Việt Nam"s second largest green bond issuer in 2021

A wind power farm of Bạc Liệu Wind Power Plant. VNA/VNS Photo

The Climate Bonds Initiatives (CBI) and HSBC have just released the ASEAN Sustainable Finance - State of the Market 2021 report.

Along with other countries in the region, Việt Nam’s sustainable debt capital market has experienced strong growth in the past year.

The report showed that the sustainable debt markets in the six largest ASEAN economies - Singapore, Thailand, Indonesia, Malaysia, the Philippines and Việt Nam - continues to grow rapidly in 2021.

Issuance volumes of green, social and sustainability bonds (GSS) reached a record of US$24 billion, an increase of 76.5 per cent compared to $13.6 billion in 2020, while sustainability-linked debt surged 200 per cent over 2020 to $27.5 billion.

The growth rate is said to reflect the positive sentiment of the ASEAN region in allocating capital for the purpose of responding to the COVID-19 pandemic, and supporting sustainable economic growth amid climate change and low carbon emissions in the long term.

Việt Nam alone issued a total $1.5 billion of GSS in 2021, nearly five times higher than the value of $0.3 billion in 2020, which maintained stable growth for three consecutive years.

The majority of green bonds and loans in the country last year came from the transportation and energy sectors. Việt Nam is the second largest source of green debt issuance in ASEAN, after Singapore, according to the report.

The two largest transactions that account for most of Vietnamese GSS were $425 million of sustainability bonds with stock options from Vinpearl and a green loan worth $400 million from VinFast (value at the time of transaction announcement).

HSBC said that the country’s bond market has swelled over $70 billion in 2021. More than 80 per cent of the issuance was government bonds, while development banks were the second largest issuers.

At the end of 2020, the National Assembly passed the Law on Environmental Protection 2020 with some important amendments, including additional definitions, general requirements for green bonds and incentives for issuers. Việt Nam is also developing a classification system along with the law, which is expected to be enacted this year.

As Việt Nam announced its commitment to achieve net-zero emissions by 2050 at the COP26 conference, it will contribute to the stronger promotion of capital mobilisation through sustainable financial markets to accelerate the carbon emission reduction process.

Tim Evans, General Director of HSBC Việt Nam, said that all forms of sustainable finance aim toward the common goal of supporting Việt Nam realise its target of achieving carbon neutrality by 2050, as committed.

Although the sustainable financial market is growing in Việt Nam and ASEAN, the need to mobilise funds to mitigate and help countries adapt to climate change is still very high, Evans added. Fundraising will support the transition to a low-carbon economy that is essential to achieve the Paris Agreement goals and ease the severe impacts of climate change for the ASEAN region and worldwide.

However, experts also said that there is still a lot of work to be done for the ASEAN region to achieve the green growth target.

Some policies in the region have contributed to the rapid growth of sustainable finance in ASEAN and it is clear that awareness of climate risks has risen among both policy makers and investors, said Sean Kidney, CBI Director General.

Nevertheless, there is still a gap that needs to be filled soon. The sectors that emit a lot of emissions and find it difficult to change must quickly shift from "brown" to "green". These are activities, assets and projects related to energy, heavy manufacturing and agriculture.

"National initiatives such as Singapore's Green Financial Industry Taskforce (GFIT) are a good start. However, we need to act faster to get vulnerable regions like ASEAN less affected by the consequences of climate change," the CBI Director General said. VNS

Related News

Vietnam’s exports to the U.S. near US$100 billion milestone

09:46 | 21/11/2024 Import-Export

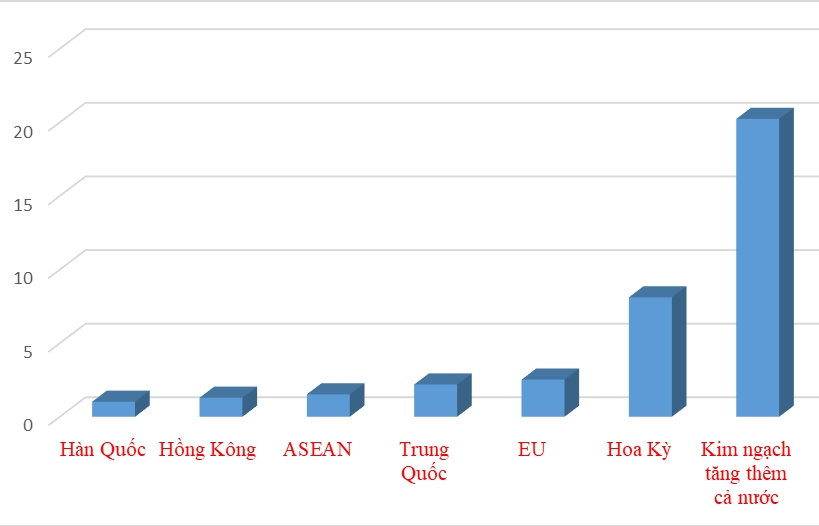

Six export markets of billion growth

09:56 | 27/06/2024 Import-Export

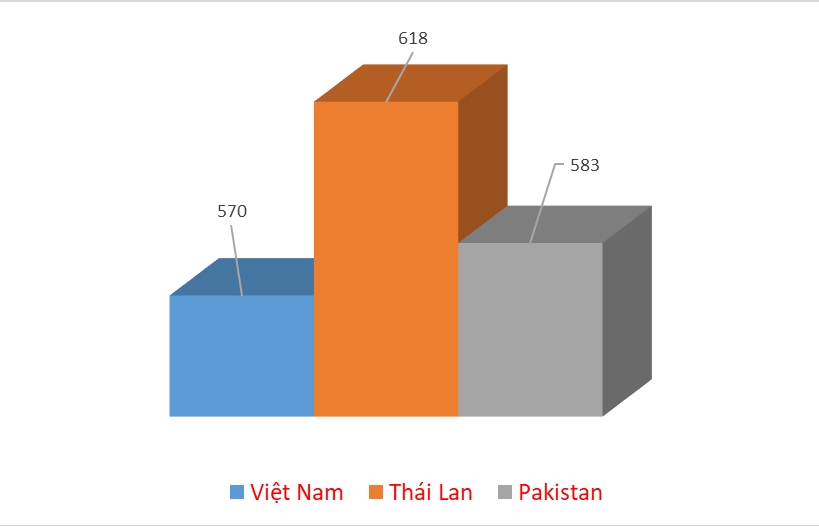

Rice exports to China drop sharply

08:03 | 20/06/2024 Import-Export

Cambodia Customs facilitates fastest movement of goods in transit

16:36 | 10/06/2024 Customs

Latest News

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

More News

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance

Fiscal, monetary policies support demand stimulation, price stabilisation

14:49 | 14/02/2025 Finance

Vietnam secures VND 157 billion from state enterprise divestment in 2024

09:16 | 14/02/2025 Finance

Vietnam gears up for potential inflation impact in 2025

14:26 | 11/02/2025 Finance

VN’s credit conditions in 2025 expected to be stable

14:24 | 11/02/2025 Finance

State revenue in first month of the year equal to 14% of the estimate

10:12 | 11/02/2025 Finance

Securities 2025 expects a breakthrough in scale and quality

14:37 | 10/02/2025 Finance

Cash reserves in stock accounts at six-quarter low amid margin rise

08:23 | 10/02/2025 Finance

Five solutions for developing stock market in 2025

10:01 | 07/02/2025 Finance

Your care

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance