Insurance is no longer a "goose that lays golden eggs" for banks

| Vietnam Report announces Top 10 prestigious banks, insurance, digital companies | |

| Insurance sector enjoys positive earnings, attracting investors |

|

| Chart: H.D |

Some banks reduce revenue from insurance up to more than 80%

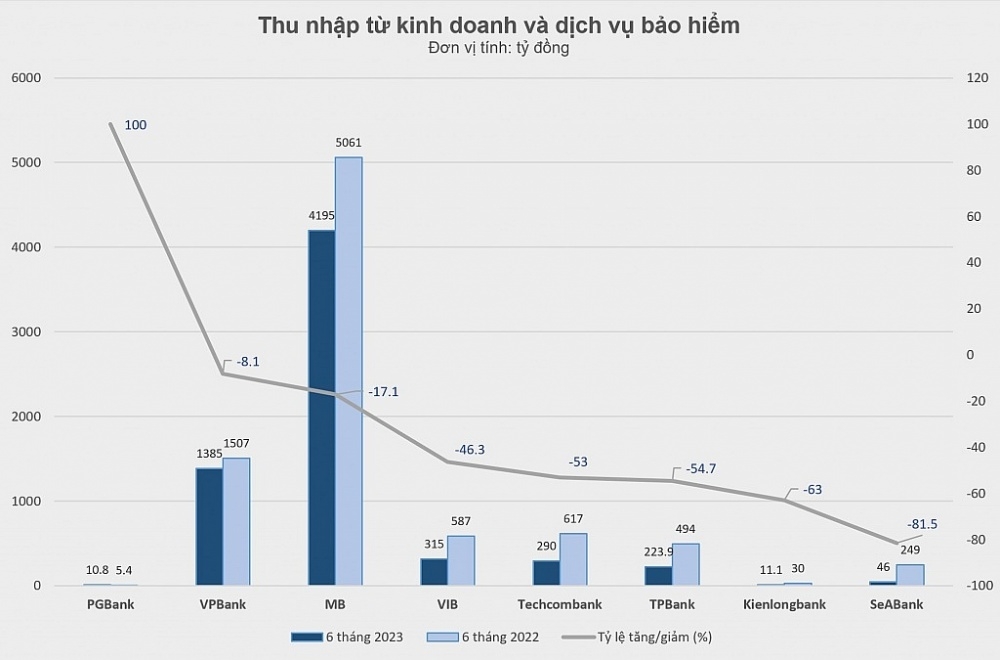

According to statistics in the financial statements of the 2nd quarter and the first 6 months 2023 of 28 banks, only 8 banks detailed their revenue from insurance activities, of which 7 banks recorded negative growth, the only bank with positive growth is PGBank when reaching VND 10.8 billion in the first 6 months of this year compared to VND 5.4 billion in the same period last year.

In terms of absolute value, MB still leads in income from insurance business and services even though there is no exclusivity agreement. In the first 6 months of 2023, MB recorded revenue of nearly VND 4,195 billion, down 17.1% compared to nearly VND 5,061 billion in the same period in 2022. The bank's financial report said that operating expenses for Insurance business in the first 6 months of the year were nearly VND 2,643 billion, meaning MB's insurance profit was more than VND 1,550 billion - still "burdening" most of the net profit from MB's service activities.

Currently, with MB, the direct ownership of 2 insurance companies, which are Military Insurance Corporation (MIC) with 68.37% of capital and MB Ageas life Insurance Company with 61% of capital, has contributed a significant part to this bank's profit each year in both life and non-life segments. MB's insurance revenue increased rapidly in the period of 2019-2022 and only decelerated in the first 6 months of this year. In 2022, revenue from the insurance segment accounted for more than 71% of MB's total service income.

SeABank has the deepest decline in revenue from insurance business and services when it dropped from VND 249 billion in the first 6 months of 2022, to only VND 46 billion in the first half of this year, it means the decrease of 81,5%. Next is Kienlongbank with a decrease of 63% from more than 30 billion VND to more than 11 billion VND. TPBank and Techcombank also recorded a decrease of more than 2 times compared to the same period last year. VIB also decreased by more than 46%, earning VND 315 billion in 6 months of 2023. Techcombank is cooperating with Manulife Insurance Company; TPBank is distributing insurance of Manulife, Sun Life; VIB signed a long-term strategic partnership agreement with Prudential Vietnam.

Insurance is still facing difficulties

According to information from the Ministry of Finance, by the end of July 2023, the total insurance premium revenue of the whole market was estimated at 130,138 billion VND, down 5.54% over the same period last year. This is an indicator that the insurance industry is facing many difficulties, thereby affecting the cross-selling business of insurance through banks, which has long been considered a "golden egg" for banks.

According to experts, the decline in revenue is an inevitable trend due to the decline of customers' trust in the type of cross-selling of insurance through banks. According to a survey published in July 2023 by Vietnam Report, 81.8% of insurers think that the appearance of a lot of negative information about life insurance is the biggest challenge that businesses face in 2023.

In particular, according to the conclusion of the inspection and examination of insurance sales through banks at 4 insurance enterprises: Prudential, MB Ageas Life, Sun Life and BIDV Metlife of the Insurance Supervision and Control Department (Ministry of Finance), in 2021, the rate of cancellation and termination of insurance policies after 1 year at BIDV Metlife is 39.4%; at Prudential (Vietnam) is 41%; At Sun Life Vietnam, this rate is 73% through TPBank, 39% through ACB; at MB Ageas Life it is almost 6%. Although the data is from 2021, it is possible that until now, this percentage is still quite large.

Although there have been many instructions from the Ministry of Finance and the State Bank of Vietnam on reviewing and strictly handling violations on the insurance sales channel through banks, in reality, the status of the consulting bank staff is not clear, which causes customers to be "tricked" with the form of savings into buying life insurance or investment-linked insurance still exists, making many people angry.

Therefore, improving the quality of the "marriage" between insurance and banks is very important. The Vietnam Insurance Association said that it has suggested that insurance businesses when signing cooperation contracts with banks need to include the retention rate of the 2nd year contract as a basis for quality assessment. At the same time, both banks and insurance enterprises must have measures to inspect and supervise the quality of the insurance sales channel through banks.

On the part of insurance companies, the work on rectification of operations is also being carried out. Mr. Phuong Tien Minh, General Director of Prudential Vietnam, said that in the first months of 2023, Prudential cooperated with partner banks to conduct 100% of sales quality inspection calls to ensure that customers are consulted right - enough, customers understand the benefits when participating in insurance. The representative of Sun Life Vietnam also said that it has continuously made strong improvements with its commitment to complying with business ethics standards in all activities, regularly performing internal inspection and audit according to annual plan as well as conducting audits, independent and periodical checks at the request of the Ministry of Finance, etc.

Related News

Aiming for 16% credit growth and removing credit room allocation

09:17 | 14/02/2025 Import-Export

Untying the knot for green finance

11:08 | 23/12/2024 Finance

Banks increase non-interest revenue

10:51 | 23/11/2024 Finance

A “picture” of bank profits in the first nine months of 2024

09:42 | 19/11/2024 Finance

Latest News

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

More News

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance

Fiscal, monetary policies support demand stimulation, price stabilisation

14:49 | 14/02/2025 Finance

Vietnam secures VND 157 billion from state enterprise divestment in 2024

09:16 | 14/02/2025 Finance

Vietnam gears up for potential inflation impact in 2025

14:26 | 11/02/2025 Finance

VN’s credit conditions in 2025 expected to be stable

14:24 | 11/02/2025 Finance

State revenue in first month of the year equal to 14% of the estimate

10:12 | 11/02/2025 Finance

Securities 2025 expects a breakthrough in scale and quality

14:37 | 10/02/2025 Finance

Cash reserves in stock accounts at six-quarter low amid margin rise

08:23 | 10/02/2025 Finance

Five solutions for developing stock market in 2025

10:01 | 07/02/2025 Finance

Your care

The system has not recorded your reading habits.

Please Login/Register so that the system can provide articles according to your reading needs.

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance