E-commerce portal: Cut off administrative procedures, saving compliance costs for e-commerce platforms

|

| There are 258 e-commerce platforms providing information on the e-commerce portal. |

Cutting off administrative procedures

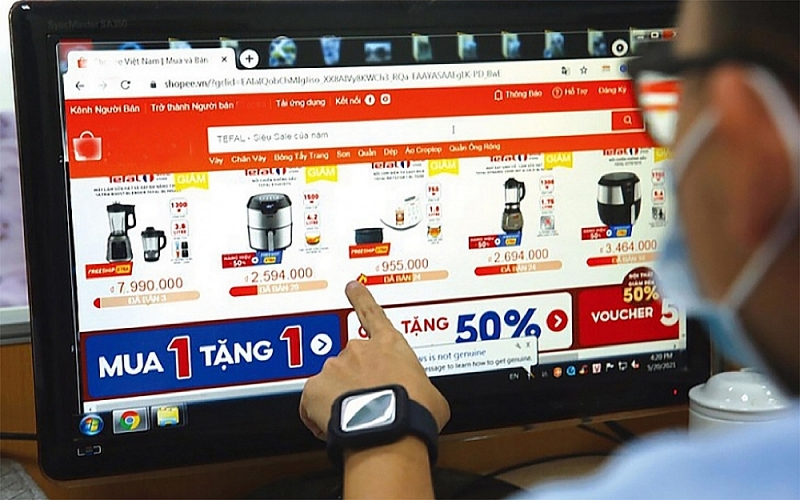

According to Decree 91/2022/NĐ-CP of the Government, e-commerce platforms must provide information electronically every quarter. However, due to the large amount of provided information while the new way of providing the information is only done manually (paper copy, excel file sent via email, sent by USB), the form of a request for information is not consistent among tax authorities.

To solve difficulties for e-commerce platforms in providing information, the General Department of Taxation has built an e-commerce portal (https://thuongmaidientu.gdt.gov.vn) to receive information from e-commerce platforms electronically and officially put into operation on December 15, 2022.

According to statistics, as of February 6, 2023, there were 258 e-commerce trading floors providing information on the e-commerce portal with detailed information about 14,883 organizations and 53,212 individuals registered to sell on the e-commerce platform.

According to the General Department of Taxation, the Portal brings many benefits to people, businesses and state management agencies. Accordingly, the Portal allows one to receive information on a large scale, regularly and continuously from e-commerce platforms through a modern and integrated information technology system. On the basis of information collected from e-commerce exchanges, the tax sector will build a centralized database for tax management according to the risk method, ensuring information security in accordance with the law.

Mrs.Ta Thi Phuong Lan, Deputy Director of the Tax Administration Department on small and medium enterprises, business households and individuals (General Department of Taxation), said that the e-commerce portal has strong implications for reducing administrative procedures, saving costs of law compliance on tax following direction of the Government, putting people and businesses at the center of digital transformation.

Continue to support e-commerce platform owners

Mrs. Nguyen Thi Lan Anh added that from the actual implementation, businesses were still confused because this was the first period of providing information.

However, the tax authority also has direct and timely support, especially large e-commerce exchanges that already have data and identification information about organizations and individuals registered to sell on the platform. As for the information on transactions and the value of traded goods, according to the preliminary assessment of the General Department of Taxation, it did not match reality. Therefore, the tax authority would continue to analyze and assess risks to direct tax authorities at all levels to deploy tax management measures in the area to each relevant organization and individual, serving the work of tax administration.

The General Department of Taxation will continue to promote dissemination and support organizations that are owners of e-commerce platforms to provide information in the first quarter of 2023 and the following quarters in accordance with the regulations, ensuring timely, complete, and no arising problems. Continuing to focus on communication to support taxpayers that are e-commerce platforms to make declarations and payments on behalf of business individuals operating through e-commerce platforms as authorized by civil law.

At the same time, on the basis of provided information about organizations and individuals doing business on e-commerce platforms on the e-commerce portal, the tax authority will exploit information about business activities through the e-commerce platform of organizations and individuals, and review and put them under management, request appropriate declaration, adjust revenue or handle tax arrears.

In addition, the General Department of Taxation continues to coordinate with the Ministry of Industry and Trade to regularly exchange information on the list of websites/applications providing e-commerce services in order to provide timely support to businesses that are owners of e-commerce platforms in providing information as prescribed.

Along with that, the Tax authority will build a risk management model for organizations and individuals selling goods on e-commerce platforms, apply artificial intelligence (AI) to process big data, and issue warnings for tax risks.

Related News

Tax policies drive strong economic recovery and growth

07:55 | 31/12/2024 Finance

Prevent counterfeit goods on e-commerce platforms

13:54 | 22/12/2024 Anti-Smuggling

At the end of the year, there is concern of counterfeit and smuggled goods entering into Ho Chi Minh City

09:31 | 20/12/2024 Anti-Smuggling

Decree on the implementation of global minimum tax: Ensuring a clear and transparent legal framework

11:06 | 30/11/2024 Finance

Latest News

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

More News

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance

Fiscal, monetary policies support demand stimulation, price stabilisation

14:49 | 14/02/2025 Finance

Vietnam secures VND 157 billion from state enterprise divestment in 2024

09:16 | 14/02/2025 Finance

Vietnam gears up for potential inflation impact in 2025

14:26 | 11/02/2025 Finance

VN’s credit conditions in 2025 expected to be stable

14:24 | 11/02/2025 Finance

State revenue in first month of the year equal to 14% of the estimate

10:12 | 11/02/2025 Finance

Securities 2025 expects a breakthrough in scale and quality

14:37 | 10/02/2025 Finance

Cash reserves in stock accounts at six-quarter low amid margin rise

08:23 | 10/02/2025 Finance

Five solutions for developing stock market in 2025

10:01 | 07/02/2025 Finance

Your care

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance