Building a trust mechanism and risk treatment tool for the corporate bond market

In order to find solutions to improve the efficiency of the corporate bond market and regain confidence in the market after arising risks, on September 13, the Bizlive website held a seminar on the topic: "Corporate bond market development goals: Trust and responsibility".

|

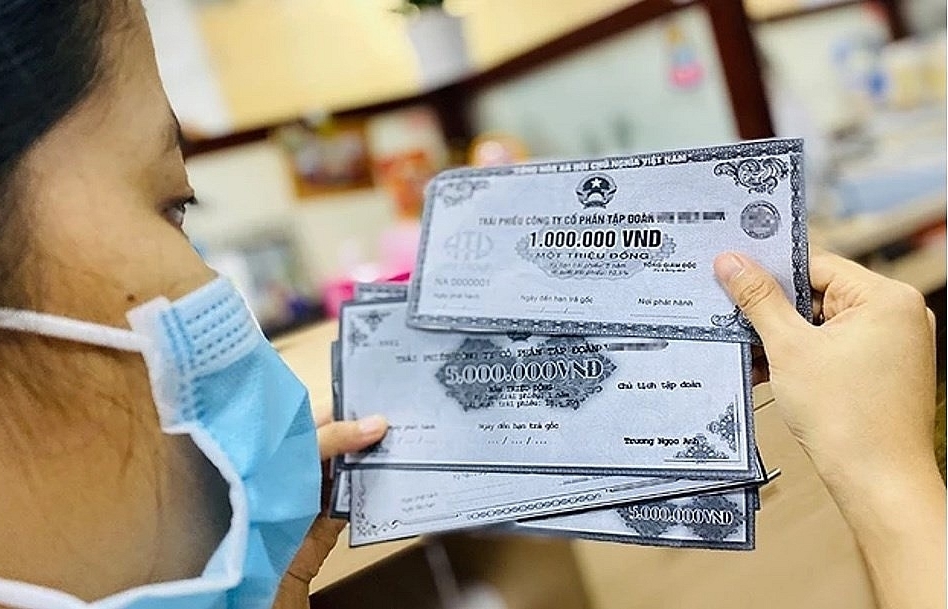

| Corporate bond market development goals: Trust and responsibility seminar. Photo: H.Dịu |

Speaking at the seminar, Ph.D. Vu Tien Loc, Chairman of the Vietnam International Arbitration Center, member of the National Assembly's Economic Committee, said that the State Bank had loosened the credit room for banks, but the room was not much due to inflationary pressures. In addition, the supply of credit to the economy was also limited compared to the demand for capital for recovery and development, so the market was expecting other tools to regulate credit for the economy through the stock and corporate bonds channels.

However, according to Mr. Loc, capital sources through securities and corporate bonds only account for 26%; that is, only one dong for every four dongs of mobilized capital comes from the capital market, and the rest is mainly through credit channels. This is a problem that needs to be solved in Vietnam.

Also related to the limited credit room, Ph.D. Trinh Quang Anh, Chairman of the Vietnam Interbank Market Research Association, shared, that the size of Vietnam's capital market was about VND11.5 million billion divided by VND 8 trillion of GDP, equaling about 144%. In particular, the corporate bond market accounts for about 40% of GDP. Credit growth this year was about 14%, and most banks were running out of room, so it would create opportunities for the corporate bond market. The reason is that enterprises that could not borrow capital from banks would issue corporate bonds to raise capital. Some banks also introduce investors to buy corporate bonds issued by companies through banks.

Therefore, economic expert Vo Tri Thanh, a National Financial and Monetary Policy Advisory Council member, said that the corporate bond story was a long story. In the current recovery period, raising capital through corporate bonds was an important channel for businesses, but the "iron" was that demand came with risks.

Evaluating the risks in the corporate bond market, Lawyer Nguyen Thanh Ha, Chairman of the Board of Directors of SBLAW Law Company, said that in the past, there were several cases related to corporate bonds. During the working process, Mr. Ha realized that investors, especially individual investors, did not understand much about macro issues and the nature of corporate bonds. They perceived buying corporate bonds as a saving. If interest rates on corporate bonds were higher than banks, they would "jump" in, regardless of the collateral or related issues.

Also according to Ph.D. Nguyen Tu Anh, Director of the General Affairs Department, Central Economic Commission, the corporate bond market is a slow-growing piece of the puzzle compared to other capital markets in Vietnam. However, the growth numbers are now huge. For example, in the period 2017-2021, the corporate bond market size increased by 24%, and by 2021 it was 56%.

"What's new, but growing up too quickly, you have to be careful, like when you just learned to walk, but if you go too fast, you often fall, sometimes falling is very painful. We have also seen that there have been several incidents recently. However, the settlement method did not cause too much disturbance to the market, the issuance of corporate bonds only slowed down in April and May, and by June, the issuance increased again, " Mr. Tu Anh said.

According to Mr. Tu Anh, the important thing is that investors must have faith when participating in the market. The "rules of the game" here are that if people do wrong, they have to pay the price. So the market has to build a belief system. The classic way is to build strict rules, and tight controls to filter out risks. The new approach is to build trust and build risk treatment tools.

Meanwhile, according to an economic expert Ph.D. Le Xuan Nghia, the corporate bond market is a relatively high-risk market, so it is necessary to have a standard monitoring violation system for investors to look at corporate health in order to decide to choose according to risk appetite.

In addition, experts recommended that enterprises must be responsible to investors, themselves, their employees, and the development of the financial market to increase confidence. To handle this problem, enterprises must use capital more efficiently, fulfill their obligations, and repay debts on time. Besides that, enterprises also need to have an investor relations department to interact and offer suitable products to investors, contributing to the use of capital more transparently and effectively.

For investors, experts said it was necessary to consider corporate bonds as an investment channel and appropriately allocate your capital. If directly buying corporate bonds, investors must find out by themselves the issuer's information or can look to professional advisors and corporate bond investment funds.

On the other hand, some experts also stated that in order to develop a healthy and advanced capital market, it needed to have an independent institution, an agency with functions of organizing, inspecting, supervising and being responsible for the movement of the financial market in general and the capital market in particular. In addition, there should be institutions that rate the health of businesses and investors from which to decide and take responsibility for their decisions.

Related News

Transparency evates the standing of listed companies

09:47 | 21/11/2024 Finance

Industrial real estate - "Magnet" attracting foreign capital

09:01 | 07/09/2024 Import-Export

Many positive signals in the corporate bond market

10:20 | 25/08/2024 Finance

Transparent and stable legislation is needed to develop renewable energy

13:45 | 01/08/2024 Import-Export

Latest News

Fed’s foreseen rate cuts affect foreign exchange rate

14:12 | 23/12/2024 Finance

Untying the knot for green finance

11:08 | 23/12/2024 Finance

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

More News

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

Six SOEs to be transferred back to industry ministry

15:38 | 18/12/2024 Finance

PM urges stronger measures to manage interest rates

16:53 | 17/12/2024 Finance

Six SOEs to be transferred back to industry ministry

16:48 | 17/12/2024 Finance

Vietnamese products: Conquering foreign customers in supermarket systems

16:45 | 17/12/2024 Finance

Answering many questions from businesses at dialogue conference on tax and customs policies

10:01 | 17/12/2024 Finance

Enterprises face difficulties in tax refunds due to partners closing

10:01 | 17/12/2024 Finance

Your care

Fed’s foreseen rate cuts affect foreign exchange rate

14:12 | 23/12/2024 Finance

Untying the knot for green finance

11:08 | 23/12/2024 Finance

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance