Promulgating analytical process to classify imported and exported goods

|

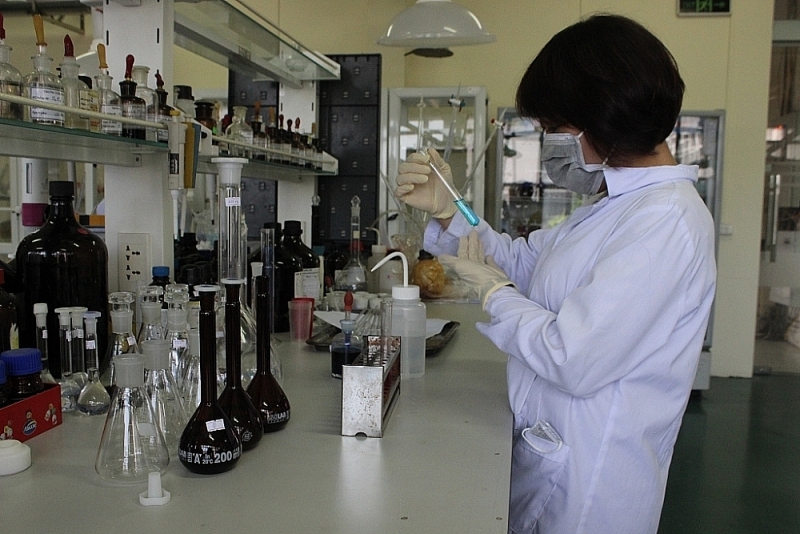

| Customs official of Customs Department of Goods Verification analyses sample of import-export goods. Photo: H.Nụ |

Attached to the process are appendices including sampling technique and sample packaging required for analysis; list of items not sampled for analysis to serve for classification purposes; diagram of the Analytical Process for Classification of Export and Import Goods and List of Forms.

According to the Analytical Process, to classify exported and imported goods, customs officers who perform analysis for classification are responsible for performing in an objective, scientific, accurate and transparent manner following regulations.

The assignment of specialists to perform analysis and classification is done automatically by the customs professional management system of the Customs Department of Goods Verification.

The process includes specific instructions on the order and procedures for analysing, classifying, processing analysis results, classifying, controlling, exploiting, looking up and announcing analysis results with the codes of exported and imported goods, and notifying the classification results for exported and imported goods.

For taking samples, sending dossiers of application for analysis for classification, goods subject to analysis samples for classification should comply with Article 3 of Circular 14/2015/TT-BTC of the Ministry of Finance guiding on goods classification, analysis to classify goods; analysis to quality inspection, food safety inspection for export and import goods.

The determination of export and import shipments that must be sampled and analysed for classification is done based on the risk level of export and import goods and the professional information of customs units.

The procedure also provides instructions for the analysis sequence for classification; the order for issuing notices on classification results; handle case of customs declarant disagrees with the notification of analysis results with codes of export and import goods and notification of classification results; control, exploit, look up notices on analysis results with the codes of exported and imported goods and notice on classification results; sample processing after issuing a notice of the analysis results with codes of export and import goods, notification of classification results for export and import goods, etc.

Related News

Checking and reviewing the classification of exported copper

09:37 | 10/10/2024 Regulations

Food safety rules relaxed for emergency imports

10:58 | 12/10/2024 Regulations

Inspection work helps prevent fraud

09:00 | 20/09/2024 Anti-Smuggling

Policies of goods quality inspection need to facilitate and prevent fraud

09:43 | 17/08/2024 Regulations

Latest News

The Government adjust import and export tariff rate on certain goods

09:01 | 05/11/2024 Regulations

"One law amending four laws" on investment to decentralize and ease business challenges

16:44 | 01/11/2024 Regulations

One law amending seven financial laws: New driving force for economic growth

16:34 | 01/11/2024 Regulations

Ensure harmony of interests of “3 parties” when applying 5% VAT on fertilizers

08:54 | 30/10/2024 Regulations

More News

Tax, fee, and land rent exemption, reduction, and deferral policies: a driving force for business recovery and growth

11:34 | 27/10/2024 Regulations

Revamping commodity management and trade protection

11:26 | 26/10/2024 Regulations

Tax support policy is a "lift" for business bounceback

14:52 | 24/10/2024 Regulations

VAT policy for on-the-spot imports

13:44 | 23/10/2024 Regulations

Applying tax on animal feed ingredient faces problems due to specialized regulations

10:17 | 21/10/2024 Regulations

Ministry of Finance proposes to choose the option of reducing land rent by 30% in 2024

15:29 | 20/10/2024 Regulations

Ensuring reasonableness upon enforcement of regulations in "1 law amending 7 laws"

00:00 | 19/10/2024 Regulations

Ensuring global trade security requires cooperation, exchange and processing of information before the goods arrive

10:29 | 18/10/2024 Regulations

New regulations on foreign indirect investment in Vietnam drafted

13:46 | 15/10/2024 Regulations

Your care

The Government adjust import and export tariff rate on certain goods

09:01 | 05/11/2024 Regulations

"One law amending four laws" on investment to decentralize and ease business challenges

16:44 | 01/11/2024 Regulations

One law amending seven financial laws: New driving force for economic growth

16:34 | 01/11/2024 Regulations

Ensure harmony of interests of “3 parties” when applying 5% VAT on fertilizers

08:54 | 30/10/2024 Regulations

Tax, fee, and land rent exemption, reduction, and deferral policies: a driving force for business recovery and growth

11:34 | 27/10/2024 Regulations