Capital market suffers from difficulties, businesses expect to access new capital mobilization channels

| Over VND638 trillion of public investment for 2023 allocated | |

| State-owned banks under capital increase pressure | |

| Solutions to overcome credit space limitations, inadequacies of capital market |

|

Liquidity suffers from difficulties

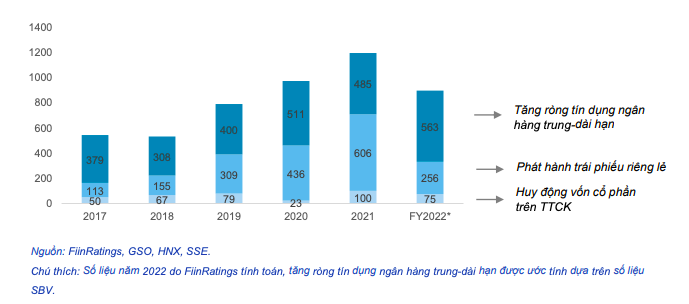

The financial market in 2022 has slowed down due to a series of civil and criminal violations. Therefore, some circulars have been issued to control the capital flow of the market. The credit channel is governed by Circular 16/2021/TT-NHNN, and Circular 39/2016/TTNHNN. For the corporate bond channel, Decree 65/2022/ND-CP requires stricter requirements on the responsibilities of investor standards and related parties.

New policies have had an impact on the corporate bond market as the bond issuance during the year reaches only 36.29% of the total value in 2021. Some other regulations also affect credit quality such as the Power Development Plan VIII. The delay in project approval has forced renewable energy businesses to operate below capacity and reduced cash flow due to EVN's debt of electricity sales.

Mechanisms and policies show the role and importance of developing regulations under standards are more reasonable, but do not tighten capital sources of enterprises.

In the 2022 Year in Review and 2023 Market Outlook, experts of FiinRatings forecast that the maturity of privately placed corporate bonds will fall in 2023 and 2024, equivalent to VND157.97 and VND341.27 trillion. The market may see more insolvent issuers, especially businesses that have continuously increased their leverage for at least 3 years and have weak cash flows. However, FiinRatings expects the maturity pressure to reduce if the draft amendment to Decree 65 is approved.

Regarding global interest rates in 2023, the FED raised interest rates by 0.25 percentage points at the February meeting, equivalent to bringing the reference interest rate to 4.5% - 4.75%. The Economic Survey of the United States in December 2022 showed that wage and labor growth had slowed and the core PCE price index fell to 4.4%, but still higher than the 2% target. This is the basis for the FED to continue tightening policy for at least 1 quarter of 2023 and maintain this level until the end of the year.

FiinRatings points out a few variables, including inflationary pressure returning when China's economy recovers, political conflicts that have not shown signs of ending, and US action to deal with the public debt ceiling.

At the end of the year, interest rates will be supported by public investment, and the disbursement speed is expected to be faster than in 2022 (reaching 67.27% of the plan). In 2023, key projects will be implemented including Long Thanh airport, North-South expressway phase 2, ring road 3, and ring road 4. In addition, the shortage of construction stone supply will also be resolved when the revised Law on Petroleum is approved to facilitate the exploitation of quarries with expired permits.

Expecting new capital channel

The corporate bond market will come into a new cycle with many changes to help this capital channel develop more sustainably. Despite many difficulties, this is considered an opportunity to classify the financial health of the participants. The strict control of this capital channel has helped the management agency to identify weak businesses to take separate measures. On the other hand, issuers with strong financial capacity and good business models may take advantage of the opportunity to expand their market share in the coming business period.

The recent violations voiced concern, but also helped participants better understand the problems of the market. Investors are also supported by new regulations, which require issuers and intermediaries to disclose information about their financial position and corporate bond offering documents. Experts expect information transparency to gradually improve with the development of the secondary trading system next year, and the investor base will shift to financial institutions.

In the context of trapped liquidity, businesses with poor credit quality may experience eroded cash flow and suffer from difficulties in accessing capital for refinancing. However, the businesses that have strong cash flow and access international capital will still be able to overcome the period. In 2022, many businesses access international capital, including Viet Capital Securities (US$105 million) and F88 (US$60 million) which have been rated by FiinRatings.

Vietnam will soon issue regulations on environmental criteria and certification for green credit and green bond issuance projects. This will boost the growth of many sectors such as energy, construction, green real estate, etc. Enterprises such as PCC1 and Phu Yen TTP have mobilized green credit through the verification process with the Climate Bonds Initiative (CBI) for wind and solar energy projects. Therefore, it is expected that more businesses will meet the criteria and successfully mobilize green credit and green bonds in 2023.

Related News

The capital market will see positive change

09:44 | 25/12/2024 Finance

Vietnamese businesses struggle to access green finance

09:58 | 18/12/2024 Import-Export

Green credit proportion remains low due to lack of specific evaluation criteria

09:02 | 24/11/2024 Finance

Green credit needs to be unblocked

11:25 | 29/06/2024 Finance

Latest News

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

More News

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance

Fiscal, monetary policies support demand stimulation, price stabilisation

14:49 | 14/02/2025 Finance

Vietnam secures VND 157 billion from state enterprise divestment in 2024

09:16 | 14/02/2025 Finance

Vietnam gears up for potential inflation impact in 2025

14:26 | 11/02/2025 Finance

VN’s credit conditions in 2025 expected to be stable

14:24 | 11/02/2025 Finance

State revenue in first month of the year equal to 14% of the estimate

10:12 | 11/02/2025 Finance

Securities 2025 expects a breakthrough in scale and quality

14:37 | 10/02/2025 Finance

Cash reserves in stock accounts at six-quarter low amid margin rise

08:23 | 10/02/2025 Finance

Five solutions for developing stock market in 2025

10:01 | 07/02/2025 Finance

Your care

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance