Drastic measures needed to remove Vietnam from money laundering grey list: Deputy PM

The Financial Action Task Force adds Vietnam to the list in June 2023. (Photo: VNA)

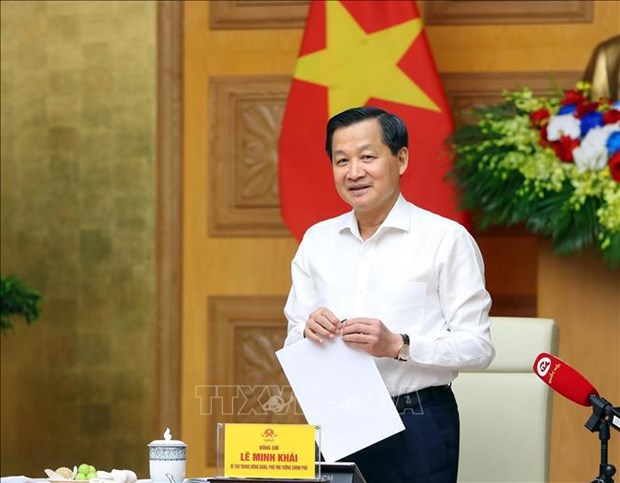

Deputy Prime Minister Le Minh Khai has urged drastic measures to lift Vietnam out of the Financial Action Task Force (FATF)’s list of Jurisdictions under Increased Monitoring (grey list) within two years.

Chairing a meeting of the steering committee for money laundering prevention and combat on October 18, he said the FATF added Vietnam to the list in June 2023. In response, the government sent a commitment to the FATF President about the implementation of an FATF-recommended action plan over two years.

The inclusion in this list will cause adverse impacts on Vietnam, especially in terms of economy, trade, investment and international cooperation, he noted. The Asia/Pacific Group on Money Laundering (APG) recently came to work with the State Bank of Vietnam (SBV) and relevant agencies to seek ways to help remove the country from the grey list, he said.

Khai said that Vietnam has integrated into the world and must comply with common international standards. Numerous solutions are required to have the country removed from the list, and the most complex issue is institutional reform.

Deputy Prime Minister Le Minh Khai has urged drastic measures to lift Vietnam out of the Financial Action Task Force (FATF)’s list of Jurisdictions under Increased Monitoring (grey list) within two years. (Photo: VNA)

The requirements set by the FATF are highly urgent, and Vietnam has a very short time to carry out. If the country does not take proactive or effective moves, the situation will become very complicated, the Deputy PM pointed out.

He asked the SBV, the standing body of the steering committee, and related ministries and sectors to carry out the tasks at the soonest.

Pointing out the substantial impacts of the FATF’s official inclusion of Vietnam in the grey list, SBV Deputy Governor Pham Tien Dung called on ministries and agencies to coordinate with the central bank to perform tasks.

Vietnam may be named in the EU’s list of high-risk country jurisdictions in terms of money laundering and in the FATF’s black list if it fails to prove that it is cooperating in implementing the FATA’s recommendations. If that is the case, particularly serious consequences will occur, forcing companies to pay more for business expenses or even suspend operations, he warned.

It will also undermine Vietnam’s political stature and reputation in the international arena, and negatively affect the country’s external relations and finance - banking systems, Dung added.

He went on to say that in October 2023, the FATF also added Vietnam to the list of countries having activities of virtual asset service providers of importance. Therefore, it may request the country carry out priority measures to implement a legal framework for combating money laundering in terms of virtual assets.

Echoing the SBV’s view, Deputy Minister of Foreign Affairs Nguyen Minh Hang held that there remains a huge workload ahead to make things happen. The implementation of recommendations is a highly technical and legal issue requiring substantive measures.

The EU also named Vietnam in its grey list on August 18. Apart from the FATF’s grey list, the inclusion in the EU list will also cause major impacts as Vietnam’s trade, financial, and banking relations with EU countries are considerable, she said.

Hang suggested Vietnam consider the implementation of commitments as useful for not only minimising risks but also helping perfect regulations and policies, fight corruption and crimes, improve the investment and business climate, and promote the country’s prestige.

At the meeting, officials looked into the draft national action plan for solving the risks of money laundering and terrorist financing for the 2023 - 2028 period. They also discussed measures for ministries and sector to implement the Prime Minister’s decision on issuing a national action plan on combating money laundering, terrorist financing, and financing of the proliferation of weapons of mass destruction./.

Latest News

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

More News

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance

Fiscal, monetary policies support demand stimulation, price stabilisation

14:49 | 14/02/2025 Finance

Vietnam secures VND 157 billion from state enterprise divestment in 2024

09:16 | 14/02/2025 Finance

Vietnam gears up for potential inflation impact in 2025

14:26 | 11/02/2025 Finance

VN’s credit conditions in 2025 expected to be stable

14:24 | 11/02/2025 Finance

State revenue in first month of the year equal to 14% of the estimate

10:12 | 11/02/2025 Finance

Securities 2025 expects a breakthrough in scale and quality

14:37 | 10/02/2025 Finance

Cash reserves in stock accounts at six-quarter low amid margin rise

08:23 | 10/02/2025 Finance

Five solutions for developing stock market in 2025

10:01 | 07/02/2025 Finance

Your care

The system has not recorded your reading habits.

Please Login/Register so that the system can provide articles according to your reading needs.

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance