Big 4" banks sharply lower deposit interest rates, loan interest rates may further decrease

| The WB highlights a series of challenges, the banking system must enhance resilience | |

| Is non-interest income an " salvation" for bank profits? |

|

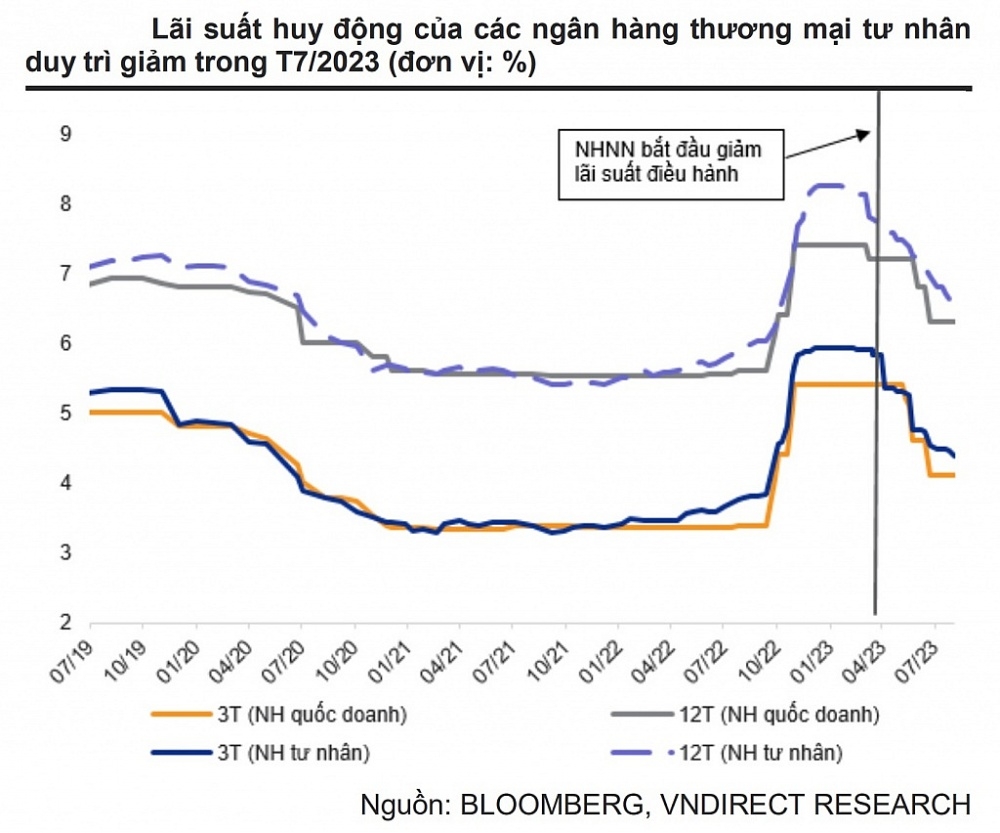

| Deposit interest rates continued to decline. (Source: Bloomberg, VNDirect) |

Accordingly, right from today (August 23), BIDV lowered the deposit interest rate for 1-month and 3-month term deposits by 0.3% to 3-3.8 percent/year. The 6-month term interest rate also decreased from 5% to 4.7%/year. Interest rates for term from 12 months adjusted sharply from 6.3% to 5.8%, i.e., down to 0.5%.

VietinBank and Vietcombank also adjusted interest rates similarly. Remarkably. Vietcombank's online deposit interest rate adjusted sharply to 0.5-0.6 percentage points, equal to the interest rate table at the counter, different from the previous 0.2-0.3 percentage point higher.

At Agribank, the deposit interest rate also decreased by 0.3-0.5%/year, the 12-month term deposit interest rate was also only 5.8%/year, only 5.8%/year for the term 13 and above.

With this adjustment, the Big 4 banks have again become ones with the lowest interest rates in the system.

Before that, a number of private banks also sharply reduced deposit interest rates, even some banks were equal to, or even lower than, all four state-owned banks. For example, at Techcombank, the highest interest rate is currently only 6.3%/year, but it also comes with many conditions such as: only for priority customers, deposit money online, with a term of 12 months or more and the amount above 3 billion dong. For regular customers and the amount under 1 billion VND, the highest interest rate is only 5.95%/year

At ACB, the highest interest rate is only 5.6%/year for ordinary deposits, customers with a deposit of 200 billion VND or more must be offered the interest rate of 6.5%/year.

Currently, there are only a few banks that maintain a high deposit interest rate of 7-7.3% for a few long terms such as ABBank, PVCombank with a term of 6 months; NCB, CBBank, BaoVietBank with terms from 9-18 months; VietABank, HDBank, NamABank, KienLongBank, LPBank… with terms over 12 months.

|

| All banks have sharply reduced deposit interest rates, following the reduction of lending rates |

It can be seen that the move to reduce interest rates by banks is still happening on a large scale, especially under the direction and encouragement of interest rate reduction of the National Assembly, the Government, and the State Bank of Vietnam (SBV).

According to Notice No. 332/TB-VPCP on conclusions issued on August 17, 2023 by the Standing Government of the Government at the meeting on tasks and major solutions to stabilize the macro-economy, control inflation, promote growth and ensure major balances of the economy in the last months of 2023, as of August 9, credit growth only reached 4.3%, while the target for the whole year is about 14-15%.

Therefore, the Standing Government requested the State Bank to urgently have timely and effective solutions to promote credit growth and enhance access to credit capital of businesses and people; continue to direct commercial banks to reduce costs, promote digital transformation..., strive to continue lowering lending interest rates.

In mid-August, the Governor of the State Bank of Vietnam also issued a document directing the implementation of tasks in the last months of 2023. In which, the State Bank requested credit institutions to actively deploy and strengthen connection bank – business relationship. At the same time, credit institutions need to continue to reduce costs, cut unnecessary procedures and fees, increase information technology application and digital transformation to have room to reduce lending interest rates. At the same time, it is necessary to implement policy to restructure debt repayment term and maintain debt group in order to support customers in difficulty according to Circular 02/2023/TT-NHNN...

The recent macro report of VNDirect Securities Company expects that the average 12-month deposit interest rate will drop to 6-6.2%/year before the end of 2023 due to the impact of 4 interest rate cuts of SBV. Moreover, mobilization pressure was loosened due to weak credit demand in the first half of 2023. On the other hand, the Government's promotion of public investment in addition to expansion of fiscal policy have injected more money into the economy.

VNDirect experts believe that, along with the reduction in deposit interest rates, lending rates have decreased by 0.5-1.0 percentage points compared to the end of 2022. Therefore, lending rates may decrease further in in the last months of this year, thanks to the rapid decrease in capital costs of commercial banks from the reduction of operating interest rates and regulations allowing banks to relax provision for bad debts.

VNDirect forecasts lending rates could fall another 100-150 basis points in the coming quarters and this will be the main driver for the recovery in private consumption and investment.

Related News

Banks still "struggling" to find tools for handling bad debt

13:47 | 28/12/2024 Finance

Continue to handle cross-ownership in banks

10:35 | 02/11/2024 Finance

More efficient thanks to centralized payments between the State Treasury and banks

13:51 | 17/10/2024 Finance

Allocating credit room, motivation for banks to compete

19:14 | 14/09/2024 Finance

Latest News

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

More News

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance

Fiscal, monetary policies support demand stimulation, price stabilisation

14:49 | 14/02/2025 Finance

Vietnam secures VND 157 billion from state enterprise divestment in 2024

09:16 | 14/02/2025 Finance

Vietnam gears up for potential inflation impact in 2025

14:26 | 11/02/2025 Finance

VN’s credit conditions in 2025 expected to be stable

14:24 | 11/02/2025 Finance

State revenue in first month of the year equal to 14% of the estimate

10:12 | 11/02/2025 Finance

Securities 2025 expects a breakthrough in scale and quality

14:37 | 10/02/2025 Finance

Cash reserves in stock accounts at six-quarter low amid margin rise

08:23 | 10/02/2025 Finance

Five solutions for developing stock market in 2025

10:01 | 07/02/2025 Finance

Your care

The system has not recorded your reading habits.

Please Login/Register so that the system can provide articles according to your reading needs.

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance