Bad debt has increased sharply, but the reserve buffer is "thin"

|

| Many banks maintained their bad debt ratio below 1% in the first quarter of 2022. Photo: Internet |

Bad debt has increased by more than 10%

Statistics of financial statements for the first quarter of 2022 of 27 banks show that by the end of March 2022, the total bad debt on the balance sheet of 27 banks has reached nearly VND109.7 trillion, an increase of 10.6% compared to the beginning of the year.

Among 27 banks, nine banks recorded a decrease in the bad debt ratio. On the other hand, OCB, TPBank, and Vietcombank are the three banks with the highest growth rate of bad debt in the industry.

|

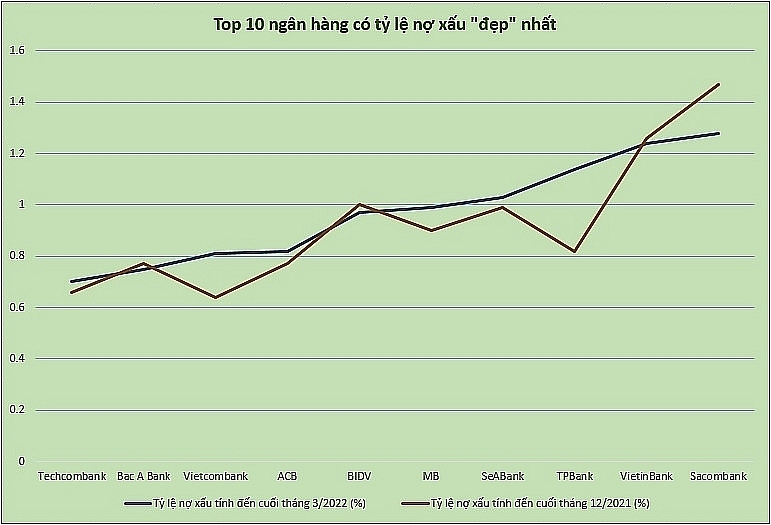

| Techcombank leads in low bad debt ratio. Chart: H.Due |

TPBank's total bad debt increased by 48% to VND1,714 billion. In particular, group 4 debt increased the most by 80% to more than VND629 billion, followed by group 5 debt increased by 50% over VND447 billion and group 3 debt also increased by 25% to nearly VND638 billion. This causes the ratio of bad debt to total outstanding loans at TPBank to increase from 0.82% at the end of 2021 to 1.14%. Specifically, as of March 31, 2022, the total bad debt at OCB was over VND2,293 billion, an increase of VND943 billion, equivalent to an increase of 70% compared to the beginning of the year. In the structure of debt groups, doubtful debt (debt group 4) at OCB increased the most by 140% to more than VND698 billion. As a result, the ratio of bad debt to total outstanding loans increased from 1.32% to 2.17%.

Vietcombank also recorded VND8,372 billion of bad debt, up 37% compared to the end of 2021. Of which, group 3 debt increased by 95% to more than VND1,459 billion. Therefore, the ratio of bad debt to outstanding loans increased from 0.64% at the beginning of the year to 0.81%, which is still low compared to many banks in the system.

In addition, many other banks also had a bad debt that increased sharply during the period, with an increase of 20-30% such as Saigonbank, NCB, HDBank, MB.

However, many banks still maintained a very low bad debt ratio, below 1% such as Techcombank, BIDV, Vietcombank, ACB, MB, BacABank.

Techcombank is currently the bank with the lowest bad debt ratio on the balance sheet, only 0.66%, slightly down from 0.67% at the beginning of the year. By the end of the first quarter of 2022, the total bad debt on the balance sheet of this bank increased by nearly VND148 billion to VND2,441 billion, but Techcombank's loan balance is very large, up to VND365,742 billion, so the debt ratio is maintained at a low level.

Notably, Techcombank is also a bank that owns many corporate bonds, so if we consider the ratio of bad debt to total credit, this ratio of Techcombank is only 0.57%.

Other commercial banks had relatively low bad debt ratios by the end of the first quarter, ranging from 1-1.5%, such as TPBank, VietinBank, Sacombank, LienVietPostBank.

|

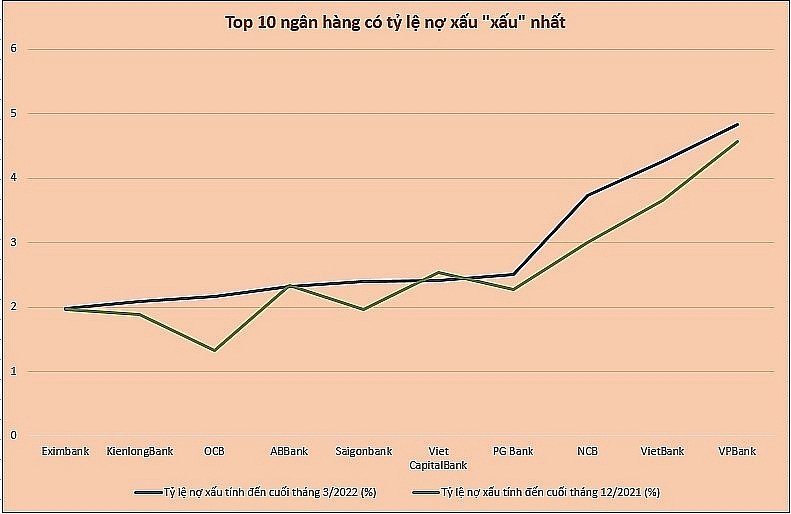

| Bad debts also have potential for increased risks at banks. Chart: H.Due |

VPBank, Vietbank and NCB are the banks with the highest bad debt ratio in the group of 27 surveyed banks, at 4.83%, 4.26% and 3.73% respectively. In which, VPBank is "persistent" to keep this rank because it has to "burden" more debt volume from its subsidiary, FE Credit - which accounts for about 63% of total outstanding loans. So if only the parent bank is counted, the bad debt balance increased by 20% to nearly VND6,746 billion, the ratio of bad debt to the total outstanding balance is 2.27%.

Redundant caches tend to be "thin"

Although bad debt tends to increase quite strongly, according to experts, bad debt can be even worse because it is hidden in many debts that have been restructured according to customer support circulars affected by Covid-19 of the State Bank. In particular, Circular 14/2021/TT-NHNN amends Circular 01/2020/TT-NHNN on the rescheduling of debt repayment, exemption and reduction of interest and fees, and retention of debt groups to support affected customers. Covid-19 benefits expire on June 30, 2022. If it is not extended, the possibility of bad debt will increase.

Therefore, the pressure on banks' provisioning is increasing. Statistics from 27 banks show that, in the first three months of 2022, provision for risks increased by VND9,620 billion to VND159.2 trillion, equivalent to an increase of 6.4% compared to the end of 2021.

But this increase in provision is not commensurate with the growth rate of bad debt as mentioned above, causing the average provisioning ratio for bad debts of banks to decrease slightly from 118% at the beginning of the year down 112% at the end of the first quarter of 2022.

In the first quarter of 2022, 15 of 27 banks recorded a decrease in bad debt coverage ratio. In which, Vietcombank, although still leading the system at 373%, has decreased by 52 percentage points compared to the record high of 424% at the end of 2021. Similarly, the ratio of provision for bad debt at BIDV also decreased by up to 42%.

Besides, 16 banks have bad debt coverage ratio below 100%. ABBank, Vietbank, Saigonbank and PGBank have bad debt coverage ratios below 50%.

Related News

Banks still "struggling" to find tools for handling bad debt

13:47 | 28/12/2024 Finance

Slower mobilization than credit may put pressure on interest rates

09:02 | 24/12/2024 Finance

Credit continues to increase at the end of the year, room is loosened to avoid "surplus in some places - shortage in others"

10:23 | 13/12/2024 Finance

There is still room for credit growth at the end of the year

09:43 | 08/12/2024 Finance

Latest News

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

More News

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance

Fiscal, monetary policies support demand stimulation, price stabilisation

14:49 | 14/02/2025 Finance

Vietnam secures VND 157 billion from state enterprise divestment in 2024

09:16 | 14/02/2025 Finance

Vietnam gears up for potential inflation impact in 2025

14:26 | 11/02/2025 Finance

VN’s credit conditions in 2025 expected to be stable

14:24 | 11/02/2025 Finance

State revenue in first month of the year equal to 14% of the estimate

10:12 | 11/02/2025 Finance

Securities 2025 expects a breakthrough in scale and quality

14:37 | 10/02/2025 Finance

Cash reserves in stock accounts at six-quarter low amid margin rise

08:23 | 10/02/2025 Finance

Five solutions for developing stock market in 2025

10:01 | 07/02/2025 Finance

Your care

The system has not recorded your reading habits.

Please Login/Register so that the system can provide articles according to your reading needs.

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance