Banks racing to "digitize" to attract deposits

| Banks boost sales of mortgaged real estate to recover bad debts | |

| Make healthy cash flow to buy corporate bonds | |

| Foreign ownership regulation hinders banks from finding strategic shareholders |

|

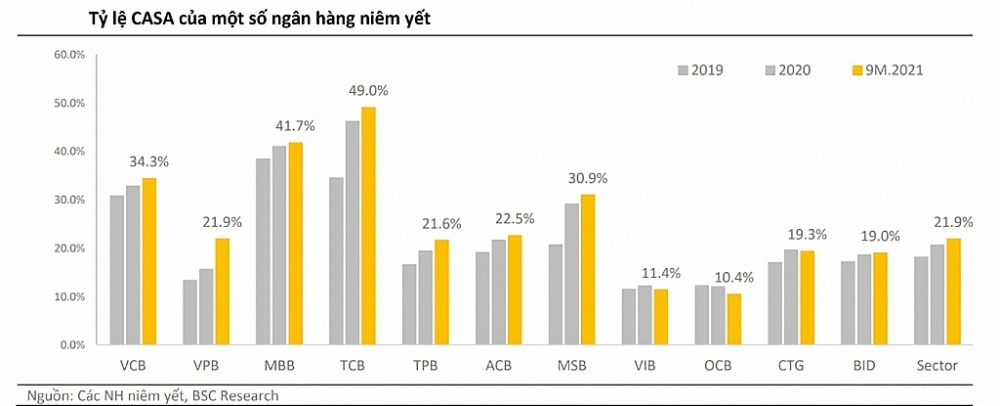

| Some banks have the advantage of high CASA rates. Source: BSC |

Investting strongly in "digitization"

Savings interest rates continuously decreased by 1.5-2 percentage points compared to before the pandemic, ranging from 3-4% for terms of less than six months, 3.7-5% for terms of 6-12 months and 4.2-6.5% for a term of more than 12 months. This has made idle cash flow to more profitable investment channels such as real estate and securities, so the deposits from residents in the system tends to decrease.

However, the growth of deposits at specific banks is quite high, which is directly proportional to the speed of digitization. For example, at MB, thanks to the integrated implementation of all banking transactions, financial management is completely free on MBBank applications (for individual customers), BIZ MBBank (for corporate customers) and MB SmartBank's automatic banking transaction model, compared to the end of 2020, the number of customers using MB's applications increased by 120%, accounting for 75% of MB's total individual customers. Total transactions on MB's digital channel accounted for 94% of transactions. As a result, the amount of deposits by the end of September 2021 reached nearly VND344,000 billion, an increase of nearly 11% compared to the beginning of the year.

At Techcombank, in the first nine months of 2021, this bank has attracted about 870,000 new customers, bringing the total number of customers to 9.2 million. Along with that, the total deposits at the end of September reached over VND316,300 billion, up 14% compared to the end of 2020. Mr. Phung Quang Hung, CEO of Techcombank, said in the 2021-2025 period, Techcombank will continue to invest in building data capacity and new digital banking platforms for corporate and individual customers, bringing new experiences to customers.

Currently, Techcombank uses iTCBLife - a digital tool with artificial intelligence to support professional insurance consultants to help the bank "promote" the field of insurance services and the amount of demand deposits on the total deposits of customers (CASA).

At HDBank, this bank has invested heavily in technology and payment platforms with key projects such as: digitizing the customer journey at the counter, digitizing the online customer journey with digital banking services and pioneering technology such as eKYC.

According to HD Bank's statistics, after five months of operation (since May 2021), digitizing the account opening process at the counter via tablet application, cross-selling rate more effective than the traditional method with the rate of registering more eBanking services reaching 67% compared to 50% before. The nine-month financial report shows that HD Bank's customer deposits also increased by 11% compared to the end of last year.

In addition, some other banks such as TPBank increased by 13%, VIB increased by 13%, VietinBank increased by 8%. The CASA ratio of these banks is quite high, with some banks up to over 40%. CASA ratio is considered as a source of money with low capital costs, so the higher this ratio, the more it helps the bank cover many costs, expanding profit margins, and increase lending efficiency.

Therefore, increasing the rate of CASA has become a trend in the entire banking industry, so promoting non-cash payment services, digital banking is one of the most effective solutions.

The "race" is an obstacle

According to the State Bank of Vietnam (SBV), many banks have over 90% of transactions on digital channels, 94% of banks have invested in digital transformation, 40% of banks have made digital transformation into a strategic vision in the next five to ten years. A Nielsen survey shows that the percentage of Vietnamese people using mobile banking and internet banking has increased from 22% and 28% respectively in the fourth quarter of 2018 to 68% and 75% in the third quarter of 2021. However, a report on financial technology (fintech) and digital banking by Backbase (a provider of digital banking platforms) predicts that by 2025, 38% of revenue of traditional banks will face the risk of the emergence of new competitors such as fintech or enterprises in the industry.

According to representatives of some banks, digital transformation helps improve customer experience, thereby developing business activities on digital channels. A "smart" bank needs to anticipate customer needs and suggest products and services that customers may need in the future. In addition, banks must put technology first, connect with open ecosystems (including partners providing products and services) to better serve customers.

However, the digital "race" of banks is facing many barriers, especially on legal issues. Leaders of some banks said that banks have digitized all money transfer and money receiving services, but the digitization of loan services has only stopped at small loans or must be combined with other banks. This means that the customer submits the loan application and some documents online, but to decide on the disbursement, the customer has to go to the counter to meet the staff, the bank still has to keep a hard copy. The reason is that the legal framework, especially regarding electronic signatures, does not allow it.

Mr. Nguyen Dinh Tung, General Director of OCB, said that many loan products cannot be digitized, especially products related to notarization and registration of secured transactions. However, OCB expects by the end of this year to deploy the first product of real estate mortgage lending with 90% digitization, the remaining 10% will still have to be done by traditional methods (notarization, registration of Secured Transactions, etc).

The representative of the State Bank said that it would speed up the research and development of the Law on Electronic Transactions to replace or amend and supplement the Law on Electronic Transactions 2005 to create a legal basis for ministries, the industry completes relevant legal regulations, helps promote digitalization and digital application, and creates a favorable transaction environment for people and businesses through digital channels and electronic methods.

Related News

Banks still "struggling" to find tools for handling bad debt

13:47 | 28/12/2024 Finance

Support aggregate demand to promote economic growth

09:41 | 12/12/2024 Import-Export

Available foundations and drivers for strong economic growth

08:34 | 13/11/2024 Headlines

Continue to handle cross-ownership in banks

10:35 | 02/11/2024 Finance

Latest News

State Bank sets higher credit growth target for 2025

15:22 | 31/12/2024 Finance

Outlook for lending rates in 2025?

15:20 | 31/12/2024 Finance

Tax policies drive strong economic recovery and growth

07:55 | 31/12/2024 Finance

E-commerce tax collection estimated at VND 116 Trillion

07:54 | 31/12/2024 Finance

More News

Big 4 banks estimate positive business results in 2024

13:49 | 30/12/2024 Finance

Flexible and proactive when exchange rates still fluctuate in 2025

11:03 | 30/12/2024 Finance

Issuing government bonds has met the budget capital at reasonable costs

14:25 | 29/12/2024 Finance

Bank stocks drive market gains as VN-Index closes final Friday of 2024 on a positive note

17:59 | 28/12/2024 Finance

Forecast upbeat for banking industry in 2025

14:30 | 27/12/2024 Finance

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Finance ministry announces five credit rating enterprises

14:54 | 25/12/2024 Finance

The capital market will see positive change

09:44 | 25/12/2024 Finance

Corporate bond issuance value rises by 60 per cent

13:51 | 24/12/2024 Finance

Your care

State Bank sets higher credit growth target for 2025

15:22 | 31/12/2024 Finance

Outlook for lending rates in 2025?

15:20 | 31/12/2024 Finance

Tax policies drive strong economic recovery and growth

07:55 | 31/12/2024 Finance

E-commerce tax collection estimated at VND 116 Trillion

07:54 | 31/12/2024 Finance

Big 4 banks estimate positive business results in 2024

13:49 | 30/12/2024 Finance