Bonds remain companies’ preferred source of capital despite tightened rules

|

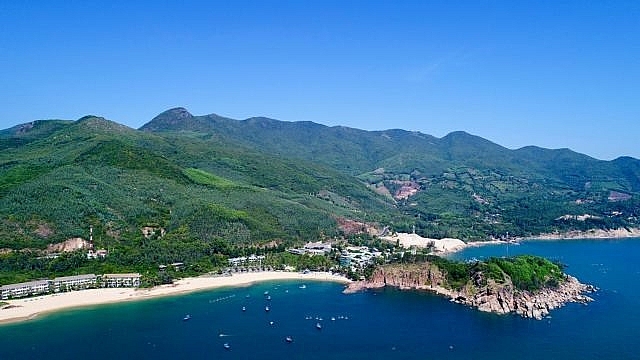

| The operational Casa Marina Resort is financed by Bamboo Capital Joint Stock Company in the central province of Bình Định. The company plans to issue bonds this year to raise VNĐ500 billion. — Photo bcgland.com.vn |

It is one of a large number of companies to issue bonds in December 2021.

According to the Hà Nội Stock Exchange (HNX), enterprises carried out up to 80 private placements of corporate bonds in just the last month of the year, mobilising a huge amount of funds.

Data from the Việt Nam Bond Market Association showed that in 2021 there were 964 issuances of corporate bonds worth VNĐ595 trillion ($26 billion), including 937 private placements, 23 public offerings and four issuances on the international market.

Analysts said that in the context of banks tightening credit to minimise risks in recent years, corporate bonds have become an increasingly important medium- and long-term source of capital for businesses in most economic sectors.

In the real estate sector for instance, corporate bonds account for nearly half of the outstanding debts.

Trần Văn Dũng, chairman of the State Securities Commission, said the capital mobilisation through the bond market has helped reduce pressure on the banking sector.

Analysts said corporate bonds would continue to be enterprises’ preferred method of raising capital this year and possibly beyond.

As a result, the bond market has grown rapidly in recent years.

They said however it has some loopholes, which pose a risk to investors, including the lax conditions for issuing bonds. Many loss-making businesses manage to mobilise thousands of billions of đồng. Thus, their corporate bonds are unsecured, meaning if a company collapses, investors will be left empty-handed.

Tightening policy

To ensure the corporate bond market develops transparently and efficiently and investors are protected, authorities have made concerted efforts to improve the legal framework and strengthen management and oversight of bond issuances.

Many new strict regulations have come into force, one of which is Decree No.163/NĐ-CP/2018.

The decree that took effect in early 2019 stipulates that private placements have to be made to less than 100 investors excluding “professional securities investors.”

It requires depository organisations to provide information about corporate bond trading within one working day of a transaction being completed. Regular updates on bond registration and depository must be provided to the stock exchange on a monthly basis.

Wrongdoing related to private corporate bond issuances will be handled based on securities market regulations.

Referring to Decree No.163, the Ministry of Finance said tightening the regulations on private placement of corporate bonds was aimed at protecting investors and ensure the safety of the bond market.

Similar to it is Decree No.81/2020 that came into effect in September 2020 and, among other things, caps leverage after some companies issued bonds worth 10-20 times their equity.

Now the total issuance by a company cannot be more than five times its equity, and there must be a gap of at least six months between two issuances. The issuer also has to declare the purpose of the issuance.

The decree seeks to raise corporate bond market standards and limit private issuances to minimise risks to inpidual investors.

It increases the responsibility of underwriters in evaluating an issuance to keep low-quality issuers out of the market to protect investors.

Then Decree No.153/2020 was issued in January 2021 to supersede the earlier two decrees to improve corporate bond market governance and market and investor protection.

It regulates private offerings and trading of corporate bonds in the domestic market and offerings in the international market.

It restricts buying of non-convertible bonds not accompanied by warrants to professional securities investors, and convertible bonds with warrants to professional securities investors and a maximum of 100 non-professional investors.

It also lists the responsibilities and rights of investors with respect to privately issued bonds.

The decree also specifies the responsibilities of organisations providing services related to corporate bond issuances to strengthen management and oversight of the market.

A draft circular with amendments to this decree is now under preparation and is set to have stricter regulations for issuances.

One of them is that the proceeds of bond issuances cannot be used for buying shares or bonds.

All issuers must have audited financial statements.

It also has stipulations related to credit ratings for certain types of bonds to comply with international practices that limit investors’ risks.

The State Bank of Việt Nam has issued Circular No.16/2021 with new regulations to govern the purchase and sale of corporate bonds by credit institutions and foreign banks, effectively curbing banks’ investment in this market.

It prohibits banks from buying bonds issued to restructure debts, buy stakes in other companies or increase working capital.

But some experts feared too many tough regulations could impede the growth of businesses and reduce their competitiveness against foreign rivals.

They said tightening bond issuance regulations is not advisable because this might force small enterprises to turn to unofficial channels to raise capital, even loan sharks.

Instead, it would be a better idea to have proper mechanisms to ensure transparency and fairness in issuing corporate bonds to protect investors.

Over the long term, improving credit rating services is critical since ratings have become mandatory for bond issuances, they pointed out.

Investors are now keen on buying corporate bonds since their interest rates are often much higher than what banks pay on deposits.

Many enterprises have announced plans to issue bonds this year.

Bamboo Capital Joint Stock Company hopes to raise VNĐ500 billion, BAF Việt Nam Agriculture Joint Stock Company is eyeing an issuance of VNĐ600 billion and Đất Xanh Group wants to raise VNĐ200 billion.

Experts from securities firm MBS said in the first half of this year the corporate bond market is likely to slow down since it needs time to digest the new regulations before beginning to grow rapidly both in size and in the persity of products.

A spokesman for Vietcombank Securities Company said interest rates would continue to be low this year while bond market transparency would improve significantly thanks to the new legal provisions, and this augurs well for the market.

Related News

State Treasury to auction VND128,000 billion of government bonds in Q4/2024

10:25 | 18/10/2024 Finance

Mobilizing government bonds to ensure budget balance and reduce debt repayment pressure

14:07 | 31/07/2024 Finance

The State Treasury ensures budget balance by effectively mobilizing Government bonds

09:59 | 08/04/2024 Finance

Good management of public debt creates room to implement expansionary fiscal policy

10:06 | 19/03/2024 Finance

Latest News

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Finance ministry announces five credit rating enterprises

14:54 | 25/12/2024 Finance

The capital market will see positive change

09:44 | 25/12/2024 Finance

Corporate bond issuance value rises by 60 per cent

13:51 | 24/12/2024 Finance

More News

Slower mobilization than credit may put pressure on interest rates

09:02 | 24/12/2024 Finance

Fed’s foreseen rate cuts affect foreign exchange rate

14:12 | 23/12/2024 Finance

Untying the knot for green finance

11:08 | 23/12/2024 Finance

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

Six SOEs to be transferred back to industry ministry

15:38 | 18/12/2024 Finance

Your care

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Finance ministry announces five credit rating enterprises

14:54 | 25/12/2024 Finance

The capital market will see positive change

09:44 | 25/12/2024 Finance

Corporate bond issuance value rises by 60 per cent

13:51 | 24/12/2024 Finance

Slower mobilization than credit may put pressure on interest rates

09:02 | 24/12/2024 Finance