Three options for restructuring bond debt: FiinGroup

| Bond yields rise in emerging East Asia | |

| MoF works with corporate bond issuers and securities companies | |

| Credit institutions and real estate businesses continue to repurchase bonds |

|

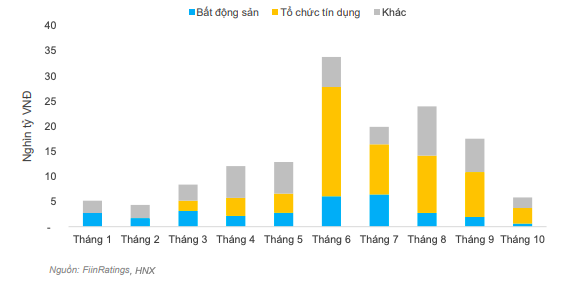

| Redemption value of bonds in the first 10 months of 2022 |

Accordingly, the first option is to extend the repayment period with partial debt payment. Businesses that have the capacity and want to pay their debts face difficulties in the short term and want to extend the repayment period to overcome this period.

According to FiinRatings, the partial payment and the extension of the payment deadline for the remaining debt amount help enterprises implement principal and interest payments, and the bond issuers maintain creditworthiness for capital mobilization in the future. The issuers should proactively notify investors about their production and business situation, project implementation and repayment schedule and offer an appropriate interest rate. In addition, investors should actively review the project's legal status and implementation progress before agreeing to extend the repayment period.

The second option provided by FiinRatings is to extend the repayment period without payment of the principal. Accordingly, if the issuer suffers from great difficulties and cannot maintain production and business activities, the investor may need to accept a certain discount to complete the project.

Specifically, the investor may have to accept the extension or postpone principal payment but can still maintain the chance to recover the principal and interest in the future, depending on the re-evaluation. However, FiinRatings also noted that the option of partial debt non-repayment is relatively sensitive and affects the issuer's reputation. Therefore, businesses should develop a plan and negotiate with the bond issuer before maturity to avoid violation.

FiinRatings also noted that the option of partial debt non-repayment is a relatively sensitive

The third solution is barter. This operation has taken place and achieved positive results. However, this option needs consensus between the investor and the issuer.

According to FiinRatings, this is a key option and depends on the nature of the business operation and products of each enterprise. The investor can agree with this option when they have full information and legality about the assets used for bond swap.

FiinRatings also reported that the bond default rate in the Chinese market at the end of 2021 was 1.35%. The bond debt restructuring is mainly implemented via self-agreements such as extending debt payments and bond swaps. About 79% of international bond defaults were handled by the bond swap method, and 72% of domestic defaults were resolved by debt extension.

Market participants resolved most bond defaults in China without court proceedings or intervention of regulatory agencies. This rate accounted for 76% of defaulted bonds. The number of deferred bonds accounted for 56%. FiinRatings said this would be an appropriate option for investors and issuers in Vietnam in the short term.

However, FiinRating also noted that this is only a short-term solution when the problem cannot be solved completely. The Chinese market suffered from the second default and needed the support fund from the Government worth US$ 29 billion in September.

Regarding the redemption of corporate bonds, the redemption value in 10 months of the year increased by 41.9% year-on-year to VND 143.44 trillion, mainly near-maturing bonds. Real estate and credit institutions are the two sectors with the largest bond redemption volume, reaching 21.1% and 63.6% of the redemption value since the beginning of the year. The redemption of the real estate sector's bonds hit VND 12,425 trillion in June and July (equivalent to 41% of the total value of 10 months of 2022).

The redemption of corporate bonds surged between June and September to VND94.4 trillion, equivalent to 56.6% of the total value in 2022. Although the redemption has put financial pressure on enterprises, we believe this is a positive sign for the current liquidity, especially for businesses with sufficient financial capacity, minimizing debt burden amid the current high-interest rates.

The surge in the redemption of corporate bonds in a short time also created pressure. In the first 10 months of this year, the real estate market witnessed a low level of liquidity, causing a sharp increase in the inventory of many real estate businesses and a reduction in the cash flow of these businesses. Meanwhile, some businesses did not actively repurchase corporate bonds but were requested by investors to pay them off early due to concern about negative information.

FiinRatings assesses that the solvency of real estate developers will be reduced, especially when the capital channel into this sector has been narrowed and controlled more strictly than the previous year. Therefore, investors should keep calm and avoid selling off corporate bonds without carefully assessing the business's financial health.

Related News

Issuers seek solutions to delay bond debt payment

16:26 | 28/02/2023 Finance

Latest News

State Bank sets higher credit growth target for 2025

15:22 | 31/12/2024 Finance

Outlook for lending rates in 2025?

15:20 | 31/12/2024 Finance

Tax policies drive strong economic recovery and growth

07:55 | 31/12/2024 Finance

E-commerce tax collection estimated at VND 116 Trillion

07:54 | 31/12/2024 Finance

More News

Big 4 banks estimate positive business results in 2024

13:49 | 30/12/2024 Finance

Flexible and proactive when exchange rates still fluctuate in 2025

11:03 | 30/12/2024 Finance

Issuing government bonds has met the budget capital at reasonable costs

14:25 | 29/12/2024 Finance

Bank stocks drive market gains as VN-Index closes final Friday of 2024 on a positive note

17:59 | 28/12/2024 Finance

Banks still "struggling" to find tools for handling bad debt

13:47 | 28/12/2024 Finance

Forecast upbeat for banking industry in 2025

14:30 | 27/12/2024 Finance

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Finance ministry announces five credit rating enterprises

14:54 | 25/12/2024 Finance

The capital market will see positive change

09:44 | 25/12/2024 Finance

Your care

State Bank sets higher credit growth target for 2025

15:22 | 31/12/2024 Finance

Outlook for lending rates in 2025?

15:20 | 31/12/2024 Finance

Tax policies drive strong economic recovery and growth

07:55 | 31/12/2024 Finance

E-commerce tax collection estimated at VND 116 Trillion

07:54 | 31/12/2024 Finance

Big 4 banks estimate positive business results in 2024

13:49 | 30/12/2024 Finance