The Government shall amend and supplement regulations on registration fees

|

| Illustrative photo |

Supplementing and amending on registration fee calculation price

Specifically, for the calculation of registration fee price for houses and land, the new Decree stipulates that the registration fee calculation price for land is the land price in the land price list issued by the People's Committee of provinces and cities under central government in accordance with provisions of the law at the time of registration fee declaration.

In the case of leases for State owned land in the form of one-time payment of land rental fee for the entire lease term, but the land lease term is shorter than the term of the land type prescribed in the land price list promulgated by the People's Committees of the provinces and centrally-run cities, the land price in the land lease term for registration fee calculation is determined by the land price list divided by 70 years, and multiplied by the land lease term.

The registration fee for calculating a house price, is the price that is issued by the People's Committees of the provinces and centrally-run cities in accordance with regulations of the law on construction at time of registration fee declaration.

Particularly, the registration fee calculation price for a state-owned house sold to the lessee in accordance with provisions of the law on sale of the state-owned house, is the actual selling price stated on the invoice under the decision of People's Committees of provinces and centrally-run cities. The registration fee calculation price for a house purchased under the auction method in accordance with provisions of the law on bidding and auction, is the actual auction price stated on the sale invoice.

In the case where a house and land price in the land use rights for transfer contract and real estate purchase contract is higher than the price promulgated by the People's Committee of the province or centrally-run cities, the registration fee calculation price for the house and land is the price in the land use right transfer contract and real estate purchase contract.

Decree No. 20/2019/ND-CP stipulates that the registration fee calculation price for cars and similar vehicles and motorcycles specified in Clause 6 and Clause 7, Article of the Decree (except for trailers or semi-trailers towed by cars) is the price in the Decision on registration fee calculation list issued by the Ministry of Finance.

The Decree also stipulates that the registration fee calculation price for used assets subject to registration fee payment (except for a used house, land and imported assets) is the remaining value calculated by the using time of these assets. For used cars and motorcycles, which are not included in the registration fee calculation list, the registration fee calculation price is the remaining usage value of similar vehicle types specified in the registration fee calculation list.

In addition, the new Decree also amended and supplemented the regulations on registration fee calculation price for other assets such as: registration fee calculation price for an asset purchased under an instalment payment method as a one-time payment price (excluding installment interest), and is determined according to the provisions of Clauses 1, 2, 3 and 4, including import tax (if any) and special consumption tax (if any), value added tax (if any); the registration fee calculation price for assets purchased under the method of handling the asset set up by the entire people of a confiscated asset, shall be the winning bid price for the asset purchased in the form of auction, or shall be the price decided by the competent agency on assets purchased in the form of direct procurement or price listing, including import tax (if any), special consumption tax (if any), and value added tax (if any).

Supplementing and amending regulations on registration fee rates

In addition, the new Decree also supplements and amends regulations on registration fee rates for cars, trailers or semi-trailers towed by cars and similar vehicles. Accordingly, the registrations fee rate for cars, trailers or semi-trailers towed by cars and similar vehicles is 2%.

Particularly, the first registration fee rate for cars of 9 seats or less is 10%. In cases where it is necessary to apply a higher fee rate to match the practical conditions in each locality, the People's Councils of the provinces and centrally-run cities shall decide whether or not to increase this rate, but they must not exceed 50% of the rate prescribed in this point.

The first registration fee rate for a pick-up car with a weight of less than 1,500 kg, and of 5 seats or less, and for vans of the same weight, shall be 60% of the first registration fee rate.

The second registration fee rate for a car of 9 seats or less, and pick-up cars with a capacity of less than 1.500kg, and for 5 seats or less, the vans with capacity less than 15,00 kg shall be 2% and apply uniformly nationwide.

At the same time, the new Decree also supplements registration fee rates for the transfer of cars and motorbikes. Specifically, it stipulates that organizations and individuals that were exempted or not required to pay registration fees when registering their ownership of cars and motorbikes for the first time, if they transfer these cars and motorbikes to other organizations or individuals, or change the using purpose that is not subject to registration fee exemption according to regulations, organizations and individuals registering ownership of cars and motorbikes shall pay the first registration fee rate for the remaining use value of these vehicles.

These provisions will take effect on 10 April 2019.

Related News

Tax, fee, and land rent exemption, reduction, and deferral policies: a driving force for business recovery and growth

11:34 | 27/10/2024 Regulations

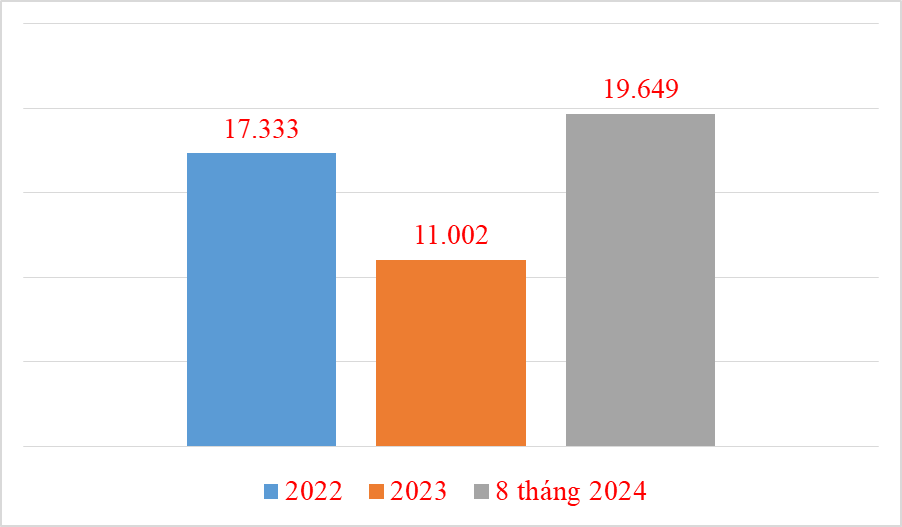

20,000 Chinese cars imported in 8 months

09:13 | 30/09/2024 Import-Export

From case of illegally importing three cars in Hai Phong: What are conditions for doing business of car import?

10:13 | 19/08/2024 Customs

Hai Phong Customs detects 3 smuggled cars hidden inside empty container

14:20 | 15/08/2024 Anti-Smuggling

Latest News

Proposal to reduce 30% of land rent in 2024

14:58 | 25/12/2024 Regulations

Resolve problems related to tax procedures and policies for businesses

13:54 | 22/12/2024 Regulations

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations

Actively listening to the voice of the business community

09:39 | 12/12/2024 Customs

More News

Step up negotiations on customs commitments within the FTA framework

09:44 | 08/12/2024 Regulations

Proposal to amend regulations on goods circulation

13:45 | 06/12/2024 Regulations

Review of VAT exemptions for imported machinery and equipment

10:31 | 05/12/2024 Regulations

Customs tightens oversight on e-commerce imports

13:39 | 04/12/2024 Regulations

Bringing practical experience into customs management policy

13:48 | 03/12/2024 Regulations

Businesses anticipate new policies on customs procedures and supervision

15:41 | 29/11/2024 Regulations

Do exported foods need iodine supplementation?

11:06 | 29/11/2024 Regulations

Amendments to the Value-Added Tax Law passed: Fertilizers to be taxed at 5%

13:43 | 28/11/2024 Regulations

Proposal to change the application time of new regulations on construction materials import

08:52 | 26/11/2024 Regulations

Your care

Proposal to reduce 30% of land rent in 2024

14:58 | 25/12/2024 Regulations

Resolve problems related to tax procedures and policies for businesses

13:54 | 22/12/2024 Regulations

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations

Actively listening to the voice of the business community

09:39 | 12/12/2024 Customs

Step up negotiations on customs commitments within the FTA framework

09:44 | 08/12/2024 Regulations