Centralized exchange helps to clean up corporate bond market

|

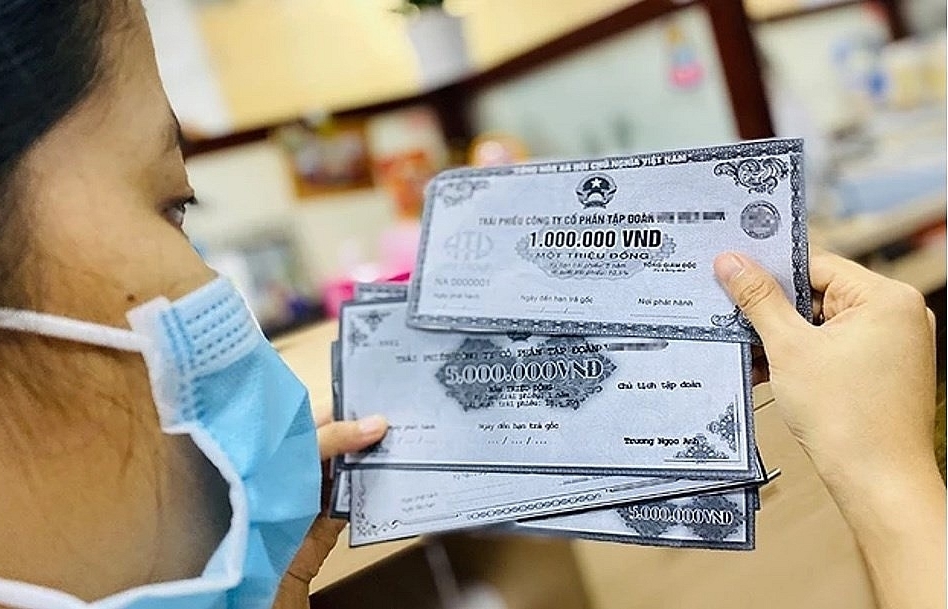

| It is expected that by the end of 2022, the centralized exchange market for private placement corporate bonds will be launched. Photo: ST |

Explosion of transactions

2021 is the first year that the issuance of corporate bonds has been carried out following new provisions of the Law on Securities 2019, the Law on Enterprise 2020, and guiding decrees and circulars.

After nearly a year of implementation, the corporate bond market continues to be an important capital mobilization channel for businesses in the context that bank credit is carefully managed by the State Bank, with the issuance volume reaching over VND495,000 billion. In particular, the volume of private placement corporate bonds accounted for 94.5%, the rest were public offering corporate bonds. The largest issuers in the market are still credit institutions and real estate enterprises, accounting for 34% and 27.7% of the total issuance volume, respectively, while the rest are commercial, service and production enterprises and securities companies. Securities companies and commercial banks are the main investors in the primary market, the proportion of individual investors buying corporate bonds decreased compared to 2020.

Commenting on the boom of the corporate bond market in the past year, especially private placement corporate bonds with a high successful issuance rate (about 800 issuances, reaching nearly VND500,000 billion), Mrs. Vu Thi Thuy Nga, Deputy Director General of HNX, said that up to now, privately issued corporate bonds were attractive to investors, especially small investors, but 99% are domestic investors while the number of foreign investors was very low. The entire market was traded through organizations that register to deposit corporate bonds, usually securities companies and commercial banks. Therefore, it was necessary to build a centralized secondary exchange market, ensuring that investors can make transparent transactions with regular and complete information.

According to Mr. Tran Viet Hung, Deputy Director General of Vietcombank Securities Company (VCBS), the size of the corporate bond market had grown very strongly in recent years, while the interest of investors in the corporate bond market is increasing. It was not only from professional investors but also individual investors who had learned and allocated their idle money to corporate bond investment channels.

According to Tran Viet Hung, professional investors which come from funds were also often researched. These investors need listed bonds, transparent information, and a day trading mechanism, so if the market becomes more professional, the participation of investors will be wider and deeper.

Launching a centralized exchange market by the end of 2022

According to HNX, in order to manage private placement corporate bond transactions on the organized trading market, based on the plan of private placement corporate bonds approved by the Ministry of Finance in Official Letter No. 68/CV-VNX dated August 17, 2021 on implementing and building a system of private placement corporate bonds, and Official Letter No. 1218/TCNH-TT dated September 20, 2021 on preparing conditions for deploying the corporate bond market, HNX has developed the corporate bond trading system and corporate bond supervision criteria system. Initially, the department has consulted with relevant professional units and is currently developing a system. At the same time, it has completed a system of corporate bond supervision criteria and reported to the Vietnam Stock Exchange and the State Security Commission of Vietnam.

Mrs. Vu Thi Thuy Nga said that regarding the orientation, besides commenting and finalizing legal documents related to amending Decree 153/2020/ND-CP and completing the portal of corporate bonds, it was expected that the centralized exchange market of individual corporate bonds would help investors have complete and accurate information and make effective trade decisions.

“The public placement corporate bond market had taken shape, has issuers and investors, so building a centralized exchange system was a very important task. In the next year, it is expected that by the end of 2022, we would try to launch a centralized exchange market for private placement corporate bonds,” Nga said.

Regarding participating organizations, a representative of HNX said that he wanted credit rating agencies to join and accompany to help investors as well as management agencies to put the best quality goods on the market.

From the perspective of a market member, Mr. Tran Viet Hung, a representative of VCBS, said that market members expected the tools of the management agency to be put into operation soon.

“When having tools like an information disclosure page or a secondary exchange system, we see this as both a benefit and a responsibility. We would go with the issuers to advise them to take responsibility, providing complete information as guided," Hung said.

Related News

Transparency evates the standing of listed companies

09:47 | 21/11/2024 Finance

Industrial real estate - "Magnet" attracting foreign capital

09:01 | 07/09/2024 Import-Export

Many positive signals in the corporate bond market

10:20 | 25/08/2024 Finance

Transparent and stable legislation is needed to develop renewable energy

13:45 | 01/08/2024 Import-Export

Latest News

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

More News

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

Six SOEs to be transferred back to industry ministry

15:38 | 18/12/2024 Finance

PM urges stronger measures to manage interest rates

16:53 | 17/12/2024 Finance

Six SOEs to be transferred back to industry ministry

16:48 | 17/12/2024 Finance

Vietnamese products: Conquering foreign customers in supermarket systems

16:45 | 17/12/2024 Finance

Answering many questions from businesses at dialogue conference on tax and customs policies

10:01 | 17/12/2024 Finance

Enterprises face difficulties in tax refunds due to partners closing

10:01 | 17/12/2024 Finance

Strengthen the management and use of electronic invoices for e-commerce

11:24 | 16/12/2024 Finance

Ministry of Finance proposes comprehensive amendments to the Personal Income Tax Law

11:23 | 16/12/2024 Finance

Your care

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance