Non-bank corporate bonds forecast to recover in year-end months

|

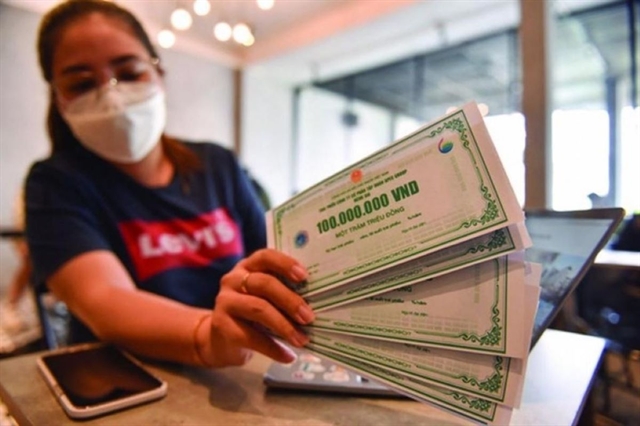

| The primary corporate bond market in September recorded a total issuance value of VNĐ45.3 trillion. Photo cafef.vn |

Under an October 2024 corporate bond market report released recently, analysts of the rating agency FiinRatings said that the US Federal Reserve (Fed)'s first interest rate cut in four years was a positive sign for the Vietnamese exchange rate, after the State Bank of Vietnam (SBV) continuously sold the US dollar due to high capital withdrawal demand.

At the same time, the SBV also stopped net withdrawal through the treasury bill channel after the bidding session on August 23, 2024.

FiinRatings’ analysts predict that the domestic exchange rate pressure will decrease, which will create favourable conditions for the SBV to buy the dollar to increase the nation’s foreign exchange reserves.

According to FiinRatings, the decrease in dollar interest rates will support international borrowing costs. Enterprises that do not hedge will benefit as the decrease in dollar interest rates will directly reduce loan interest rates.

Lower exchange rates also facilitate upcoming international borrowing or bond offerings.

In addition, FiinRatings’s analysts said, credit is on track to recover until the end of this year thanks to the corporate customer segment.

However, the analysts note that credit growth quality needs to be focused on. Banks’ outstanding loans at the end of September 2024 increased by 8.53 per cent compared to the beginning of this year, but was mainly driven by the corporate customer segment in the context of weak personal consumption demand.

"The ability to achieve the SBV's credit growth target by the end of this year will depend on the recovery of the real estate, energy and export sectors. However, as the credit growth has focused on the corporate customers, especially the real estate one, the quality of credit growth also requires due attention to avoid causing rising bad debt, which will increase risks for the banking system," FiinRatings’ analysts noted.

According to the report, the primary corporate bond market in September recorded a total issuance value of VNĐ45.3 trillion, with 39 issuances, down 27.5 per cent compared to the previous month but up 20.8 per cent compared to the same period last year.

The total bond issuance value in the first nine months of this year reached VNĐ313.6 trillion, recording an increase of 57.9 per cent compared to the same period last year.

Private and public issuance activities both recorded growth of 62.0 per cent and 28.1 per cent respectively over the same period last year. The rise shows the rapid recovery of this market.

However, according to FiinRatings, there has not been a clear recovery from the group of non-bank issuers. The majority of issuances in September 2024 and in the first nine months of this year were still from credit institutions, accounting for 82.9 per cent and 74 per cent of the total value of new corporate bonds, respectively.

Meanwhile, the issuance value of the non-bank group in September only reached VNĐ5.4 trillion, bringing the total issuance value in the first nine months of this year to VNĐ80 trillion, down 26.3 per cent compared to the same period last year.

Latest News

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

More News

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance

Fiscal, monetary policies support demand stimulation, price stabilisation

14:49 | 14/02/2025 Finance

Vietnam secures VND 157 billion from state enterprise divestment in 2024

09:16 | 14/02/2025 Finance

Vietnam gears up for potential inflation impact in 2025

14:26 | 11/02/2025 Finance

VN’s credit conditions in 2025 expected to be stable

14:24 | 11/02/2025 Finance

State revenue in first month of the year equal to 14% of the estimate

10:12 | 11/02/2025 Finance

Securities 2025 expects a breakthrough in scale and quality

14:37 | 10/02/2025 Finance

Cash reserves in stock accounts at six-quarter low amid margin rise

08:23 | 10/02/2025 Finance

Five solutions for developing stock market in 2025

10:01 | 07/02/2025 Finance

Your care

The system has not recorded your reading habits.

Please Login/Register so that the system can provide articles according to your reading needs.

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance