Annual crude output forecast to drop 5 per cent in decade

|

Efforts by the government to revise the outdated domestic oil and gas law and to introduce better incentives for upstream contractors, could go a long way to reigniting investor sentiment in the sector. (Illustrative photo: VOV)

Fitch Solutions, a macro research unit of Fitch Group, said in its newly announced oil production outlook that Vietnam was estimated to have produced 247,000 barrels per day (b/d) during 2018, a year on year drop of nearly 12 per cent, according to figures released by the General Statistics Office of Vietnam. This figure remains some way short of state-owned oil and gas company PetroVietnam’s target of 14.2 million tons, or 285,000 b/d.

The research firm noted that PetroVietnam keeps on a pessimistic prospect for the sector and forecast in late-2018 that its crude oil production could plunge by as much as 10 per cent annually by 2025.

The fall in production comes as output declines in its most mature domestic fields - namely Bach Ho - the country’s largest oilfield accounting for some 60 per cent of total production - continue unabated. Meanwhile, the start of the Ca Tam oilfield, a satellite development for the aging Bach Ho, in February could see a modest uptick in short-term output as it ramped up to peak an output of 23,000 b/d, although it remains insufficient to stem the broader structural decline.

Efforts by the government to revise the outdated domestic oil and gas law and to introduce better incentives for upstream contractors, could go a long way to reigniting investor sentiment in the sector, though the contributions to future oil output growth could be limited.

Moreover, Fitch Solutions noted that some of Vietnam’s most prominent oil blocks lie in the East Sea (South China Sea), where despite the estimated reserves of 11 billion barrels of oil and 5.7 thousand cubic meters (tcm) of gas, exploration is notoriously challenging due to disputes.

|

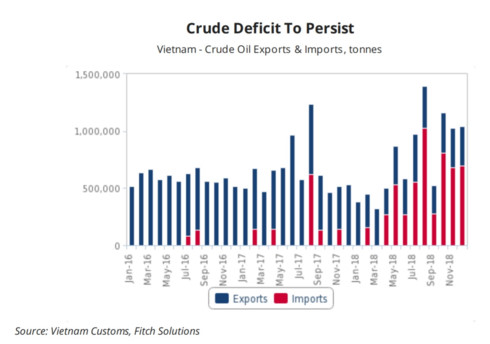

The result will see Vietnam’s crude oil self-sufficiency come to an end. In fact, data shows that the country turned into a net importer of crude for the first time last year, bringing an end to its reign as one of the few net crude exporters in the Asia-Pacific region.

Crude imports rapidly expanded by more than three times in 2018 to 5.3 million tons, and looks poised to expand further over the coming year.

This comes following the full commissioning of its second refining and petrochemicals complex in Nghi Son Economic Zone in the central province of Thanh Hoa. Meanwhile, crude exports plummeted by 41 per cent on year, mirroring the declines seen in domestic production.

After running at an average operating rate of 103 per cent in 2018, the Dung Quat refinery is expected to continue to maintain elevated runs, in order to meet strong domestic demand and fend off competition from the Nghi Son complex. The outlook on refining capacity growth in Vietnam remains upbeat, although this could come at the cost of even greater dependence on crude oil imports going forward.

A third standalone facility also marked down for start-up in 2023. Following a final investment decision in 2017, the long-delayed construction of the 200,000 b/d Long Son refining and petrochemicals complex is finally underway, spearheaded by Thailand’s Siam Cement Group. In addition, the Dung Quat refinery operator - Binh Son Refining and Petrochemical Company - is also progressing with steps to upgrade and expand its facility with an investment of US$1.8 billion by 2021, while securing an environmental impact assessment from the Ministry of Natural Resources and Environment in March.

In light of a widening domestic crude deficit, the country plans to manage its oil import bill by maximizing exports of its low sulphur Bach Ho crude, which often fetches a strong premium in the Asian crude market, while substituting crude feedstock for its own consumption with competitively priced crude from the US.

Since the lifting of a longstanding export ban in December 2015, US crude exports grew more than fourfold between 2015 and 2018.

US crude is gaining popularity among refiners across Asia, for its higher light distillate yields and consistent discount against comparable Middle East and European benchmarks. Indeed, West Texas Intermediate (WTI)’s discounts to both Brent and Dubai Fateh have widened in recent months, from averaging US$7.1/barrel and US$4.6/ barrel in 2018, respectively, to US$8.6/ barrel and US$8.3/ barrel during the first five months of 2019.

PetroVietnam received its first-ever cargo of US crude in May, comprising of 950,000 barrels of WTI. Additional imports could be on the cards, depending on the prices and the grade’s compatibility with the refinery.

Vietnam is one of the Asian countries opening their doors to more US crude inflows, in order to capitalize on favorable US-Asia arbitrage as well as deepen energy ties and improve trade relations with the US.

Fitch Solutions cited figures from the US Energy Information Administration (EIA) as showing that crude exports to Asia made up 45 per cent of the total annual exports of the US in 2018, a significant increase from 35 per cent seen in the previous year.

Related News

Continue to handle cross-ownership in banks

10:35 | 02/11/2024 Finance

"One law amending four laws" on investment to decentralize and ease business challenges

16:44 | 01/11/2024 Regulations

Removing difficulties in public investment disbursement

09:30 | 31/10/2024 Finance

Ensuring reasonableness upon enforcement of regulations in "1 law amending 7 laws"

00:00 | 19/10/2024 Regulations

Latest News

Increasing opportunities for exporting agricultural products to China by rail

15:31 | 05/11/2024 Import-Export

Monthly aquatic exports top 1 billion USD again after 2 years

15:00 | 05/11/2024 Import-Export

EU partners no longer 'lenient', Vietnam must adapt through ESG policies

09:02 | 05/11/2024 Import-Export

Changes in Canada's trade defense laws

09:00 | 05/11/2024 Import-Export

More News

Import and export are expected to reach 800 billion USD

13:32 | 04/11/2024 Import-Export

Fresh coconuts quenching new overseas markets

13:29 | 04/11/2024 Import-Export

Rice exports likely to set new record in 2024

13:25 | 04/11/2024 Import-Export

Vietnamese goods conquer halal market through trust and quality

09:57 | 04/11/2024 Import-Export

Exporters urged to have strategies to take advantage of UKVFTA for expansion

17:33 | 03/11/2024 Import-Export

Fresh coconuts quenching new overseas markets

17:29 | 03/11/2024 Import-Export

Vietnam and UAE trade sees billion-dollar growth

07:15 | 03/11/2024 Import-Export

Sharing responsibility for ensuring security and safety of the supply chain

07:13 | 03/11/2024 Import-Export

Many factors affecting tuna exports in the last months of the year

19:38 | 02/11/2024 Import-Export

Your care

Increasing opportunities for exporting agricultural products to China by rail

15:31 | 05/11/2024 Import-Export

Monthly aquatic exports top 1 billion USD again after 2 years

15:00 | 05/11/2024 Import-Export

EU partners no longer 'lenient', Vietnam must adapt through ESG policies

09:02 | 05/11/2024 Import-Export

Changes in Canada's trade defense laws

09:00 | 05/11/2024 Import-Export

Import and export are expected to reach 800 billion USD

13:32 | 04/11/2024 Import-Export