Complete legal framework for private placement of corporate bonds

The Ministry of Finance has assessed the market situation to develop a draft decree amending and supplementing a number of articles of Decree No. 153/2020/ND-CP on private placement of corporate bonds.

|

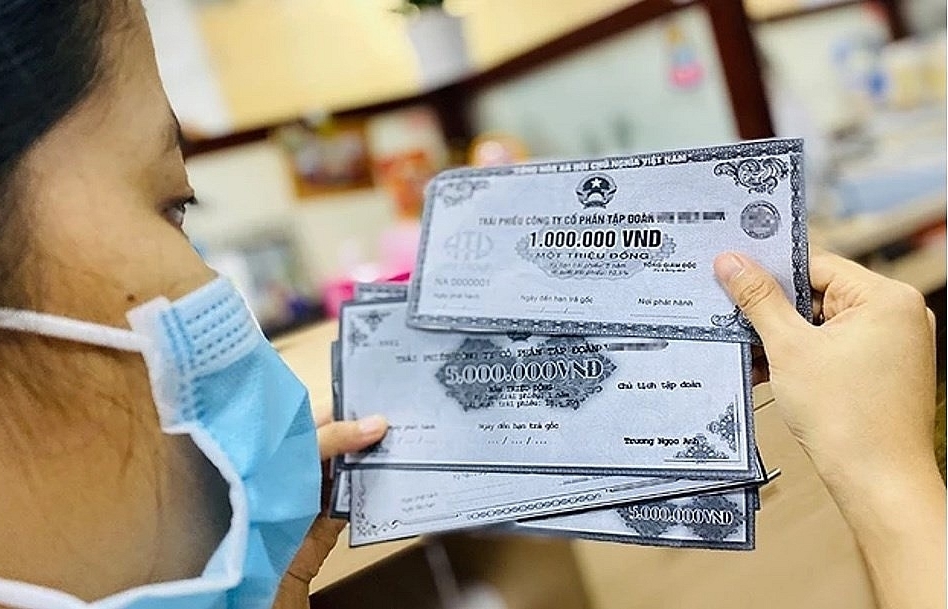

| New regulations will affect the issuance of private placement of corporate bonds in the future. |

Mobilized capital must be used for the right purposes

Heading towards the safe and sustainable development of the corporate bond market, many new contents have been amended and supplemented by the drafting agency.

Accordingly, the draft amended the regulations on the purpose of bond issuance in order to strengthen the responsibilities and obligations of the issuer in using the proceeds from the bond issuance for the right purposes.

Specifically, Clause 1, Article 5 of Decree No. 153/2020/ND-CP is amended and supplemented in the direction: “The purpose of the bond issuance includes: to implement investment programs and projects; increase the scale of working capital; restructuring the capital source of the enterprise or the purpose of issuing bonds following the specialized laws”.

Enterprises might not be allowed to issue bonds in order to contribute capital in any form, buy shares, buy bonds of other enterprises or lend capital to other enterprises. Enterprises must specify the issuance purpose in the issuance plan as prescribed in Article 13 of this draft Decree and disclose information to investors registering to buy bonds. The use of capital raised from the issuance of bonds by the enterprise must ensure that it is only used for the issuing enterprise itself, for the right purposes, following the issuance plan and the content disclosed to investors.

The draft also supplements regulations on credit ratings for some types of issued bonds, aiming to increase publicity and transparency, and contribute to improving the quality of issued bonds; at the same time, helping the market get into the habit of using the results of credit ratings to assess the risks of bonds, approaching international practices, and limiting risks for investors.

Accordingly, if Article 12 of Decree 153 only stipulates that the bond offering dossier includes the credit rating results of the credit rating organization for the bond issuer and the type of bond to be issued (if any), in the draft amendment decree, the drafting agency amends in the direction of requiring the credit rating results of credit rating organizations for bond issuers and bonds issued in the case that issuing bonds to professional securities investors as individuals, issuing bonds without collateral and payment guarantees, or the issuer has business results of the year immediately preceding the year of issuance suffering losses or having an accumulated loss as of the year of issuance.

Private placement of corporate bonds is only traded among professional securities investors

Along with that, the draft stipulates how to identify professional securities investors who are allowed to invest and trade corporate bonds that are private placement.

Specifically, the draft amending and supplementing Article 16 of Decree 153 is as follows: private placement of corporate bonds may only be traded between professional securities investors, except in cases of compliance with judgments or decisions of the Court that have taken legal effect, decisions of the Arbitration or inheritance as prescribed by law.

Professional securities investors as individuals are only allowed to buy corporate bonds of private placement which have credit ratings, except in the cases of complying with legally effective court judgments or decisions, decisions of the Arbitrator or inheritance as prescribed by law.

Along with that, convertible bonds and covered warrant bonds are restricted from being transferred as prescribed in the provisions of Point c, Clause 1, Article 31 of the Law on Securities No. 54/2019/QH14. After the transfer restriction period, convertible bonds and covered warrant bonds are only allowed to be traded between investors as prescribed in Point b, Clause 1, Article 8 of this draft Decree, except the case that complies with the legally effective judgment or decision of the Court, the decision of the Arbitrator or the inheritance as prescribed by law.

Also according to this draft decree, to register for transactions on the trading system of corporate bonds offered for private placement at the Stock Exchange, non-convertible bonds, without warrants for private placement of a company that is not a public company must satisfy the following conditions: enterprises issuing bonds have a contributed charter capital of VND30 billion or more at the time of the transaction on the system according to the audited financial statements of the latest year; enterprises having business activities of the year immediately preceding the year of transactions on the system must be profitable and have no accumulated losses based on the audited financial statements of the latest year.

In case the issuing enterprise is the parent company, charter capital and business results are determined in the consolidated financial statements. In case the issuing enterprise is a superior accounting unit that has affiliated units with their own accounting apparatus, charter capital and business results are determined on the general financial statements; bonds have collateral or guarantee payments of all principal and interest upon the deadline.

Facing the recent cases of violations in the private placement of corporate bonds, experts believed that the amendment of Decree 153 would help to strengthen the responsibility and obligations of the issuer in the use of capital received as well as in the disclosure of information to investors and regulators. Newly added and revised points towards tightening may reduce the issuance volume of corporate bonds, but it would help to increase the quality of issued bonds as well as enhance the publicity and transparency of the corporate bond market.

Related News

Decree on the implementation of global minimum tax: Ensuring a clear and transparent legal framework

11:06 | 30/11/2024 Finance

Crypto Assets should be managed rather than prohibited

19:29 | 30/08/2024 Finance

Many positive signals in the corporate bond market

10:20 | 25/08/2024 Finance

Corporate bond issuance doubles in seven months

16:27 | 13/08/2024 Finance

Latest News

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

More News

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance

Fiscal, monetary policies support demand stimulation, price stabilisation

14:49 | 14/02/2025 Finance

Vietnam secures VND 157 billion from state enterprise divestment in 2024

09:16 | 14/02/2025 Finance

Vietnam gears up for potential inflation impact in 2025

14:26 | 11/02/2025 Finance

VN’s credit conditions in 2025 expected to be stable

14:24 | 11/02/2025 Finance

State revenue in first month of the year equal to 14% of the estimate

10:12 | 11/02/2025 Finance

Securities 2025 expects a breakthrough in scale and quality

14:37 | 10/02/2025 Finance

Cash reserves in stock accounts at six-quarter low amid margin rise

08:23 | 10/02/2025 Finance

Five solutions for developing stock market in 2025

10:01 | 07/02/2025 Finance

Your care

The system has not recorded your reading habits.

Please Login/Register so that the system can provide articles according to your reading needs.

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance