Asanzo violated tax with many aggravating circumstances

|

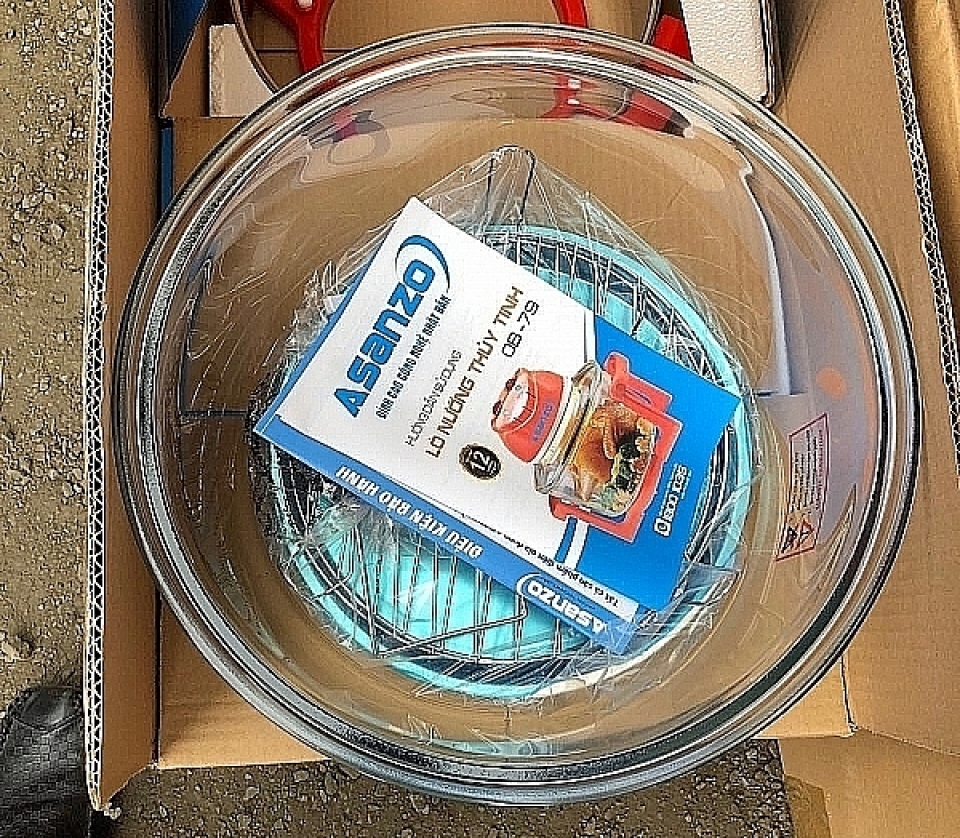

| Products named Asanzo was the exhibit in case of the Sa Huynh Company. Photo: Lê Thu |

According to the decision of Ho Chi Minh City Tax Department, Asanzo Group Joint Stock Company (referred to as Asanzo) had committed a series of violations in tax declaration and deduction of VAT, corporate income tax, and personal income tax which were not in accordance with the provisions of law.

Ho Chi Minh City Tax Department has applied aggravating circumstances to Asanzo because this business has committed administrative violations many times, violations with large volume or great value. In particular, according to the HCMC Tax Department, after violating, Asanzo has evaded and concealed administrative violations.

Specifically, for VAT, businesses declare output VAT and input VAT inconsistently with regulations.

In terms of invoices, the Ho Chi Minh City Tax Department asserted that Asanzo had committed violations when selling goods or providing services but did not issue invoices; illegal use of invoices (the invoice containing the fake contents, showed air conditioners but the actual content were components of air conditioners).

This enterprise is determined not have recorded in the accounting book for the items of air-conditioner components purchased from a number of enterprises in order to process, partial manufacturing and assembly of finished products which was air conditioners (capacity of 90,000 BTU or less, with Asanzo stamped, packaging labeled Asanzo).

The products were then sold to businesses under Asanzo system, and the use of an input invoice containing the fake contents, which showed the item of air conditioners but the actual content were components in order to keep business account of the input. This means that they did not have to declare payable excise tax.

Besides that, with associated transactions, Asanzo did not declare in the appendix enclosed with the declaration of corporate income tax finalization as prescribed in Decree 20/2017/ND-CP.

Thus, with the above violations, the Ho Chi Minh City Tax Department has issued a decision on sanctioning about tax and collect arrears of Asanzo Group Joint Stock Company with a total amount of monetary penalties is VND68.57 billion.

Asanzo was sanctioned with aggravating circumstances after the act of evading and hiding violations, so the monetary penalties was VND26.3 billion VND (including sanctions for incorrect declaration of VND4.9 billion, sanction 1.5 times for the acts of failing to issue invoices with the value of VND6.3 billion, and sanction 1.5 times for the special consumption tax of VND14.6 billion; collect tax amount of VND40.5 billion and amount of late tax payment is VND1.6 billion).

Related News

Ho Chi Minh City Customs: Timely detection of many cases of false declaration in import documents

13:42 | 03/12/2024 Anti-Smuggling

Tax authorities and Police join forces to crack down on e-invoice fraud

14:14 | 12/11/2024 Finance

An Giang Customs: Preventing many cases of illegal currency transport and tax fraud

15:41 | 13/07/2024 Anti-Smuggling

Many tricks are used to fraud VAT refund

10:47 | 02/11/2022 Finance

Latest News

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Finance ministry announces five credit rating enterprises

14:54 | 25/12/2024 Finance

The capital market will see positive change

09:44 | 25/12/2024 Finance

Corporate bond issuance value rises by 60 per cent

13:51 | 24/12/2024 Finance

More News

Slower mobilization than credit may put pressure on interest rates

09:02 | 24/12/2024 Finance

Fed’s foreseen rate cuts affect foreign exchange rate

14:12 | 23/12/2024 Finance

Untying the knot for green finance

11:08 | 23/12/2024 Finance

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

Six SOEs to be transferred back to industry ministry

15:38 | 18/12/2024 Finance

Your care

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Finance ministry announces five credit rating enterprises

14:54 | 25/12/2024 Finance

The capital market will see positive change

09:44 | 25/12/2024 Finance

Corporate bond issuance value rises by 60 per cent

13:51 | 24/12/2024 Finance

Slower mobilization than credit may put pressure on interest rates

09:02 | 24/12/2024 Finance