Banks' bad debt burden is getting "bigger"

| Bad debt alarm of Real estate bond | |

| Handling bonded debt by real estate will speed up the settlement of bad debt |

|

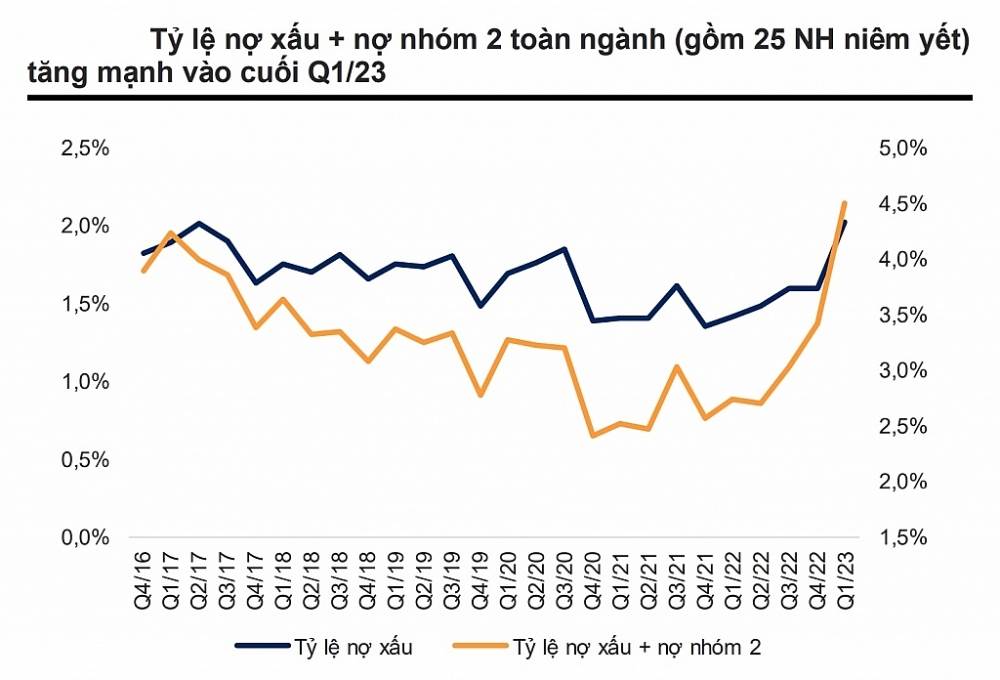

| Evolution of bad debt ratio and debt group 2 in the whole industry (including 25 listed banks). Source: VNDirect |

According to data from the State Bank of Vietnam (SBV), the industry-wide bad debt ratio increased to 2.9% at the end of the first quarter of 2023 compared to 2% at the end of 2022. Most banks recorded an increase in the off-balance sheet bad debt ratio and a decrease in the risk forecast ratio compared to the previous quarter.

Results from the financial statements of the first quarter of 2023 of 27 banks listed on the stock market showed that many banks increased their bad debt by 50-70%.

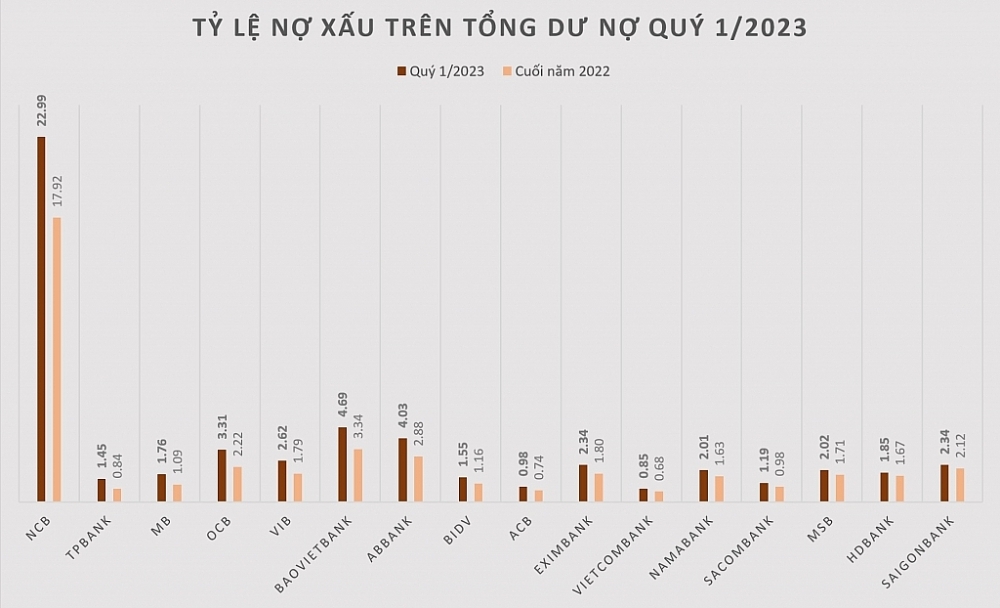

In which, one bank is leading in terms of the bad debt ratio, reaching nearly 23% of total outstanding loans by the end of March 2023, up from nearly 18% at the end of 2022.The bad debt ratio of this bank increased because the total volume of bad debts as of the first quarter of 2023 increased by more than 28% compared to the end of 2022, while the total outstanding loans decreased slightly.

TPBank is the bank with the largest increase in bad debt volume when total bad debt increased sharply by 84% from VND1,357 billion to nearly VND 2,500 billion in the first quarter of 2023. In which, debt group 3 (sub-standard debts) increased by three digits from VND385 billion at the end of 2022 to nearly VND1,200 billion at the end of 1st quarter of 2023, debt group 4 (doubtful debts) also increased sharply by 64%, and debt group 5 (potentially irrecoverable debts) only increased by 6%.This made the ratio of bad debt to TPBank’stotal outstanding loans currently at 1.45%, up from 0.84% at the end of last year.

Earlier, at the General Meeting of Shareholders, Nguyen Hung, General Director of TPBank, explained that the debt structure in TPBank's system has not changed much, but according to the regulations on credit information at the Vietnam National Credit Information Center (CIC), when a customer has bad debt at another bank, TPBank also has to classify that customer's debt to a higher debt group, even though the loan at TPBank is still being paid in full.However, TPBank has made provision for risks as well as has specific plans to strengthen debt collection.

Similarly, many banks also had a sharp increase in bad debt. One of the "big four" banks, BIDV, also recorded a bad debt on the balance sheet increased by more than 40% to VND24,730 billion.In which, debt group 3 increased by 127%; debt group 4 increased by 59% and debt group 5 increased by 13%. The ratio of bad debt to total loans of this bank increased from 1.19% to 1.59%.

Meanwhile, Vietcombank's bad debt as of March 31, 2023, also increased by 27% compared to the previous year in 2022, to VND9,942 billion. The ratio of bad debt to total outstanding loans increased from 0.68% at the beginning of the year to 0.85%.

Additionally, MB also had a bad debt balance that increased by 68% compared to 2022 to VND8,452 billion, with debt group 3 and group 4 increasing sharply, bringing the bad debt ratio to nearly 1.76 % compared to 1.09% at the end of last year.However, MB still reduced provisioning by 13%, helping the bank maintain profit growth of 10.2% in the first three months of the year.

OCB also recorded a 51% increase in bad debt compared to the beginning of the year, to more than VND4,000 billion, of which debt group 3 increased by 54%; debt group 4 increased by 55%, and debt group 5 increased by 49%.The ratio of bad debt to total outstanding loans increased from 2.2% to 3.3%. Eximbank also had a total bad debt increase of 30% compared to the beginning of the year; bad debt ratio increased from 1.8% at the end of last year to 2.3% at the end of March 2023.ABBank also recorded a decline in loan quality when the ratio of bad debts to total outstanding loans increased from 2.88% at the beginning of the year to 4.03%, and the volume of bad debts increased by 35%.

Among 27 banks surveyed, onlySeABank, recorded a flat bad debt ratio of 1.6%; five banks with reduced bad debt ratio wereLPBank, KienlongBank, PGBank, VietABank, and Techcombank. Three banks that had a bad debt-to-total balance ratio of less than 1% were ACB (0.98%), Vietcombank (0.85%), and BacABank (0.57%),although this rate had increased slightly compared to the end of 2022.

|

| The ratio of bad debt to total outstanding loans of some banks increased. Chart: H.Diu |

According to experts from VNDirect Securities Company, difficulties in the real estate market are still a big challenge for the banking industry's prospects when this sector accounted for 21% of system credit by the end of 2022.

In the report sent to the National Assembly, the State Bank said that the bad debt on the balance sheet was controlled below 3% However, some debts are not yet bad debts but have the potential to change debt groups such as those that are restructured and kept in the same group, investment in corporate bonds for the purpose of debt restructuring or bad receivables, and accrued interest must be withdrawn.

Therefore, the SBV believed that these amounts should be recorded to have solutions for management and handling to prevent the risk of bad debt transfer in the future.On that principle, the SBV determined that the total bad debt on the balance sheet, unresolved debt sold to the VAMC, and potential bad debt of credit institutions by the end of February 2023 is estimated to account for 5% of the total outstanding loans.

On the side of banks, many solutions have also been proposed. Nguyen Duc Vinh, CEO of VPBank, expected that thanks to the customer support solutions that the bank was implementing, bad debt would decrease significantly in the second half of the year. VPBank's target is bad debt for the whole year at 2.2%.

According to VNDirect experts, banks with good reserve buffers and loan portfolios that are not focused on real estate such as Vietcombank and ACB will limit risks.The pressure of provisioning as well as the risk of bad debt of banks, such as Techcombank, MB, and VPBank will be reduced when the cash flow of real estate businesses can be improved somewhat thanks to the promulgated supportive policies and a number of projects being removed from the legal system.

Related News

Aiming for 16% credit growth and removing credit room allocation

09:17 | 14/02/2025 Import-Export

Untying the knot for green finance

11:08 | 23/12/2024 Finance

Banks increase non-interest revenue

10:51 | 23/11/2024 Finance

Regularly check tax obligations to avoid temporary exit suspension

09:47 | 21/11/2024 Regulations

Latest News

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

More News

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance

Fiscal, monetary policies support demand stimulation, price stabilisation

14:49 | 14/02/2025 Finance

Vietnam secures VND 157 billion from state enterprise divestment in 2024

09:16 | 14/02/2025 Finance

Vietnam gears up for potential inflation impact in 2025

14:26 | 11/02/2025 Finance

VN’s credit conditions in 2025 expected to be stable

14:24 | 11/02/2025 Finance

State revenue in first month of the year equal to 14% of the estimate

10:12 | 11/02/2025 Finance

Securities 2025 expects a breakthrough in scale and quality

14:37 | 10/02/2025 Finance

Cash reserves in stock accounts at six-quarter low amid margin rise

08:23 | 10/02/2025 Finance

Five solutions for developing stock market in 2025

10:01 | 07/02/2025 Finance

Your care

The system has not recorded your reading habits.

Please Login/Register so that the system can provide articles according to your reading needs.

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance