Banks continue to cut interest rates for pandemic-hit clients

Illustrative image (Source: VNA)

The State Bank of Vietnam (SBV) will continue directing commercial banks to reduce interest rates for customers affected by the COVID-19 pandemic, said Deputy Governor Dao Minh Tu at the Government’s press conference on August 11.

Tu noted that recently, 16 major commercial banks have committed to cutting interest rates for specific groups with a total reduced amount until the end of this year estimated at about 20.3 trillion VND (891.8 million USD).

Alongside, four state-owned commercial banks, Vietcombank, Viettinbank, BIDV, Agribank, have agreed to cut an additional 1 trillion VND worth of interest rates each for cities and provinces undertaking social distancing measures.

Meanwhile, banks have pledged to reduce 100 percent of service and banking fees, including currency payment fee for Ho Chi Minh City and southern localities.

The SBV Deputy Governor affirmed that the bank will strengthen supervision to make sure the commitments are realised until the end of this year.

At the press briefing, Deputy Minister of Finance Nguyen Duc Chi said that affected businesses and people are expected to benefit from 118 trillion VND (5.18 billion USD) resulting from support related to taxes, land rent as well as charge and fee reduction to them overcome difficulties caused by COVID-19.

The ministry is making revisions to propose a number of additional solutions, including a 30 percent reduction in corporate income tax for firms with total revenue of less than 200 billion VND in 2021.

Business households and inpiduals will enjoy a tax cut of 50 percent, while COVID-19 hard-hit groups will enjoy reductions in added value tax, along with exemption of late tax payment fines and decreases in land rent, with an expected value of over 20 trillion VND.

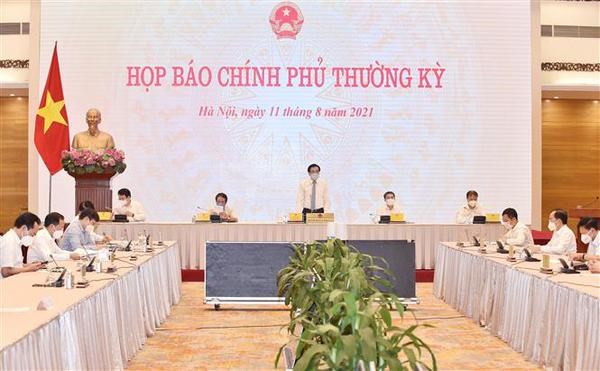

An overview of the press conference (Photo: VNA)

For his part, Deputy Minister of Industry and Trade Do Thang Hai said that the ministry is working with the Ministry of Health to design more optimal conditions for the “three-on-site” scheme applied in Ho Chi Minh City and southern localities, with guidances to be issued soon to ensure the efficiency of pandemic control and production at the same time.

Regarding the circulation of goods, Hai said that the issue has basically been solved thanks to the government's approval of its proposal on allowing the circulation of all goods excepting for banned goods.

At the same time, the ministry has suggested prioritising vaccination against COVID-19 for drivers and cargo loaders, while designing traffic regulating plans to avoid congestion, he added./.

Related News

Continue to handle cross-ownership in banks

10:35 | 02/11/2024 Finance

More efficient thanks to centralized payments between the State Treasury and banks

13:51 | 17/10/2024 Finance

The biggest challenges businesses are facing

15:28 | 20/10/2024 Headlines

Allocating credit room, motivation for banks to compete

19:14 | 14/09/2024 Finance

Latest News

M&A activities show signs of recovery

13:28 | 04/11/2024 Finance

Fiscal policy needs to return to normal state in new period

09:54 | 04/11/2024 Finance

Ensuring national public debt safety in 2024

17:33 | 03/11/2024 Finance

Removing many bottlenecks in regular spending to purchase assets and equipment

07:14 | 03/11/2024 Finance

More News

Striving for average CPI not to exceed 4%

16:41 | 01/11/2024 Finance

Delegating the power to the government to waive, lower, or manage late tax penalties is suitable

16:39 | 01/11/2024 Finance

Removing difficulties in public investment disbursement

09:30 | 31/10/2024 Finance

State-owned commercial banking sector performs optimistic growth, but more capital in need

09:28 | 31/10/2024 Finance

Stipulate implementation of centralized bilateral payments of the State Treasury at banks

09:29 | 29/10/2024 Finance

Rush to finalize draft decree on public asset restructuring

09:28 | 29/10/2024 Finance

Inspection report on gold trading activities being complied: SBV

14:37 | 28/10/2024 Finance

Budget revenue in 2024 is estimated to exceed the estimate by 10.1%

10:45 | 28/10/2024 Finance

Ensure timely and effective management and use of public asset

11:31 | 27/10/2024 Finance

Your care

M&A activities show signs of recovery

13:28 | 04/11/2024 Finance

Fiscal policy needs to return to normal state in new period

09:54 | 04/11/2024 Finance

Ensuring national public debt safety in 2024

17:33 | 03/11/2024 Finance

Removing many bottlenecks in regular spending to purchase assets and equipment

07:14 | 03/11/2024 Finance

Continue to handle cross-ownership in banks

10:35 | 02/11/2024 Finance