Special preferential import tariffs for goods imported from Laos

| New-generation FTAs: opportunities and challenges | |

| Vietnam sets new tariffs on imported steel | |

| Manufacturers worry about steel price hikes |

|

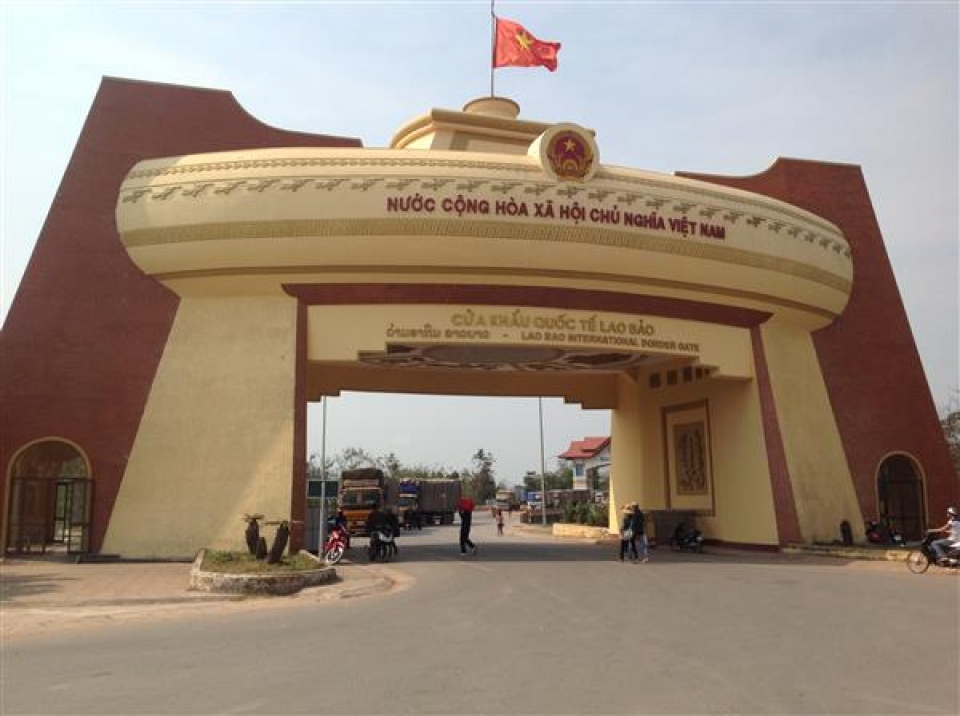

| Goods imported from Laos enjoy special preferential import tariffs. |

A decrease of 50% of ATIGA tax rate

According to Decree 124/2016/ ND-CP on special preferential import tariffs under the Bilateral Trade Agreement between Vietnam and Laos, imported goods originating from Laos on the list of goods specified in Annex I shall attract an import tax rate of 50% of ATIGA in special preferential import tariffs attached to the Government's Decree promulgating special preferential import tariffs to implement the ASEAN Trade in Goods Agreement (ATIGA).

If the tax rates specified in ATIGA are higher than those specified in the preferential import tax (MFN), imported goods from Laos will attract a tax rate of 50% specified in the preferential import tax (MFN).

Goods which enjoy special preferential import tariffs must meet the following conditions: goods must be imported and transported directly from Laos into Vietnam; goods must meet the provisions of the current legislation on rules of origin applicable to goods entitled to preferential tariffs between Vietnam and Laos, and the owners of goods must present a certificate of origin form S (C/O form S) issued by the competent authorities under the provisions of Laos.

Apply a special tax of 0% for specific goods.

Goods imported from Laos, except for imported goods applied with quotas, which are not on the list of goods specified in Annex I and Annex II of Decree 124, enjoy a tax rate of 0% if they meet the conditions specified above.

Imported goods originating from Laos on the list of goods applied with quotas stipulated in Annex III meeting the conditions specified above are entitled to enjoy an import tax rate of 0% under the provisions of the Ministry of Industry and Trade on annual tariffs and quotas for goods originating from Laos.

Imported goods originating from Laos on the list of goods specified in Annex III and meeting the conditions on quantities exceeding quotas stipulated in Annex III, excluding imported tobacco products and tobacco leaves, import goods which exceed the quota shall enjoy an import tax rate of 50% ATIGA tax rate.

Imported goods originating from Laos on the list of goods specified in Annex III but not meeting the conditions on quantities exceeding quotas stipulated in Annex III, excluding imported tobacco products and tobacco leaves, import goods which exceed the quota shall be applied a tax rate under ATIGA.

| The list of the ASEAN Harmonised Tariff Nomenclature (AHTN) 2017 will be issued soon VCN-To complete the listof the ASEAN Harmonized Tariff Nomenclature (AHTN) in 2017, the Ministry of Finance is ... |

This Decree shall take effect from September 1, 2016 to October 3, 2020.

Related News

Preliminary assessment of Vietnam international merchandise trade performance in the first 11 months of 2024

10:50 | 27/12/2024 Customs Statistics

FTA Index helps measure the effectiveness of FTA implementation

10:51 | 27/12/2024 Import-Export

Latest News

Proposal to reduce 30% of land rent in 2024

14:58 | 25/12/2024 Regulations

Resolve problems related to tax procedures and policies for businesses

13:54 | 22/12/2024 Regulations

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations

Actively listening to the voice of the business community

09:39 | 12/12/2024 Customs

More News

Step up negotiations on customs commitments within the FTA framework

09:44 | 08/12/2024 Regulations

Proposal to amend regulations on goods circulation

13:45 | 06/12/2024 Regulations

Review of VAT exemptions for imported machinery and equipment

10:31 | 05/12/2024 Regulations

Customs tightens oversight on e-commerce imports

13:39 | 04/12/2024 Regulations

Bringing practical experience into customs management policy

13:48 | 03/12/2024 Regulations

Businesses anticipate new policies on customs procedures and supervision

15:41 | 29/11/2024 Regulations

Do exported foods need iodine supplementation?

11:06 | 29/11/2024 Regulations

Amendments to the Value-Added Tax Law passed: Fertilizers to be taxed at 5%

13:43 | 28/11/2024 Regulations

Proposal to change the application time of new regulations on construction materials import

08:52 | 26/11/2024 Regulations

Your care

Proposal to reduce 30% of land rent in 2024

14:58 | 25/12/2024 Regulations

Resolve problems related to tax procedures and policies for businesses

13:54 | 22/12/2024 Regulations

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations

Actively listening to the voice of the business community

09:39 | 12/12/2024 Customs

Step up negotiations on customs commitments within the FTA framework

09:44 | 08/12/2024 Regulations