2017 - the time to dispose of weak banks

| HCM City enterprises borrow US$12.5 bln from banks in 2016 | |

| The exchange rate may increase at the range of 2% - 4% in 2017 | |

| Banks expect stable interest rates |

|

| The restructuring of the financial institutions in Vietnam should be implemented drastically. |

In fact, in recent times, the draft Scheme has been drastically implemented by the State Bank (SBV) or otherwise, bad debts may put a heavy burden on the development of a healthy banking system.

"Disposing"

Since late 2011, the State Bank of Vietnam has identified 9 weak banks to be resolved. After that, through self-restructuring based on its own resources or merger, these banks have become “healthier”. However, many banks have also gone bankrupt and had to sell all shares with the price of 0 vnd. After 5 years of implementation, many banks have achieved good results and gradually affirmed their brand in the market, but many banks have faced many difficulties, which may negatively affect the banking system.

Recently, in a press conference summarizing the results of monetary policy and banking activities in 2016, Mr. Nguyen Van Hung, the Deputy Chief of the Inspectorate and Supervision Agency (under the State Bank of Vietnam) said that the number of weak credit institutions had been reduced through sales and mergers in accordance with the Law. Basically, there were a few weak banks such as 3 banks sold at the price of "0 vnd" (including Ocean Bank, GPBank and VNCB) and DongA bank. As a result, the operations of the banking system have gradually improved without causing any negative influences on other banks.

According to Mrs. Nguyen Thi Hong, the Deputy Governor of the State Bank of Vietnam, in 2016, the State Bank of Vietnam focused on restructuring credit institutions and resolving bad debts. For 3 banks sold at the price of “0 vnd” earlier, the State Bank of Vietnam will continue to strengthen the control and supervision of these banks.

Through such activities, the State Bank of Vietnam said that in 2016, the activities of credit institutions had many positive changes with an outstanding growth in many fields such as assets and reserves for the economy; the credit system remained stable and the financial capacity of the banks continued to be improved. The weak banks were controlled and restructured. Bad debts remained stable at less than 3%. To 30th November 2016, the rate of bad debts was estimated at 2.46%.

Thus, in 2017, the banking sector will continue to strengthen and improve the efficiency of the inspections and supervision of banking activities in line with the practical requirements of Vietnam and international practices. Developing a plan to implement solutions in the scheme of restructuring the bank system for 2016-2020 was approved by the PolitBureau.

High risk

Although the report of the State Bank of Vietnam showed a "bright picture" in solving problems of bad debts and restructuring some weak credit institutions and banks, the Financial Supervisory Commission said that these operations in 2016 were still slow, affecting the target of interest rate reduction. Some weak banks have difficulty in getting loans due to lack of credit and assets. Thus, these banks must mobilize capital in the market (including businesses and residents) with an interest rate of 1.5% to 2% per year higher than in commercial banks. This situation has partly affected the effectiveness of monetary policy.

A study of the National Economic University showed that the level of capital adequacy ratio (CAR) of Vietnamese banks gradually complied with international practices, but not in line with Basel II. In addition, most commercial banks in Vietnam are small and medium banks in spite of capital of more than 3,000 billion vnd. Currently, the bank which has the largest equity is the Vietnam Joint Stock Commercial Bank for Industry and Trade - VietinBank (37,234 billion vnd in 2015), larger than a total of the 12 smallest banks. Currently, 36 commercial banks in Vietnam can be divided into 3 groups: 9 banks with capital of more than 10,000 billion vnd; 10 banks with capital of 5,000 - 10,000 billion vnd; and 17 banks with capital of 3000 - 5000 billion vnd. Therefore, the pressure to raise capital to comply with the requirements of Basel II in the banking system will be very high in the near future.

According to the Vietcombank Securities Limited Company (VCBS), although the rate of bad debts has been at a low level, there have been no specific solutions to resolve problems of banks. Moreover, bad debts mainly focus on 1 group with 7 banks, accounting for more than 50% of total bad debts in the banking system. Therefore, VCBS recommended that the State Bank of Vietnam should apply specific sanctions to deal with problems instead of using the State budget for support.

Need to resolve drastically

Recently, the State Bank of Vietnam said it had built a draft Scheme on bank restructuring for 2016-2020 with many solutions and measures, especially in institutional building. The State Bank of Vietnam has developed plans for dealing with weak banks and proposed to the PolitBureau to wait for conclusion of the Government in early 2017.

At a recent conference of one of the "big" banks in 2016, the Governor of the State Bank of Vietnam, Mr. Le Minh Hung also said that there were many weaknesses in the system of credit institutions. Therefore, in 2017, the authorities will focus on resolving problems of bad debts and bank restructuring. Accordingly, the State Bank of Vietnam will build a Law on restructuring banks and bad debts to help commercial banks solve problems of bad debts.

At the Vietnam Development Forum (VDF 2016) in early December 2016, Prime Minister Nguyen Xuan Phuc revealed that the Asian Development Bank (ADB) would collaborate with some private partners in Vietnam to acquire weak commercial banks in Vietnam and introduce other partners to support Vietnam in resolving bad debts and weak banks. Earlier, the State Bank of Vietnam called for foreign investors to actively participate in the process of restructuring domestic financial institutions. The representative of the State Bank of Vietnam also pledged to ensure an equal and competitive environment for foreign investors to participate in.

| Governor of the State Bank of Vietnam (SBV) Lê Minh Hưng: Stable monetary policy in “global chaos” VCN - According to the Governor of the State Bank of Vietnam (SBV) Lê Minh Hưng, thanks ... |

The restructuring of credit institutions not only improves the power of credit institutions but it also contributes to building strong credit institutions in the world. Meanwhile, there have been a few shortcomings and drawbacks in the mechanisms and legal framework of the banking system, which requires the State Bank of Vietnam to carefully calculate to avoid a "domino effect", which may affect the system of credit institutions as well as the domestic financial sector.

Related News

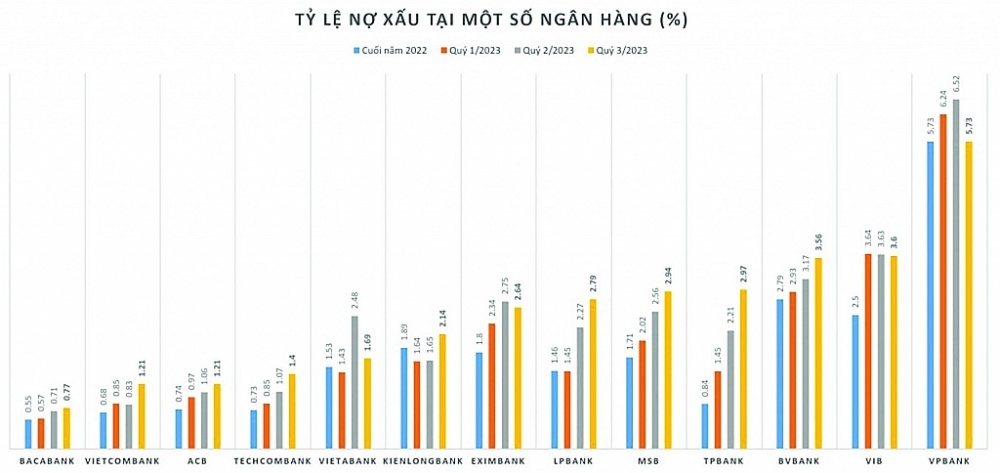

Concerns about bank credit quality as bad debt increases

11:01 | 11/11/2023 Import-Export

Commercial banks invest nearly 630 million USD in digital transformation: SBV

17:05 | 22/08/2023 Finance

The risk of bad debt increases, the bank proposes regulations on debt collection rights

10:24 | 30/07/2023 Finance

Banking sector focuses on credit institution restructuring associated with bad debt settlement

15:10 | 29/06/2023 Finance

Latest News

Ample room for Việt Nam-Thailand cooperation in new economic sectors: official

14:50 | 03/05/2024 Headlines

Exports, FDI remain Vietnam’s bright spots: HSBC

17:16 | 02/05/2024 Headlines

Growth engines rev up in first four months

17:12 | 02/05/2024 Headlines

Vietnam fulfills Chairmanship of Asia Pacific Group at UN for April

19:38 | 01/05/2024 Headlines

More News

Startups gradually mature in international markets

08:22 | 01/05/2024 Headlines

Việt Nam to promote local tourism

13:37 | 30/04/2024 Headlines

April 30 Victory – Glorious milestone in national history

13:34 | 30/04/2024 Headlines

Vietnam secures remarkable economic successes since national reunification

13:31 | 30/04/2024 Headlines

Precious significance of Điện Biên Phủ Victory

16:44 | 29/04/2024 Headlines

Tourism sector surges with over six million visitors in four months

16:40 | 29/04/2024 Headlines

Removing the yellow card, seafood businesses commit to "say no to IUU"

07:51 | 29/04/2024 Headlines

Vietnam ranks third in Southeast Asia in startup investment attraction

14:57 | 28/04/2024 Headlines

All-out efforts needed to get IUU yellow card removed: Minister

14:55 | 28/04/2024 Headlines

Your care

Ample room for Việt Nam-Thailand cooperation in new economic sectors: official

14:50 | 03/05/2024 Headlines

Exports, FDI remain Vietnam’s bright spots: HSBC

17:16 | 02/05/2024 Headlines

Growth engines rev up in first four months

17:12 | 02/05/2024 Headlines

Vietnam fulfills Chairmanship of Asia Pacific Group at UN for April

19:38 | 01/05/2024 Headlines

Startups gradually mature in international markets

08:22 | 01/05/2024 Headlines