt to outstanding debt has now increased to 3.96% compared to 2.8% at the end of 2022; VIB also increased to 3.6% from 2.5% at the end of last year. Kienlongbank recorded a 25% increase in nine-month profit compared to the same period last year, but total bad debt also increased by more than 20% compared to the beginning of the year, group 3 debt increased nearly 5 times, pulling the ratio of bad debt to total outstanding debt from 1.89% at the beginning of the year to 2.14% after 9 months.

For some other banks, the bad debt ratio is on the rise but profits are falling sharply. For example, at VietABank, pre-tax profit in the first 9 months of 2023 only reached more than 63 billion VND, down 67% over the same period last year, but loan quality also decreased when more than 96% of bad debts were group 5 debt with potential potential loss of capital, so the ratio of bad debt to outstanding loans increases from 1.53% at the beginning of the year to 1.69% after 9 months of 2023.

Eximbank also recorded 9-month pre-tax profit of more than 1,712 billion VND, down 46% over the same period, while total bad debt increased 53% compared to the beginning of the year, pushing the ratio of bad debt to total loan balance to increase from 1 .8% by the end of 2022 to 2.64% as of September 30, 2023. TPBank also reduced pre-tax profit by 26%, to only nearly 1,576 billion VND, but the ratio of bad debts to outstanding loans increased sharply from only 0.84% at the beginning of the year to 2.97%.

Previously, the Government's report to the National Assembly said that the bad debt ratio of the entire credit institution system increased from 2% at the beginning of the year to 3.56% by the end of July 2023, equivalent to more than 440,000 billion VND of bad debt. However, the above bad debt ratio includes 5 banks under special control: SCB, DongABank, CBBank, OceanBank and GPBank. If these 5 banks are excluded, the banks' on-balance sheet bad debt ratio is currently at 1.92%.

If calculating bad debt on the balance sheet plus bad debts sold to the Credit Institutions Asset Management Company (VAMC) that have not yet been processed and potential debts of the credit institution system (including debts kept in the same group, corporate bonds with potential bad debts, bad receivables, accrued interest that must be withdrawn...), this rate is 6.16% (equivalent to 768,000 billion VND) of total outstanding credit debt.

At a recent group discussion session on evaluating the results of implementing the 2023 socio-economic development plan, National Assembly delegate Ha Sy Dong (Quang Tri delegation) expressed concern that bad debt in banks is high and will continue to increase, reflecting the health of the real economy.

This delegate also said that if updated until August 31, the bad debt ratio of the whole system would continue to increase to nearly 8%, the main reason is that bad debt of a bank under special control skyrocketed. This number will continue to increase, especially when potential bad debts as prescribed in Circular 01/2020/TT-NHNN (amended and supplemented) and Circular 02/2023/TT-NHNN Expiry date is limited, extended or postponed.

In the context of high bad debt, banks share that handling bad debt faces many difficulties, especially the gloomy real estate market, making the handling of real estate collateral even more challenging. Furthermore, the difficult economic context reduces the ability of households and businesses to repay overdue debt. According to experts, the legal framework related to restructuring credit institutions and handling bad debts has not been completed and there is a lack of preferential policies to encourage domestic and foreign investors to participate in handling secured assets and buying and selling bad debt.

Therefore, continuing to improve the legal framework on currency is an issue that needs more attention and focus, with high expectations that the National Assembly will pass the Law on Credit Institutions (amended) at this 6th Session. In addition, experts recommend that management agencies must strengthen inspection and supervision of banks' operations, paying attention to credit quality and bad debt handling to detect potential signs. Hide risks and violations to take appropriate prevention and handling measures.

Related News

Untying the knot for green finance

11:08 | 23/12/2024 Finance

Banks increase non-interest revenue

10:51 | 23/11/2024 Finance

A “picture” of bank profits in the first nine months of 2024

09:42 | 19/11/2024 Finance

Stipulate implementation of centralized bilateral payments of the State Treasury at banks

09:29 | 29/10/2024 Finance

Latest News

UK a niche market for Vietnamese speciality coffee

14:11 | 23/12/2024 Import-Export

Vietnam-US trade thrives on effective mechanisms: trade counsellor

14:08 | 23/12/2024 Import-Export

Opening of overseas markets boosts coconut exports

13:59 | 23/12/2024 Import-Export

Increasing consumption demand, steel enterprises face many opportunities

11:08 | 23/12/2024 Import-Export

More News

VN faced with increasing trade defence investigations on rising protectionism

18:58 | 22/12/2024 Import-Export

Việt Nam expects to officially export passion fruit to the US next year

18:55 | 22/12/2024 Import-Export

UK’s carbon tax to affect VN exports

18:51 | 22/12/2024 Import-Export

Removing obstacles in granting certificates of exploited aquatic products

13:56 | 22/12/2024 Import-Export

Promoting agricultural exports to the Japanese market

13:55 | 22/12/2024 Import-Export

Agricultural exports in 2024 to exceed 60 billion USD?

13:53 | 22/12/2024 Import-Export

Seafood exports expected to exceed $10 billion in 2025: expert

20:28 | 21/12/2024 Import-Export

Top 10 Reputable Animal Feed Companies in 2024: Efforts to survive the challenges of nature

18:30 | 21/12/2024 Import-Export

Vietnam's import-export surges 15.3%

09:44 | 20/12/2024 Import-Export

Your care

UK a niche market for Vietnamese speciality coffee

14:11 | 23/12/2024 Import-Export

Vietnam-US trade thrives on effective mechanisms: trade counsellor

14:08 | 23/12/2024 Import-Export

Opening of overseas markets boosts coconut exports

13:59 | 23/12/2024 Import-Export

Increasing consumption demand, steel enterprises face many opportunities

11:08 | 23/12/2024 Import-Export

VN faced with increasing trade defence investigations on rising protectionism

18:58 | 22/12/2024 Import-Export