Investors should be cautious in corporate bond market: experts

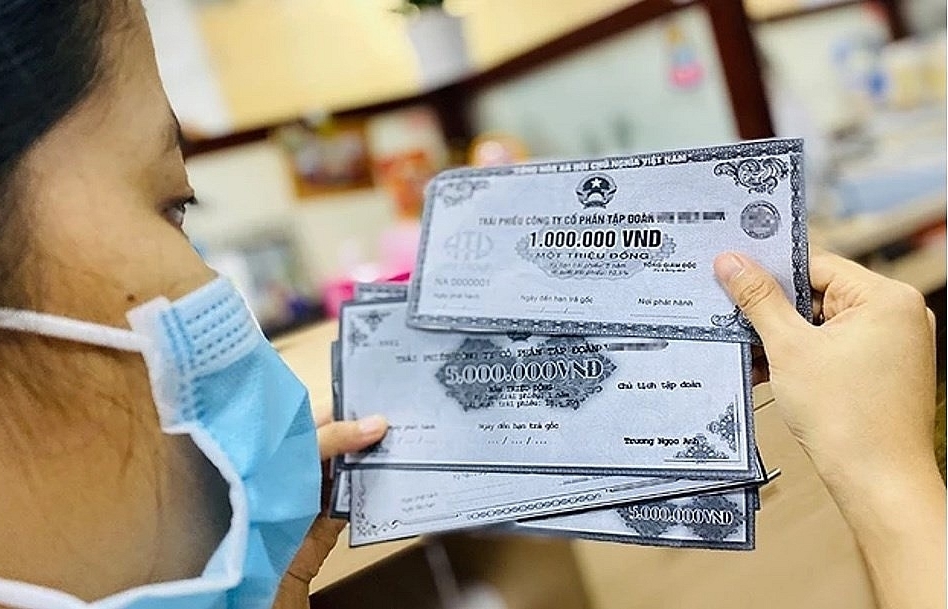

Việt Nam's corporate bond market amounts to nearly 16 per cent of GDP and is the fastest-growing market in Asia over the past 15 years. Photo vneconomy.vn

The risk of corporate bond defaults will keep increasing unless legal loopholes in the market are plugged, according to experts.

Nguyễn Hoàng Dương, deputy director of Department of Banking and Financial Institutions, noted that total corporate bond issuance in Việt Nam had been rising steadily since Q2/2021.

Around VNĐ658 trillion (US$29.1 billion) worth of bonds were issued in 2021, up 42 per cent year-on-year.

Private placement took up the lion’s share of over 95 per cent of bond issuance, whereas the rest went to public offering.

The rapid growth of the corporate bond market has attracted much interest from inpiduals.

However, inpiduals are not eligible for private placement according to securities law. It is only available to strategic investors and professional investors.

Given such a legal barrier, some banks, financial institutions and counselling organisations have begun to exploit loopholes to turn inpiduals into professional investors.

This practice is not illegal but puts non-professional bondholders at risk of bond defaults.

“Inpiduals are just inpiduals. They are not fully aware of the risks carried by the bonds they’ve bought or by the issuers,” said the deputy director.

By late Q3/2021, nearly 300,000 inpiduals had put their money in corporate bonds.

According to Dương, many loss-making firms and small firms with low equity have managed to raise a large amount of money through bonds.

Some bond issuers do not use the proceeds for their stated purposes. Instead, they transfer the money to other organisations, which turn out to be the actual beneficiaries of the bond revenues.

Several securities firms also get in on the act by providing issuers with favourable issuance documents to help them draw in money more easily.

The risk of bond defaults is high. Regardless, a lot of investors keep pouring their money into corporate bonds and turn deaf ears to any warnings.

“Many experts advised the Ministry of Finance to allow several bond defaults to occur, so inpiduals and investors could become more aware of the risk," Dương said.

Nguyễn Quang Thuân, chairman of FiinGroup JSC, said that a large number of bond issuers were financially weak with a low ability to repay, notably unlisted ones.

According to Thuân, 94 out of 383 issuers in 2021 had been accumulating losses, 81 were running at a loss in 2020 and 121 offered bonds with no collateral.

“I want to remind investors, especially non-professional investors, that even professional banks have bad debts. Accordingly, bonds are not risk-free or default-free. It is all about when a default will occur,” warned the chairman.

Đỗ Ngọc Quỳnh, general secretary of Vietnam Bond Market Association, believes both professional and non-professional investors will be at risk if the exodus of inpiduals to the bond market is left unchecked.

To reduce the risk of a bond default, he called for a crackdown on issuers that have manoeuvred to raise money from investors.

Dương believes bond defaults would be detrimental to the financial system as there might be strong links between bonds and banks and financial institutions.

The deputy director urged authorities to continue to refine the legal framework to reduce the market's risks, safeguard investors and maintain the market's stability.

In 2021, 56 per cent of corporate bondholders were banks and securities firms. Professional inpiduals accounted for 8.6 per cent.

Regarding bond issuers, listed firms took up about 54 per cent, whereas unlisted firms took about 46 per cent. — VNS

Related News

Transparency evates the standing of listed companies

09:47 | 21/11/2024 Finance

Industrial real estate - "Magnet" attracting foreign capital

09:01 | 07/09/2024 Import-Export

Many positive signals in the corporate bond market

10:20 | 25/08/2024 Finance

Transparent and stable legislation is needed to develop renewable energy

13:45 | 01/08/2024 Import-Export

Latest News

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

More News

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance

Fiscal, monetary policies support demand stimulation, price stabilisation

14:49 | 14/02/2025 Finance

Vietnam secures VND 157 billion from state enterprise divestment in 2024

09:16 | 14/02/2025 Finance

Vietnam gears up for potential inflation impact in 2025

14:26 | 11/02/2025 Finance

VN’s credit conditions in 2025 expected to be stable

14:24 | 11/02/2025 Finance

State revenue in first month of the year equal to 14% of the estimate

10:12 | 11/02/2025 Finance

Securities 2025 expects a breakthrough in scale and quality

14:37 | 10/02/2025 Finance

Cash reserves in stock accounts at six-quarter low amid margin rise

08:23 | 10/02/2025 Finance

Five solutions for developing stock market in 2025

10:01 | 07/02/2025 Finance

Your care

The system has not recorded your reading habits.

Please Login/Register so that the system can provide articles according to your reading needs.

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance